MACD Indicator: Adding Some Swagger to Your Trading Strategy

|

|

Are you tired of using boring technical indicators that put you to sleep

faster than your uncle’s stories at Thanksgiving dinner? Look no further

than the MACD indicator! This little guy might just be the life of the party

in your trading strategy. Okay, maybe not quite, but it can certainly add

some pizzazz to your analysis. Let’s dive in and see what all the fuss is

about!

The MACD (Moving Average Convergence Divergence) indicator is

a popular technical analysis tool used by traders to identify potential

trend reversals and momentum shifts in financial markets. It was developed

by Gerald Appel in the late 1970s, and it remains one of the most widely

used indicators today.

The MACD indicator is composed of three

components: the MACD line, the signal line, and the histogram. The MACD line

is the difference between two exponential moving averages (EMAs) of

different time periods, usually 12 and 26 periods. The signal line is a

9-period EMA of the MACD line, and the histogram represents the difference

between the MACD line and the signal line.

When the MACD line crosses

above the signal line, it is considered a bullish signal, indicating that

momentum is shifting to the upside. Conversely, when the MACD line crosses

below the signal line, it is a bearish signal, indicating that momentum is

shifting to the downside. The histogram can also be used to confirm these

signals, with positive values indicating bullish momentum and negative

values indicating bearish momentum.

Traders can use the MACD

indicator in a variety of ways. Some use it as a standalone indicator, while

others use it in combination with other technical analysis tools such as

support and resistance levels, trendlines, and chart patterns. One popular

strategy is to look for divergences between the MACD indicator and price

action. For example, if price is making lower lows while the MACD is making

higher lows, it may indicate that a trend reversal is imminent.

Another way to use the MACD is to look for crossovers between the MACD line

and the signal line. For example, a bullish crossover occurs when the MACD

line crosses above the signal line, indicating a potential uptrend. Traders

may enter a long position at this point and exit when the MACD line crosses

back below the signal line.

It’s worth noting that while the MACD

indicator can be a useful tool for identifying potential trading

opportunities, it should not be relied on as the sole basis for making

trading decisions. Traders should always conduct their own research and

analysis, and consider factors such as market trends, news events, and

economic indicators before making any trades.

However, in this blog,

we plan to test a simple “MACD” Trading Strategy exclusively, to get a

direct impression, without any help or correction from other indicators,

about the effectiveness of a pure MACD strategy.

Let’s download the

“MACD” Trading Strategy backtesting tool from this link. It’s an Excel Macro

that’s very easy to use. For this trial, let’s pick NVDA (Nvidia

Corporation’s stock symbol). We’ll import NVDA’s historical data, keeping

around 3,000 days’ worth and removing the remaining. The settings will be as

follows:

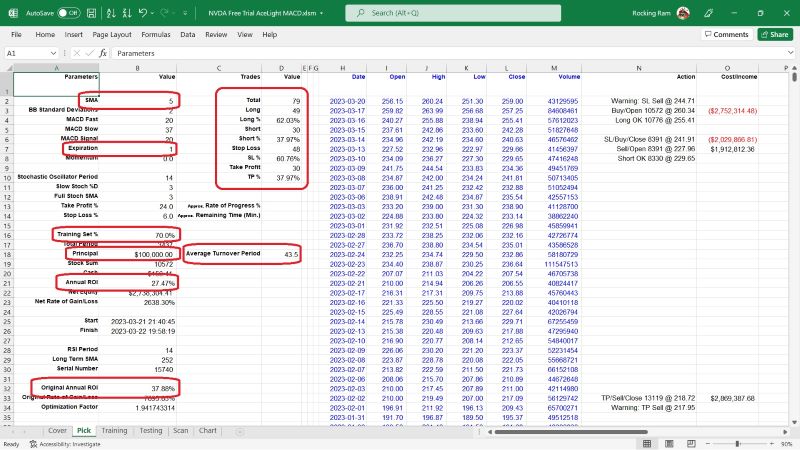

In the “Pick” worksheet, set the Principal at cell B18

(typically set at 100,000), and the Training % at cell B16 (normally set at

70).

Set the SMA at cell B2 (normally set at 5), and the Expiration

at cell B7 (normally set at 3; this time, we’ll try 1).

Fill the

Optimization Factor value in cell B34. This value is specific to each stock

and is calculated based on its unique features. It influences the Trigger

and Momentum used during the backtesting VBA Macro. Users can follow us for

getting the newest unique Optimization Factor for particular stock.

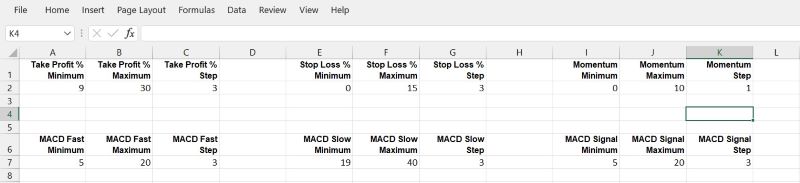

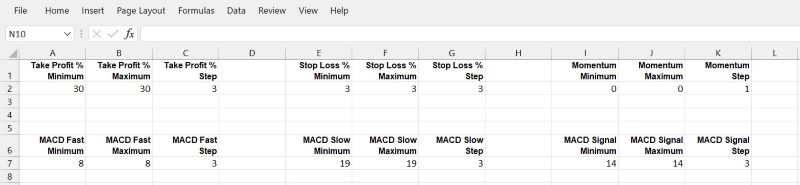

Now, let’s go to the “Scan” worksheet, set the scan ranges for Take Profit,

Stop Loss, omentum, MACD Fast, Slow and Signal. The “Scan” worksheet looks

like below:

The backtesting VBA Macro will try every combination, such as Take

Profit at 3%, Stop Loss at 12%, and Momentum (a standard to trigger the Buy

or Sell actions) at 5, etc. This tool will execute these conditions to

simulate a series of trading actions using historical data from the

beginning, opening and closing long or short positions based on the signals

generated by your trading strategies.

To run the VBA Macro program,

there are several methods, for example, we can:

1. Click on the

“View” tab on the Excel ribbon.

2. Click on the “Macros” button in

the “Macros” group. This will open the “Macro” dialog box.

3. In the

“Macro” dialog box, select the Macro that you want to run.

4. Click

on the “Run” button.

We can also press Alt + F8, the “Macro” dialog

box will jump out, select the Macro (the name in this demo is “MACD” and its

version number), then click the “Run” button.

The fastest method is

using shortcut hot keys: Press Ctrl + Y, the Macro will run immediately.

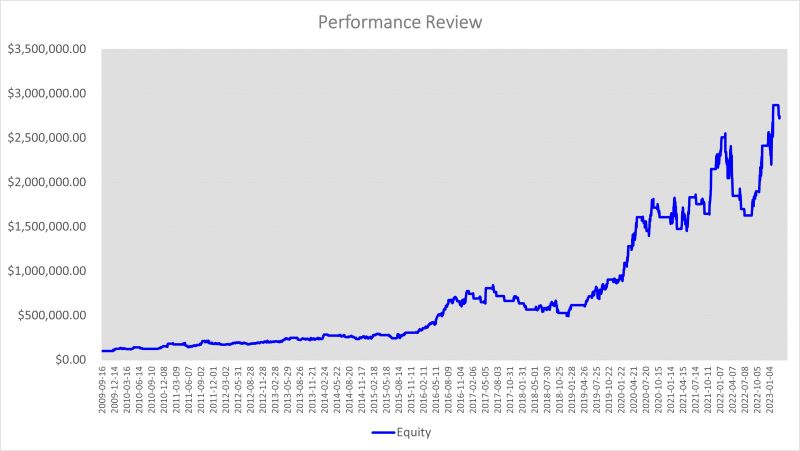

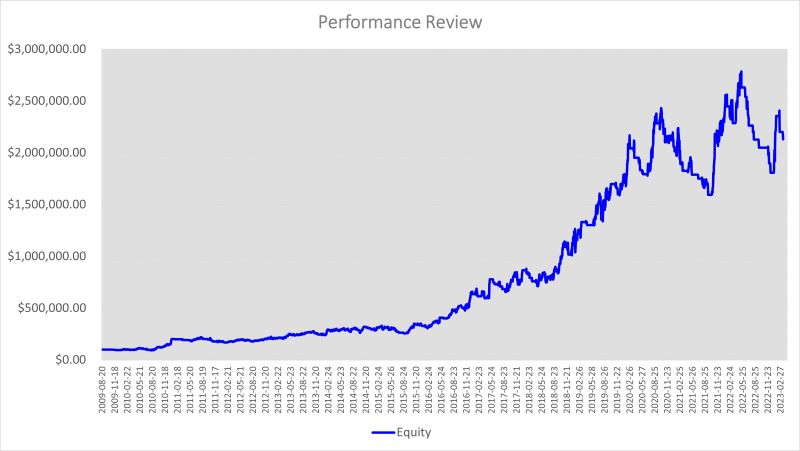

After running the VBA tool, we will get a curve in “Chart” worksheet

like this:

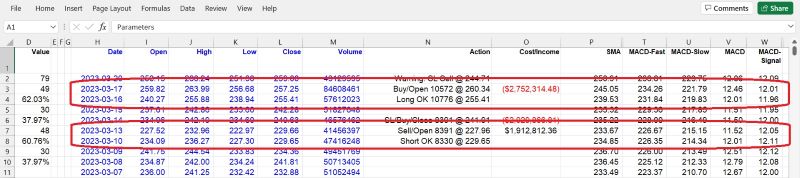

And we can see, when the MACD is crossing up and higher than MACD

Signal, the VBA Macro generates a Long OK signal, and Buy to open Long in 1

day; when the MACD is crossing down and lower than MACD Signal, the VBA

program gives a Short OK signal, then Sell to open short in 1day. If we set

the Expiration (“Pick” worksheet cell B7) as 3, the signals will expire

after 3 days.

After a

long run, since 2009–07–24 to 2023–03–20, which is a total of 3437 trading

days, and with the following parameters set: Momentum at 0, Take Profit at

24%, Stop Loss at 6%, MACD Fast at 20, MACD Slow at 37, MACD Signal at 20,

we will get an Annual ROI at 27.47%, compared to S&P 500 Index’s average of

7%, it sounds impressive, eh?

During this period, there were 79 trade

deals completed, with 49 of them being long positions and 30 of them being

short positions. Stop loss was triggered 48 times, while take profit was

achieved 30 times, 1 position is not closed yet. The ratio of stop loss vs.

take profit was 38% vs. 61% (because Take Profit at 24% and Stop Loss at 6%,

one Take-Profit will cover 4 Stop-Loss). On average, it took 43.5 days to

complete one full round of buying and selling.

In

conclusion, the MACD Trading Strategy works well for NVDA. However, the

transactions (which occurred 79 times over a 13-year period) are relatively

few to provide strong evidence of the strategy’s repeatability.

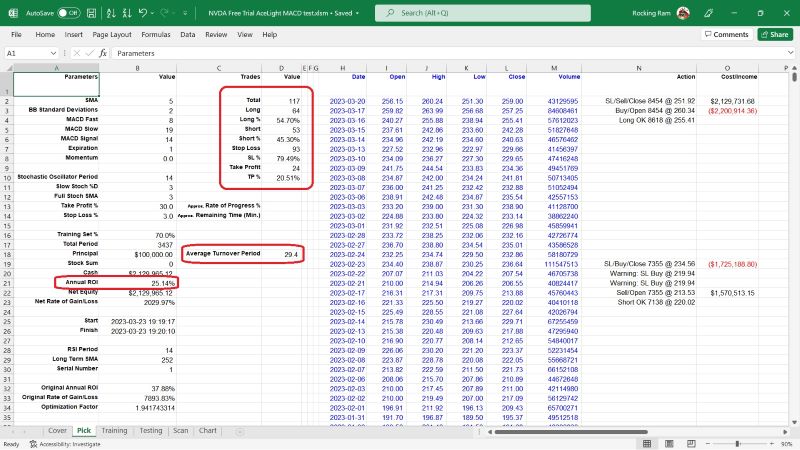

We

can try another parameter group like this:

Then we

can get this result:

Still

good enough, eh? Take a look at the Average Turnover Period:

The

transactions (which occurred 117 times over a 13-year period) are sufficient

to provide strong evidence of the strategy’s repeatability. If this

indicator shows such quality while working solely, it is qualified to be one

part of materials in a trading strategy that integrates other indicators or

patterns of the same quality, and has the potential to be combined with

other good indicators or patterns to create a stronger trading strategy.

Some traders complain that MACD does not work well for them. There could

be many reasons for this failure, but one of the reasons could be that they

did not do the backtesting correctly, especially if they did not find the

right parameter combinations or settings. Do you remember the default

parameters of MACD? They are MACD Fast at 12, Slow at 26, and Signal at 9,

right? We tried these default settings to backtest the MACD, using the same

data of NVDA, and got a sad result: no matter how the Take Profit, Stop

Loss, and Momentum were set, the typical 12–26–9 MACD setting failed.

This result explains why some traders dislike the MACD indicator.

Actually, they do not know that it is not the MACD’s fault, but rather a

problem with the parameter settings. If they had known how to adjust the

parameter settings earlier, they might have discovered a “gold mine”. In

short, backtesting is crucial, and a backtesting tool can be very helpful.

Sometimes it can make the difference between life and death. If you still do

not have a backtesting tool to verify trading strategies and find the

correct settings for your favorite indicators, get one now. You must be glad

when you have a good tool on hand and your competitors don’t even know there

are such cool things in the world.

Overall, the MACD indicator is a

powerful tool for identifying potential trend reversals and momentum shifts

in financial markets. However, it is important to note that no indicator is

foolproof, and traders should always use proper risk management techniques

to protect their capital. Overall, the MACD indicator is a

powerful tool for identifying potential trend reversals and momentum shifts

in financial markets. However, it is important to note that no indicator is

foolproof, and traders should always use proper risk management techniques

to protect their capital.

So, there you have it folks, the MACD

indicator: the one tool that won’t make you want to take a nap during your

trading sessions. Sure, it may not be as exciting as a clown juggling

flaming swords, but it can certainly add some excitement to your chart

analysis. So, go forth and conquer the markets with the MACD, and may your

trades be as profitable as a used car salesman on a hot summer day. Happy

trading!

Click

LIGHTING THE PATH TO PROFITABLE TRADING: A Step-by-Step Guide to Building a Trading Strategy Verification Tool with VBA Macros to get the whole tutorial handbook for free!

And click Free Trial to download other strategies testing tools, all for a 30-day Free Trial.

Click on Subscription to order more strategies testing tools to help your stock trading.

|

|

Free Tutorial

Share

|

|

|

|