Two Years, 100+ Sets of Testing Results Confirm:

Machines Can Beat Human Aces in Stock Market!

|

|

AlphaGo, an AI Go game software system, beat

World Go champion Lee Sedol in 2016. Then, AlphaGo Master defeated Ke Jie,

the world No. 1 ranking Go player in 2017. At this point, in Go, the most

racking-brains game in the field of board and card games, the result of

Human-Machine Battle has been settled, machine swept all the top human

masters. The power of artificial intelligence (AI) is invincible and no

doubt about it.

The next logical question could be : "What would

happen if the stock market had a Human-Machine Battle?"

About this

question, people's views are not as certain as board and card games. Most

people advocate that machines and Artificial Intelligence technology can not

defeat human beings in the fields of economy and finance. The reason is

simple:

There are boundaries, clear rules, unified standards, clear

order of taking turns, equal opportunities for all sides in board and card

games. For machines with strong computing power, certain results can be

solved sooner or later. And when it comes to computing power, of course,

humans can't compete with sleepless computers.

Economics, finance and

securities are quite different. There are no boundaries, neither orders and

equality. And rules are fuzzy, standards are uneven in these fields. In the

stock market, big institutional investors have much more insider information

than retail investors dreaming for. Even the same piece of information

published under the fairest conditions can be interpreted in opposite ways.

The stock market is a chaotic market, where the fluctuations are not

entirely caused by economic activities, but certain partly by human

emotions.

Computers can calculate astronomical figures that people

can not image, but it is impossible to calculate the hearts of people, human

nature and human feelings.

This, of course, makes sense. However,

with the rapid development of Artificial Intelligence technology, there are

always some "technical maniacs" against this tone. They've challenged this

"mission impossible" over and over again, even built two ETFs powered

entirely by AI, which have indeed outperformed most human fund managers, but

far weaker than Warren Buffett, the best human stock trading master. Here's

a comparison of their growth rates:

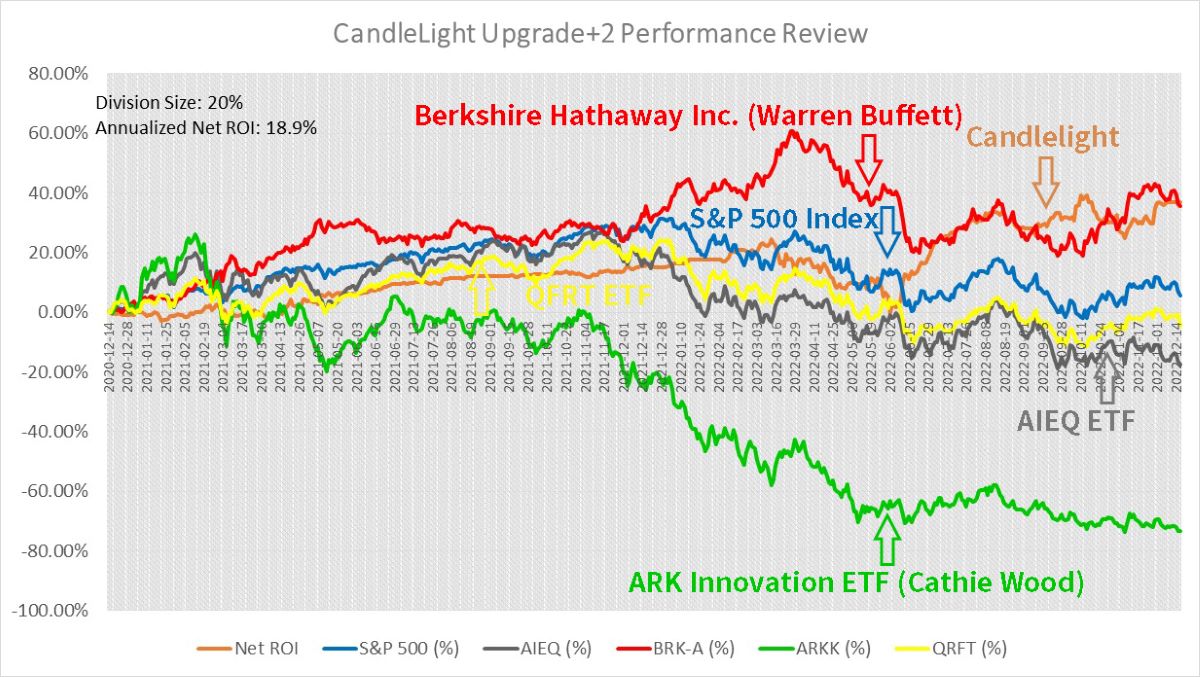

Since December 14, 2020, the growth rate of Berkshire Hathaway Inc.

stock BRK-A (red line), owned and managed by Warren Buffett, has been

outpacing AIEQ (gray line), the first ETF powered by Artificial intelligence

machines in the world. AIEQ only surpassed Buffett shortly on November 18,

2021. Only one day later, it was reversed by Buffett, and then fell into a

slump, and falling far behind.

So it is right to believe that in the

"Human-Machine Battle" in the stock markets, the machine cannot win...

Wait a minute!

Look at the same chart, July 5, 2022, an orange

line is catching up and overtaking the red line!

The orange line represents the growth rate of Candlelight, another AI

trading system. Starting from December 14, 2020, this AI quantitative

trading system developed by us has been continuously tested (test

conditions: real time, real field, real price and virtual capital). Since

then, the growth rate of "Candlelight" AI quantitative trading system has

been slowly climbing.

In April 2021, Candlelight outperformed ARKK

(green line), The ARK Innovation ETF managed by Cathie Wood. Ms. Wood was

admired by many fans after her breakout years in 2020 and early 2021. This

was the first milestone for Candlelight.

In January 2022, Candlelight surpassed its rival, AIEQ. AIEQ is equipped

with IBM's "Watson" supercomputer hardware platform and Google's AI software

platform. No matter whether its hardware or software, it is representing the

highest level of Artificial Intelligence technology in the world.

In

May 2021, Candlelight shortly surpassed AIEQ. After January 2022,

Candlelight quickly ran away from AIEQ and has remained in the lead ever

since. Surpassing AIEQ marks the second important milestone of Candlelight.

QRFT (yellow line) is another AI-driven ETF. Unlike AIEQ, which uses IBM's

"Watson" supercomputer general-purpose platform, QRFT claims to use AI

systems specifically designed and developed for investment task. Its

performance in real operation is as same as AIEQ roughly. The Candlelight

system established a lead over QRFT after June 2022.

In March 2022,

Candlelight surpassed the growth rate of the S&P 500 Index (blue line) for

the first time. July, Candlelight surpassed the S&P 500 Index again,

officially passing the third milestone and maintaining the advantage, which

means that the profitability of the pure machine trading system outperforms

the market.

This seeming low-end target is actually beyond the reach of many human

fund managers, and even Warren Buffett's growth rate was briefly suppressed

by the Index in November 2021.

That's why he repeatedly advises inexperienced investors to buy index

funds on a regular basis. Buffett first mentioned his advice in his 1993

letter to Investors, quoting: "By periodically investing in an index fund,

for example, the know-nothing investor can actually outperform most

investment professionals."

On July 5, 2022, after 19 months of

continuous forward testing, the latest version of "Candlelight" finally

passed the fourth milestone and surpassed Buffett's growth rate for the

first time. To be honest, when we developed this software, we did not expect

to be able to compete with the top human master, Mr. Buffett. Our goal is to

beat another machine operating fund AIEQ only, that is enough to prove that

our machine's algorithm is better than the peer, the design goal is 100%

achieved. Satisfied. Especially from March to May 2022, under the

superimposed impact of war, inflation, interest rate hike and other major

impacts, the growth rate of "Candlelight" once suffered a heavy decline,

which was left a dozen streets away by master Buffett, and even faced the

dilemma of being surpassed again by the rival AIEQ. As we have been very

frustrated, Candlelight AI Quantitative Trading System drives machine to

make a series of adjustments, fights back continuously, finally get rid of

the darkness and weakness. July 5, 2022, unexpectedly, narrowly exceeded

Warren Buffet’s performance, which was unreachable before, completed a

"mission impossible".

On October 13, 2022, Candlelight stepped on its fifth milestone: the

completion of a full 100 forward testing transactions. As we all know,

repeatability is a hard-core indicator to verify a model. The success of one

or two sets of experiments does not mean anything. The results of ten or

eight sets of experiments could be also highly contingence. Only when

certain phenomena can be repeated, we can be sure that they are not

coincidental. After 22 months, since December 14, 2020 to October 13, 2022.

The operation of 100 opening and closing positions completely carried out by

machines has basically tested the Repeatability and Robustness of the

Candlelight system, in the complex market environment.

On December

14, 2022, Candlelight passed its sixth milestone: two years of continuous

forward testing. While the Quantity of tests is a very important hardcore

metric, there is another metric that is equally important: Time Span. In

addition to the constraints of boundaries, rules, criteria, order, and so on

mentioned above, there is another big difference between stock trading and

board/card games: stock trading will be influenced greatly by the dimension

of time.

The time span factor is not considered in the programming of

AI for board and card games. As long as the results of a batch of tests

confirm that the algorithm works, it is feasible, even if these sets of

tests are completed intensively in a short period of time, because the test

objects do not have periodic fluctuations. The test subjects of board and

card games are the rules of the games themselves, which are eternal and do

not change over time.

Stock trading is another story. It is a part of

human economic activity, and it rises and falls with the fluctuations of

financial markets. Such financial market fluctuations not only come from the

economic activities themselves, nor reflect the supply and demand

relationship of commodities alone. More often, they are also closely related

to the political environment and natural changes, not to mention

unpredictable shocks such as wars, epidemics and disasters. In any country,

under any economic system, economic and market cyclical fluctuations are

unavoidable. From three or five years to ten or eight years, human economic

activity has always been a cycle of booms and busts. Even within a year,

with the climate of cold and warm change, various markets have varying

degrees of peak-season and off-season shock.

Therefor, quantitative

trading systems developed for stock markets must also be able to withstand

the test of economic fluctuations to be practical. If only a short period of

intensive testing is successful, it just means that the system works in one

economy situation and may not reproduce the same results in another. We

believe that a truly effective AI quantitative trading system should cover

at least one cycle of booms and busts, and the more economic fluctuations it

can span, the more battle-ready the system will be.

In these 113 groups of consecutive forward testing (conditions: real time,

real field, real price, virtual money) :

The Candlelight Quantitative

Trading System takes profit 79 times, break-even retreats 15 times, stops

loss 19 times. The Wins/Losses Ratio is 4.2:1, the average Return per trade

is 1.2%, and the average holding time is 13.4 days.

48 times Long and

65 times Short.

For Long positions, takes profit 30 times, break-even

retreats 10 times, 8 times stops loss. The Wins/Losses Ratio is 3.8 to 1,

the average Return per trade is 0.6%, and the average holding time is 14.9

days.

For Short positions, takes profit 49 times, break-even retreats

5 times, 11 times stops loss. The Wins/Losses Ratio is 4.5 to 1, the average

Return per trade is 1.7%, and the average holding time is 12.2 days.

Let's take a look back at some of the most dramatic events that happened

during the past 24 months and 113 groups of live testing:

December

2020: one full year of the COVID-19 outbreak;

January 2021: Capitol

Hill Riots, USA political turmoil;

August 2021: Afghanistan changed,

and the United States accepted defeat and withdrew hastily;

December

2021: two full years of the COVID-19 outbreak;

January 2022: USA

reports inflation rate hit 7% last month;

February 2022:

Russia-Ukraine war broke out;

March 2022: The Fed raised interest

rates by 25 points for the first time in nearly three years; America's

inflation rate jumped to 8.5% last month; Shanghai lockdown; The

Russia-Ukraine peace talk, which turned out to be a scam;

May 2022:

The Fed raised interest rates by 50 points due to severe inflation;

June 2022: USA inflation rate hit 8.6%, the highest since 1981; The Fed

raised interest rates by a whopping 75 points;

July 2022: US

inflation hit 9.1%, the highest since 1981; The Fed raised another

blockbuster 75 points interest rates; The USA economy grew at a negative

rate for the second quarter in a row; Political turmoil in UK, prime

minister resigned;

August 2022: China reported unemployment at 5.4%

last month and youth unemployment at 19.9%;

September 2022: Queen of

UK Elizabeth II died; Russia partially mobilized and the war escalated; The

explosion of the Nord Stream gas pipeline between Russia and Germany,

worsening the European energy crisis and high inflation; US inflation still

high, the Fed raised thirdly blockbuster 75 points interest rates;

October 2022: USA-Saudi Arabia relations broke down as OPEC+ announced crude

oil production cuts; The Crimean bridge was bombed; UK's new prime minister

resigns after just 45 days, the shortest serving in the history of UK;

November 2022: US inflation remained high and the Federal Reserve raised

interest rates by 75 heavy points for the fourth time this year;

December

2012: G7 and the European Union set a cap on the price of Russian oil, the

international energy supply waves again; Fed raises rates aggressively by 50

points to fight inflation...

Candlelight Quantitative Trading System

is surfing in such a stormy sea completely by its independent judgment. The

machine carries out whole process of long and short two-way operations, zero

human intervention. So far, this system has met or even exceeded our design

expectations.

Candlelight does not achieve this performance overnight. Since 2018,

this AI trading system developed by us has conducted forward simulation

tests in the US stock market according to the real-time market environment,

and posted every operation and action on social networks, left verifiable

records and milestones. It has been more than four years until 2022. The

algorithm has gone through three major iterations, optimization, polishing

and numerous small upgrades. Continuous tests show that: it is not a

"mission impossible" to completely make machine learning, automatically

generate buying and selling signals, operate without manual intervention in

the whole process, and make long-term profits. We have already gone through

this.

The creator of "Candlelight" once took part in the Automated Trading

Championship 2008, the highest level FOREX programming competition on the

Earth, and finally ranked 56th among 2420 participants in the world, a TOP

3% class rank.

Since February 2020, we have continuously published the real-time

forward test records of "Candlelight" in the US stock market on major social

networking sites. The original data and operation records of these

experiments can be reviewed. In each post, we reveal the next day's plan,

the target price, for readers and viewers to verify.

Our next stage of

optimization is to improve the stability of the growth rate, avoid big ups

and downs.

Candlelight keeps challenging the best players. Thanks for

continuous attention and witness.

Disclaimer:

This video or article, including all of its

features, content, and services, is provided for informational and

entertainment purposes only. All features, content, and services have been

researched and expressed to the best of its knowledge and belief.

Nevertheless, no guarantee can be provided for the correctness,

completeness, or accuracy of this information.

Please be aware: I am

neither a financial adviser nor a CPA. All Stock Trading Signals, Plans,

Predictions and Actions here are 100% generated by "Candlelight" Artificial

Intelligence Machine Learning Quantitative Algorithm. It is under testing in

real time and market prices, by virtual funds. Some of the models used by

Machine Learning Trading System are predictive in nature. The use of

predictive models has inherent risks. When Models and Data prove to be

incorrect or incomplete, any decisions made in reliance thereon expose the

System to potential risks. For example, by relying on Models and Data, the

System may be induced to buy certain targets at prices that are too high, to

sell at prices that are too low, or too early, or too late, then miss some

favorable opportunities.

The performance

represented is historical. Past performance may not be a reliable indicator

of future results. None of the authors, contributors, administrators, or

anyone else connected with this System, in any way whatsoever, can be

responsible for your use of the information contained in or linked from

here. Any action you take upon the information from here is strictly at your

own risk.

This video or article is based on personal

opinion and experience, and it should not be considered professional

financial investment advice. The ideas and strategies should never be used

without first assessing your own personal and financial situation. All

contents are our TEST records only, not for real trading. Market is

dangerous, trading is risky, DO NOT copy anything we do.

|

|

Free Tutorial

Share

|

|

|

|