|

If your strategy is not

profitable, you need to make some changes to improve it. In this chapter, we

will cover some basic techniques for improving your trading strategies. If your strategy is not

profitable, you need to make some changes to improve it. In this chapter, we

will cover some basic techniques for improving your trading strategies.

Improving stock trading

strategies is a continuous process that requires traders to regularly

evaluate their strategies and make adjustments based on their performance.

Here are some steps that traders can take to improve their stock trading

strategies:

1.

Analyze the results: After

backtesting your trading strategies, analyze the results to determine the

strategy's profitability. Look for patterns in the data and identify areas

where the strategy is performing well or poorly.

2.

Identify weaknesses:

Identify any weaknesses in your strategy and determine the cause. For

example, if the strategy is failing to generate profits in a particular

market condition, it may need to be adjusted to account for that condition.

3.

Experiment with new ideas:

Try new ideas to improve your strategy. This may involve experimenting with

new indicators, adjusting your position sizing, or tweaking your entry and

exit rules.

4.

Keep a trading journal: Keep

a trading journal to track your trades and analyze your performance over

time. This will help you identify trends and patterns in your trading

behavior and allow you to make adjustments to your strategy accordingly.

5.

Stay up-to-date: Stay

up-to-date with the latest market data, trends and technologies, even some

high-tech such as Artificial Intelligence (AI), Machine Learning,

Quantitative Trading (Quant), or chatGPT etc,. This will help you adjust

your strategy to account for changes in market conditions and stay ahead of

the competition.

6.

Seek feedback: Seek feedback

from other traders and experts in the field. This can help you identify

areas where your strategy can be improved and give you new ideas for trading

more effectively.

This chapter, we would like

to introduce you to one method to improve your trading strategies, called

“Hybrid Power”. This involves blending two or more rules or indicators

together to filter out signal noise and identify real trading opportunities,

thereby increasing your chances of success and reducing your chances of

failure.

For example, let’s try

mixing Hammer and Shooting Star candlestick patterns and RSI indicator to

make a Hybrid trading strategy, and do some backtesting to verify how well

(or bad) this Hybrid Power machine (or monster) will run.

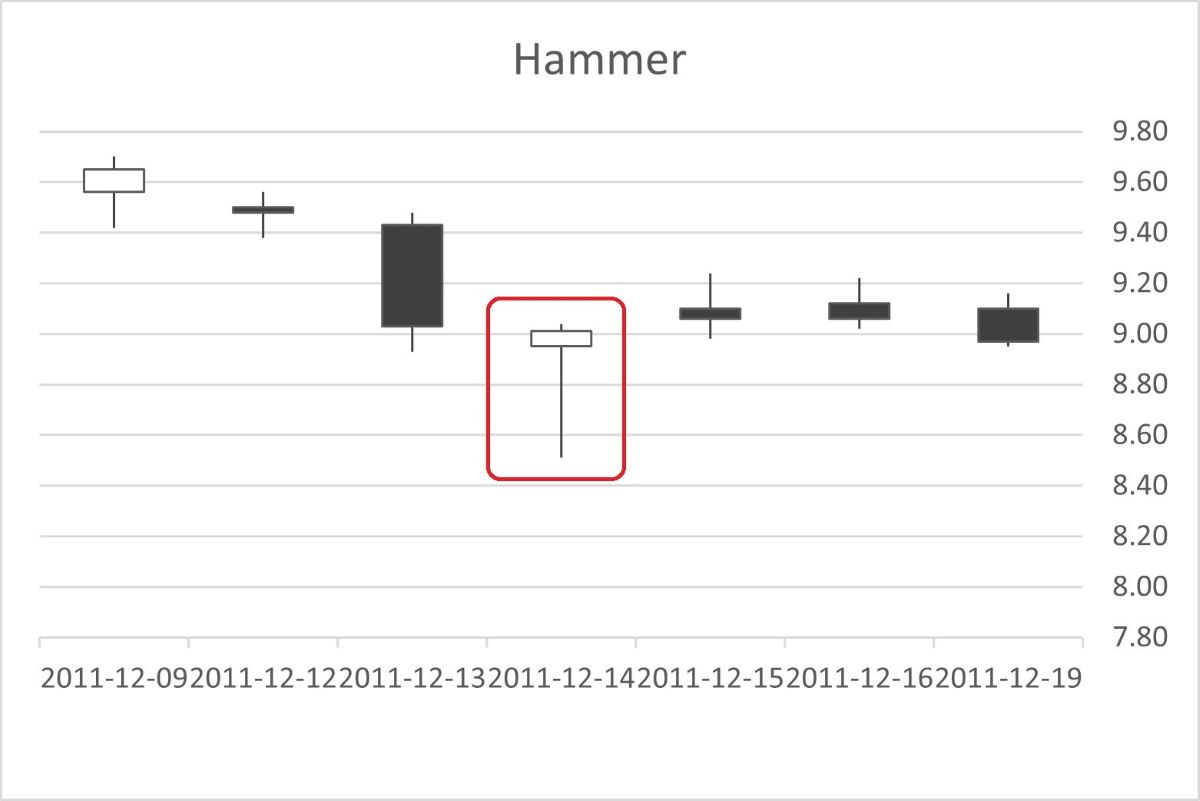

A hammer is a bullish

reversal candlestick pattern that can be identified on a stock chart. It is

formed when the price opens near its high, then drops during the day to a

low, but then recovers to close near the opening price. This creates a

candlestick shape that looks like a hammer, with a small real body and a

long lower shadow.

The hammer pattern is

significant because it shows that the price of the stock was pushed down

during the day by sellers, but then buying pressure came in to push the

price back up to the opening level. This suggests that the bulls have taken

control and that the price may start to rise.

Traders often look for

confirmation of the hammer pattern, such as a gap up on the next trading

day, or a move above the high of the hammer pattern. This helps to confirm

that the bullish momentum is continuing and can be used as a signal to buy

the stock.

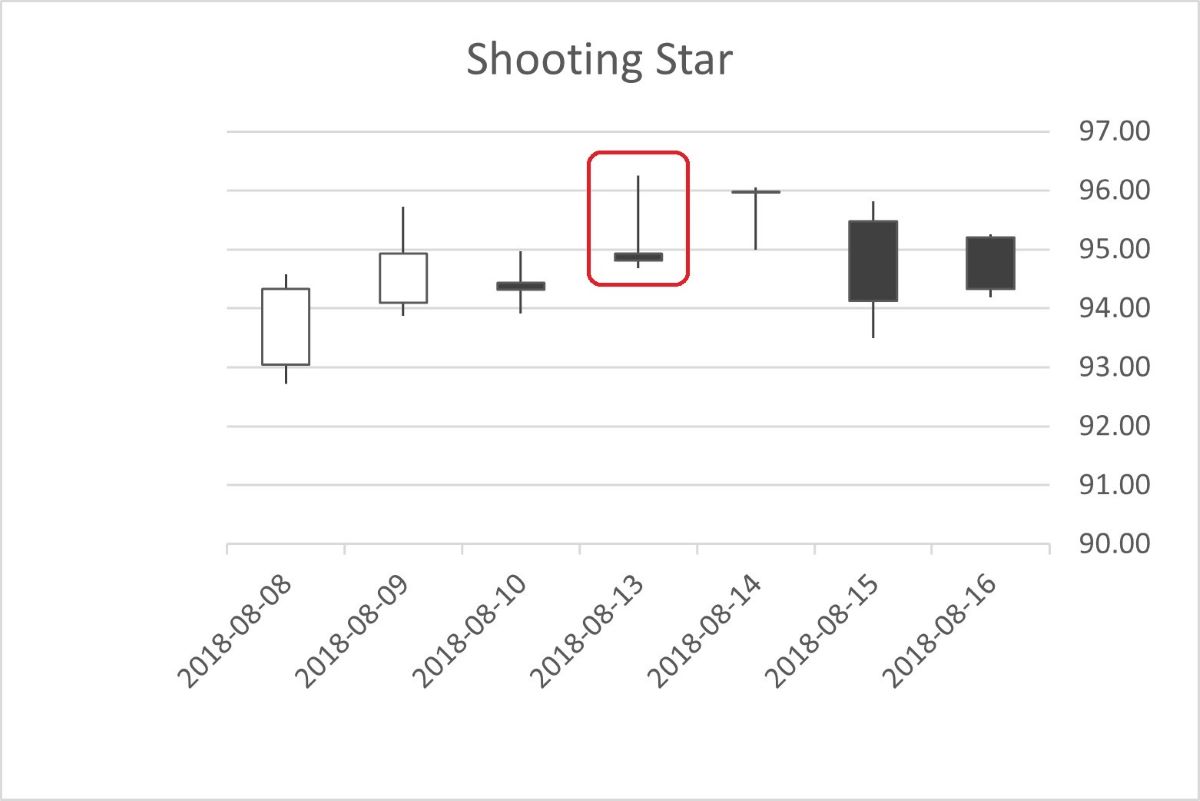

A shooting star is a bearish

reversal candlestick pattern that can appear in an uptrend. It is formed

when a stock's price opens higher than its previous close, trades higher

throughout the day, but then sells off to close near its opening price. This

results in a candlestick with a long upper shadow and a small real body near

the bottom of the trading range.

The shooting star pattern

suggests that sellers were able to overcome the buying pressure earlier in

the day and push the price down. It is often seen as a sign of a potential

trend reversal, as the bulls appear to be losing control and the bears are

gaining momentum.

Traders who spot a shooting

star pattern may look to take a short position or sell their existing long

position, in anticipation of a price drop. However, it is important to

confirm the pattern with other technical indicators and not rely solely on

the shooting star as a trading signal.

RSI stands for Relative

Strength Index, which is a technical analysis indicator used to measure the

strength and momentum of a stock's price movement. It was developed by J.

Welles Wilder Jr. in 1978.

The RSI is calculated by

comparing the average gains and losses over a specific time period. The

formula takes into account the average price gains and losses over a set

period of time and produces a value ranging from 0 to 100.

Traders and investors use

the RSI indicator to identify potential buy and sell signals for a stock.

For example, when the RSI is above 70, it may suggest that the stock is

overbought and due for a price correction, which could be a signal to sell.

Conversely, when the RSI is below 30, it may suggest that the stock is

oversold and due for a price rebound, which could be a signal to buy.

OK, now let’s blend these

ideas together to make a new strategy. The signal generation part may look

like these:

'The strategy is inside

between If and Then. If Hammer appears and RSI is lower than 30, Then

generate a Long OK signal.

If Cells(Candle, "L").Value

> Cells(Candle, "I").Value And Cells(Candle, "K").Value < Cells(Candle,

"I").Value Then

If LongOK =

False And _

(Cells(Candle, "I").Value - Cells(Candle, "K").Value) /

(Cells(Candle, "L").Value - Cells(Candle, "I").Value) > Trigger And _

(Cells(Candle, "J").Value - Cells(Candle, "L").Value) /

(Cells(Candle, "I").Value - Cells(Candle, "K").Value) < 0.1 And _

Cells(Candle, "Y").Value < 30 Then

'Strategy for Long

LongOK = True

BCBM = Candle

BBP = Round(Cells(Candle, "L").Value, 2)

Cells(Candle, "N").Value = "Long OK " & Int([B20].Value * CP /

100 / BBP) & " @ " & BBP

Exit Sub

End If

End If

If Cells(Candle, "L").Value

< Cells(Candle, "I").Value And Cells(Candle, "K").Value < Cells(Candle,

"L").Value Then

If LongOK =

False And _

(Cells(Candle, "L").Value - Cells(Candle, "K").Value) /

(Cells(Candle, "I").Value - Cells(Candle, "L").Value) > Trigger And _

(Cells(Candle, "J").Value - Cells(Candle, "I").Value) /

(Cells(Candle, "L").Value - Cells(Candle, "K").Value) < 0.1 And _

Cells(Candle, "Y").Value < 30 Then

'Strategy for Long

LongOK = True

BCBM = Candle

BBP = Round(Cells(Candle, "L").Value, 2)

Cells(Candle, "N").Value = "Long OK " & Int([B20].Value * CP /

100 / BBP) & " @ " & BBP

Exit Sub

End If

End If

'The strategy is inside

between If and Then. If Shooting Star appears and RSI is higher than 70,

Then generate a Short OK signal.

If Cells(Candle, "L").Value

< Cells(Candle, "I").Value And Cells(Candle, "J").Value > Cells(Candle,

"I").Value Then

If ShortOK =

False And _

(Cells(Candle, "J").Value - Cells(Candle, "I").Value) /

(Cells(Candle, "I").Value - Cells(Candle, "L").Value) > Trigger And _

(Cells(Candle, "L").Value - Cells(Candle, "K").Value) /

(Cells(Candle, "J").Value - Cells(Candle, "I").Value) < 0.1 And _

Cells(Candle, "Y").Value > 70 Then

'Strategy for Short

ShortOK = True

SCBM = Candle

SBP = Round(Cells(Candle, "L").Value, 2)

Cells(Candle, "N").Value = "Short OK " & Int(([B20].Value + 1.5 *

[B19].Value * SlPebP) / 1.5 * CP / 100 / SBP) & " @ " & SBP

Exit Sub

End If

End If

If Cells(Candle, "I").Value

< Cells(Candle, "L").Value And Cells(Candle, "J").Value > Cells(Candle,

"L").Value Then

If ShortOK =

False And _

(Cells(Candle, "J").Value - Cells(Candle, "L").Value) /

(Cells(Candle, "L").Value - Cells(Candle, "I").Value) > Trigger And _

(Cells(Candle, "I").Value - Cells(Candle, "K").Value) /

(Cells(Candle, "J").Value - Cells(Candle, "L").Value) < 0.1 And _

Cells(Candle, "Y").Value > 70 Then

'Strategy for Short

ShortOK = True

SCBM = Candle

SBP = Round(Cells(Candle, "L").Value, 2)

Cells(Candle, "N").Value = "Short OK " & Int(([B20].Value + 1.5 *

[B19].Value * SlPebP) / 1.5 * CP / 100 / SBP) & " @ " & SBP

Exit Sub

End If

End If

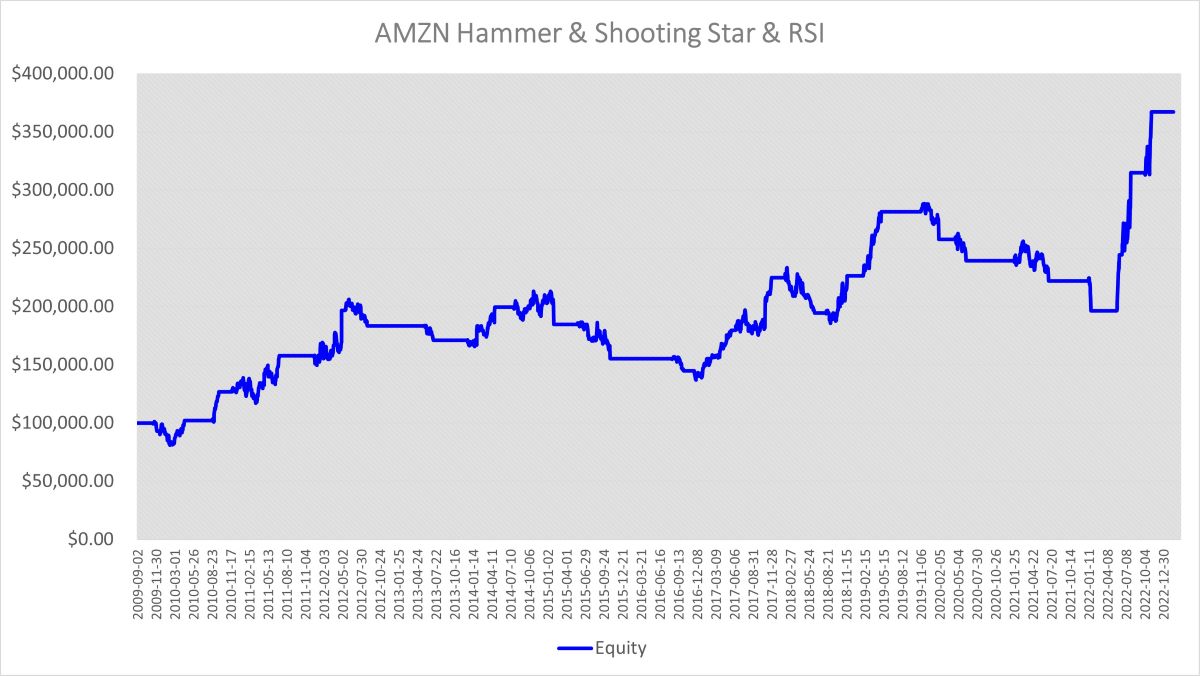

Let's run the VBA Macro to

test our new trading strategy using AMZN (Amazon.com, Inc.). The Macro will

generate a set of paper trading records on Excel worksheets that will help

us evaluate the strategy's effectiveness. When the Shooting Star pattern

appears and the RSI is higher than 70, this strategy will open Short:

Similarly, when the Hammer

candlestick appears and the RSI index value is lower than 30, the strategy

will trigger a Long position:

After scanning all parameter

combinations which ranges are set in “Scan” worksheet, we will get a curve

like this:

It doesn't look as

impressive as the "Three White Soldiers and Three Black Crows" strategy for

Tesla, but it still performs better than the average S&P 500 index. This

teaches us that sometimes a simple strategy can be better than a complex

one. Additionally, if we don't convert our strategy into code and run it

through backtesting, we'll never have clear visualizations to compare and

draw meaningful conclusions.

Overall, the key to

improving your stock trading strategies is to remain flexible and open to

change. By analyzing your results, identifying weaknesses, experimenting

with new ideas, keeping a trading journal, staying up-to-date, and seeking

feedback, you can continuously improve your strategies and achieve greater

success in the market.

Remember, trading is not a

sprint, it's a marathon. But beware, if you're not vigilant, you may find

yourself running in the wrong direction. Good luck with your trading, and

remember, the only thing worse than losing money in the stock market is

losing your sense of humor. Keep laughing, keep trading!

If you would like to try out

the “Hammer & Shooting Star & RSI” strategy backtesting tool, click on

Free Trial to get a 30-day free trial

demo.

LIGHTING THE PATH TO PROFITABLE TRADING

(the whole tutorial handbook pdf Free Download)

A Step-by-Step Guide to Building a Trading

Strategy Verification Tool with VBA Macros

|