How does the "Hammer & Shooting Star" Trading Strategy work for Microsoft Stock?

|

|

Let’s face it — trading can be a serious business. With all the charts,

indicators, and economic news to keep track of, it’s easy to forget that

there’s a human being behind every trade. But every once in a while, a

trading strategy comes along that’s so funny it makes you forget about all

the stress and anxiety that comes with trading. So, let’s take a break from

all the seriousness and have a chuckle as we explore the “Hammer” and

“Shooting Star” trading strategies.

When it comes to trading, there

are countless strategies out there that traders can use to help them make

informed decisions and maximize their profits. One such strategy is the

“Hammer” trading strategy, which is a popular method for identifying

potential price reversals in a given market.

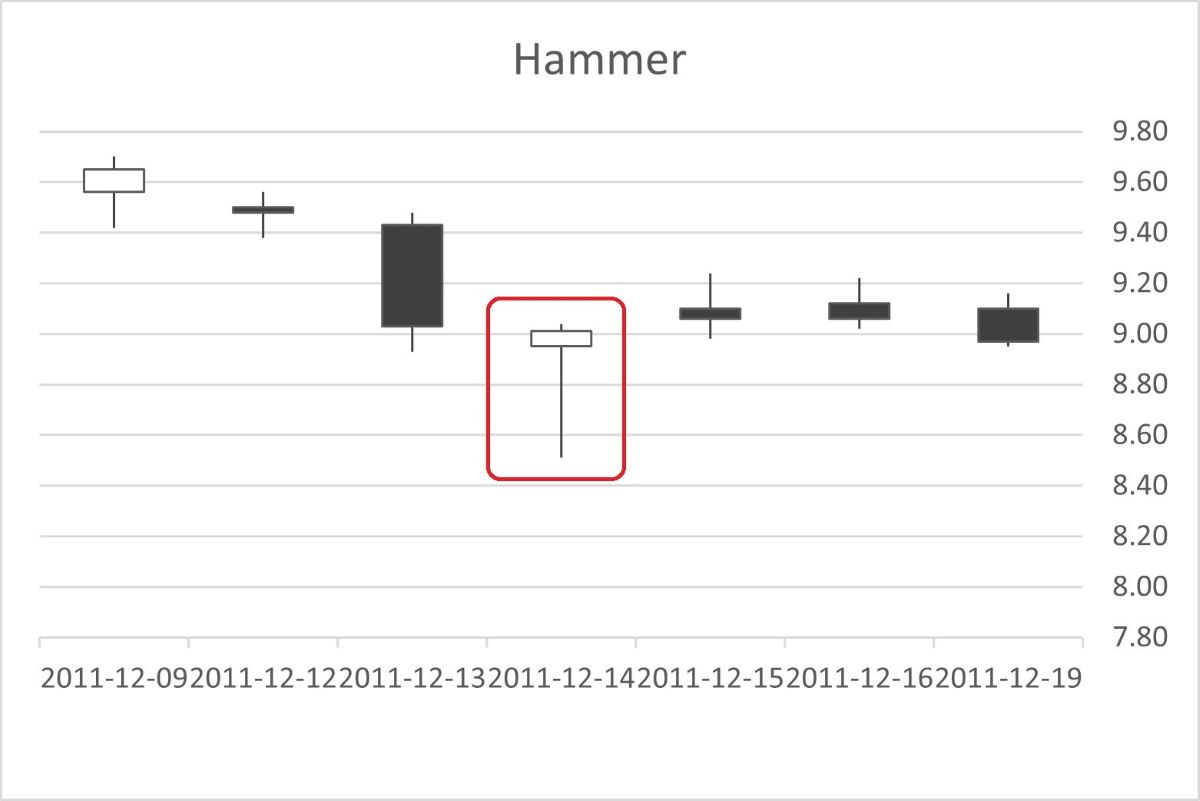

What is a “Hammer”?

Before we dive into the specifics of the “Hammer” trading strategy, it’s

important to first understand what a hammer is. A hammer is a type of

candlestick pattern that occurs when a security’s price opens, then falls

significantly during the trading session, but ultimately recovers most or

all of those losses by the close of the session.

The hammer pattern gets its name from its appearance, which resembles a

hammer with a long handle and a small head. The “head” of the hammer is the

candlestick itself, which represents the difference between the opening and

closing prices, while the “handle” represents the range between the high and

low prices of the session.

Why use the hammer trading strategy?

The hammer trading strategy is based on the assumption that a hammer pattern

is a bullish signal, meaning that it suggests that the price of the security

in question is likely to rise in the near future. This is because the hammer

pattern indicates that despite early selling pressure, buyers were

ultimately able to push the price back up, suggesting that there is strong

support for the security at that price level.

When combined with

other technical indicators and analysis techniques, the hammer trading

strategy can be a powerful tool for traders looking to identify potential

entry points for long positions.

Implementing the hammer trading

strategy

To use the hammer trading strategy, traders should look for

hammer patterns on a price chart of the security they’re interested in.

Ideally, the hammer pattern should appear at the end of a downtrend, as this

is when it is most likely to signal a potential price reversal.

Once

a hammer pattern is identified, traders can then use other technical

indicators and analysis techniques to confirm their bullish outlook and

identify potential entry and exit points. Some common indicators and

techniques that traders might use in conjunction with the hammer pattern

include moving averages, trend lines, and Fibonacci retracements.

It’s worth noting that while the hammer trading strategy can be a useful

tool for identifying potential bullish opportunities, it should not be

relied on as the sole basis for making trading decisions. Traders should

always conduct their own research and analysis, and consider factors such as

market trends, news events, and economic indicators before making any

trades.

In addition to the hammer trading strategy, another

candlestick pattern that traders commonly use to identify potential price

reversals is the “Shooting Star” pattern. Like the hammer pattern, the

shooting star is a type of candlestick pattern that can indicate a potential

change in the direction of a security’s price movement.

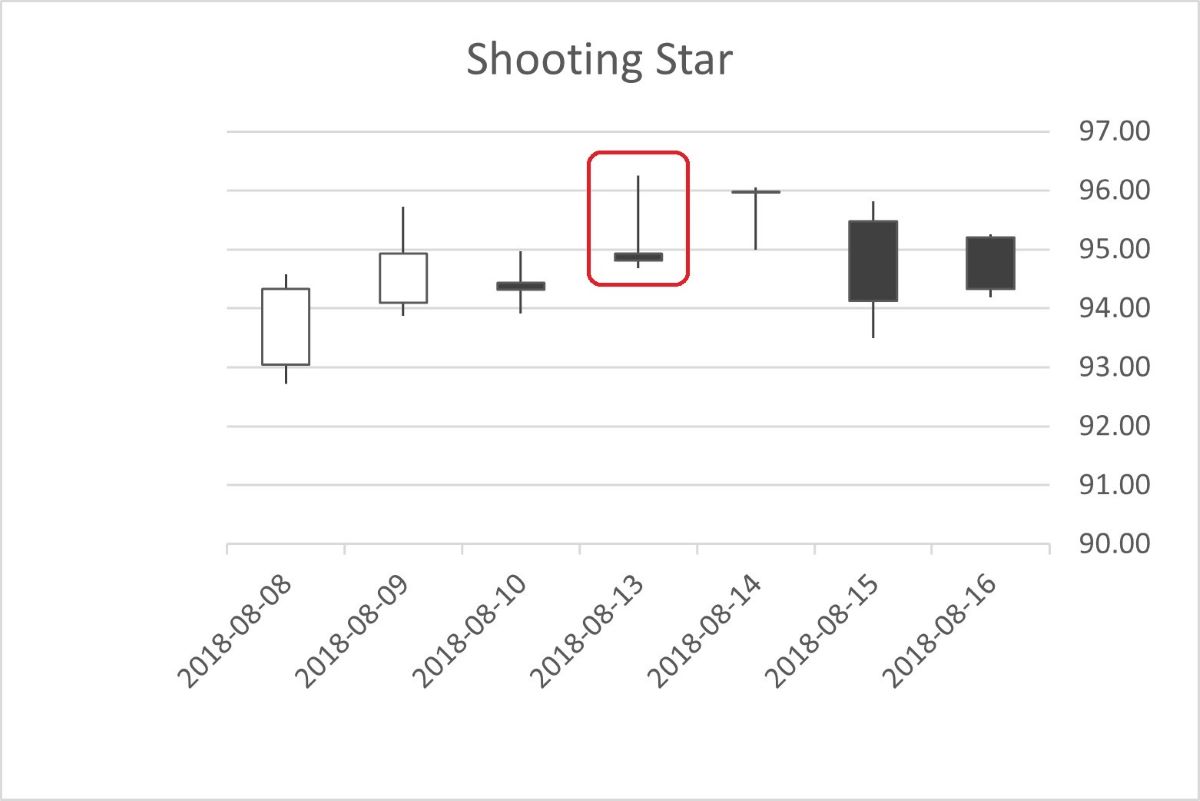

What is a

“Shooting Star”?

A shooting star pattern is a bearish candlestick

pattern that occurs when a security’s price opens higher than the previous

day’s close, then rises significantly during the trading session before

falling back down to close near or below the opening price. The pattern gets

its name from its resemblance to a shooting star, with a long upper shadow

and a small real body.

The shooting star pattern is considered a bearish signal because it

suggests that despite the initial buying pressure, sellers ultimately gained

control of the market and pushed the price down.

Using the shooting star pattern in trading

To use the shooting

star pattern in trading, traders should first look for the pattern on a

price chart of the security they’re interested in. Like the hammer pattern,

the shooting star is most useful when it appears at the end of a trend, as

this is when it is most likely to signal a potential price reversal.

Once a shooting star pattern is identified, traders can then use other

technical indicators and analysis techniques to confirm their bearish

outlook and identify potential entry and exit points. Some common indicators

and techniques that traders might use in conjunction with the shooting star

pattern include support and resistance levels, moving averages, and trend

lines.

Like the hammer trading strategy, it is important to remember

that the shooting star pattern should not be relied on in isolation. Traders

should always conduct their own research and analysis, and consider a range

of factors before making any trades.

However, in this blog, we plan

to test a simple “Hammer & Shooting Star” Trading Strategy solely, to get a

direct impression, without other indicators’ help or correction, how a pure

Hammer and Shooting Star strategy will work?

Let’s download the

‘Hammer & Shooting Star’ Trading Strategy backtesting tool from this link.

It’s an Excel Macro that’s very easy to use. For this trial, let’s pick MSFT

(Microsoft Corporation’s stock symbol). We’ll import MSFT’s historical data,

keeping around 3,000 days’ worth and cutting off the rest. The settings will

be as follows:

In the “Pick” worksheet, set the Principal at cell B18

(typically set at 100,000), and the Training % at cell B16 (normally set at

70).

Set the SMA at cell B2 (normally set at 5), and the Expiration

at cell B7 (normally set at 3).

Fill the Optimization Factor value in

cell B34. This value is specific to each stock and is calculated based on

its unique features. It influences the Trigger and Momentum used during the

backtesting VBA Macro. Users can follow us for getting the newest unique

Optimization Factor for particular stock.

Now, let’s go to the “Scan”

worksheet, set the scan ranges for Take Profit, Stop Loss, and Momentum. The

“Scan” worksheet looks like below:

The

backtesting VBA Macro will try every combination, such as Take Profit at 3%,

Stop Loss at 12%, and Momentum (a standard to trigger the Buy or Sell

actions) at 5, etc. This tool will execute these conditions to simulate a

series of trading actions using historical data from the beginning, opening

and closing long or short positions based on the signals generated by your

trading strategies.

To run the VBA Macro program, there are several methods, for example, we

can:

1. Click on the “View” tab on the Excel ribbon.

2. Click

on the “Macros” button in the “Macros” group. This will open the “Macro”

dialog box.

3. In the “Macro” dialog box, select the Macro that you

want to run.

4. Click on the “Run” button.

We can also press

Alt + F8, the “Macro” dialog box will jump out, select the Macro (the name

in this demo is “Hammer_ShootingStar” and its version number), then click

the “Run” button.

The fastest method is using shortcut hot keys:

Press Ctrl + Y, the Macro will run immediately.

After running the VBA

tool, we will get a curve in “Chart” worksheet like this:

After

a long run, since 2011–01–03 to 2023–03–14, which is a total of 3069 trading

days, and with the following parameters set: Momentum at 2, Take Profit at

24%, Stop Loss at 12%, we will get an Annual ROI at 16.28%, compared to S&P

500 Index’s average of 7%, not bad, eh? During this period, there were 16

trade deals completed, with 11 of them being long positions and 5 of them

being short positions. Stop loss was triggered 5 times, while take profit

was achieved 11 times. The ratio of stop loss vs. take profit was 68.75% vs.

31.25%. On average, it took 191.8 days to complete one full round of buying

and selling.

In

conclusion, the ‘Hammer & Shooting Star’ Trading Strategy works okay for

MSFT. However, the transactions (which occurred 16 times over a 12-year

period) are too few to provide strong evidence of the strategy’s

repeatability.

While the hammer and shooting star trading

strategies may sound like they belong in a hardware store or a sci-fi movie,

they’re actually powerful tools that traders can use to make informed

decisions. But let’s not forget to have some fun along the way — after all,

life is too short to take everything so seriously. So, go ahead and

incorporate the hammer and shooting star into your trading strategy, but

don’t forget to take a break and laugh at the occasional “hammer time” or

“shooting star” joke. Happy trading, and may the laughter be with you! While the hammer and shooting star trading

strategies may sound like they belong in a hardware store or a sci-fi movie,

they’re actually powerful tools that traders can use to make informed

decisions. But let’s not forget to have some fun along the way — after all,

life is too short to take everything so seriously. So, go ahead and

incorporate the hammer and shooting star into your trading strategy, but

don’t forget to take a break and laugh at the occasional “hammer time” or

“shooting star” joke. Happy trading, and may the laughter be with you!

Click

LIGHTING THE PATH TO PROFITABLE TRADING: A Step-by-Step Guide to Building a Trading Strategy Verification Tool with VBA Macros to get the whole tutorial handbook for free!

And click Free Trial to download other strategies testing tools, all for a 30-day Free Trial.

Click on Subscription to order more strategies testing tools to help your stock trading.

|

|

Free Tutorial

Share

|

|

|

|