How to use RSI indicator to trade stocks: Backtesting results for Google stock

|

|

Are you tired of the same old boring technical indicators? Do you find

yourself falling asleep at your desk while staring at charts? Fear not, my

fellow traders, for I have a solution that will not only wake you up but

also put a smile on your face. Let me introduce you to the Relative Strength

Index, or as I like to call it, the Really Simple Indicator. Don’t let the

name fool you; this little guy may be simple, but it’s also mighty. So

buckle up, my friends, and get ready to add a little laughter to your

trading strategy with the RSI.

The Relative Strength Index (RSI) is a

popular technical indicator used by traders to identify potential buy and

sell signals in stocks. It measures the strength of a stock’s recent price

movements and helps traders determine if a stock is overbought or oversold.

In this blog, we will discuss how to use the RSI indicator to trade stocks

effectively.

What is the RSI Indicator? The RSI is a momentum

oscillator that measures the strength of a stock’s recent price movements.

The indicator oscillates between 0 and 100 and is calculated based on the

average gain and loss of the stock over a specific period. The RSI is

typically calculated using a 14-day period, but it can be adjusted based on

the trader’s preference.

How to Use the RSI Indicator to Trade

Stocks: The RSI indicator can be used in several ways to identify potential

buy and sell signals in stocks. Here are a few common strategies:

Overbought and Oversold Conditions: The RSI is often used to identify

overbought and oversold conditions in a stock. When the RSI is above 70, the

stock is considered overbought, and when the RSI is below 30, the stock is

considered oversold. Traders can use these levels as potential sell and buy

signals, respectively.

Divergence: Divergence occurs when the stock’s

price is moving in the opposite direction of the RSI. This can be a

potential signal that the current trend is losing momentum and a reversal is

likely to occur. Traders can use divergence as a potential signal to exit or

enter a position.

Trendline Analysis: Traders can use trendlines to

identify potential buy and sell signals. When the RSI breaks above a

downtrend line, it can be a signal to buy the stock. Conversely, when the

RSI breaks below an uptrend line, it can be a signal to sell the stock.

Bullish and Bearish Divergence: When the stock’s price is making lower

lows, and the RSI is making higher lows, it is called bullish divergence.

This can be a potential signal that the stock is likely to reverse and move

higher. Conversely, when the stock’s price is making higher highs, and the

RSI is making lower highs, it is called bearish divergence. This can be a

potential signal that the stock is likely to reverse and move lower.

Moving Average Crossover: Traders can use the RSI in combination with a

moving average crossover to identify potential buy and sell signals. When

the RSI crosses above the moving average, it can be a signal to buy the

stock. Conversely, when the RSI crosses below the moving average, it can be

a signal to sell the stock.

Today we like to test the pure RSI

indicator’s power. Let’s pick GOOG (Google LLC’s stock symbol) to be the

target. Based on a simple trading strategy: When the RSI is below 30, we buy

and open a Long position. When the RSI is above, we sell to open a Short

position.

We can download the ‘RSI’ Trading Strategy backtesting tool

from the TYZU website. It’s an Excel Macro that’s very easy to use, and

offers a 30-day free trial. For this backtesting, we’ll import GOOG’s

historical data, keeping around 3,000 days’ worth and cutting off the rest.

The settings will be as follows:

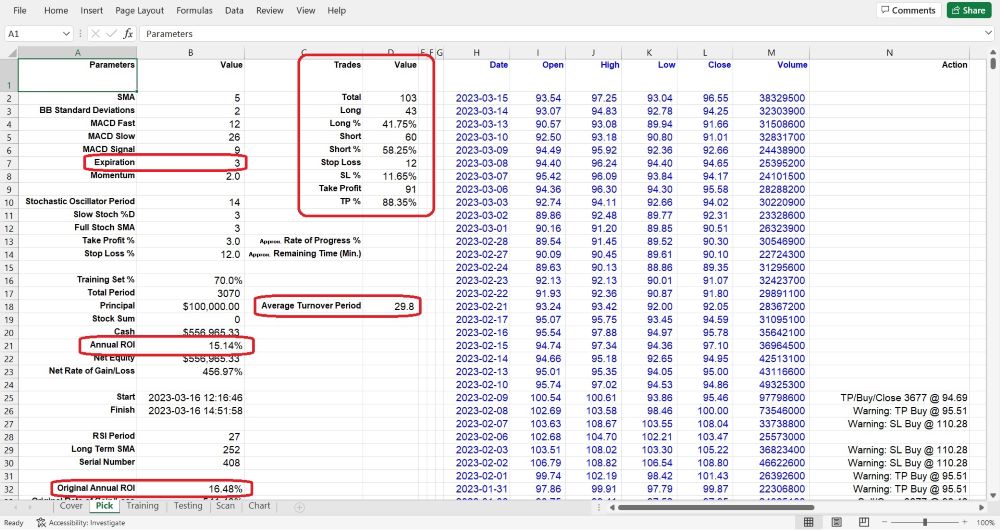

In the “Pick” worksheet, set

the Principal at cell B18 (typically set at 100,000), and the Training % at

cell B16 (normally set at 70).

Set the SMA at cell B2 (normally set

at 5), and the Expiration at cell B7 (normally set at 3).

Fill the

Optimization Factor value in cell B34. This value is specific to each stock

and is calculated based on its unique features. It influences the Trigger

and Momentum used during the backtesting VBA Macro. Users can follow us for

getting the newest unique Optimization Factor for particular stock.

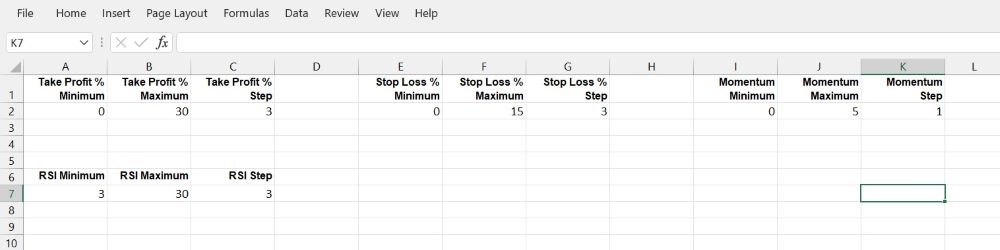

Now, let’s go to the “Scan” worksheet, set the scan ranges for Take Profit,

Stop Loss, Momentum, and RSI. The “Scan” worksheet looks like below:

The

backtesting VBA Macro will try every combination, such as Take Profit at 3%,

Stop Loss at 12%, and Momentum (a standard to trigger the Buy or Sell

actions) at 5, etc. This tool will execute these conditions to simulate a

series of trading actions using historical data from the beginning, opening

and closing long or short positions based on the signals generated by your

trading strategies.

To run the VBA Macro program, there are several

methods, for example, we can:

1. Click on the “View” tab on the Excel

ribbon.

2. Click on the “Macros” button in the “Macros” group. This

will open the “Macro” dialog box.

3. In the “Macro” dialog box,

select the Macro that you want to run.

4. Click on the “Run” button.

We can also press Alt + F8, the “Macro” dialog box will jump out, select

the Macro (the name in this demo is “RSI” and its version number), then

click the “Run” button.

The fastest method is using shortcut hot

keys: Press Ctrl + Y, the Macro will run immediately.

When the VBA

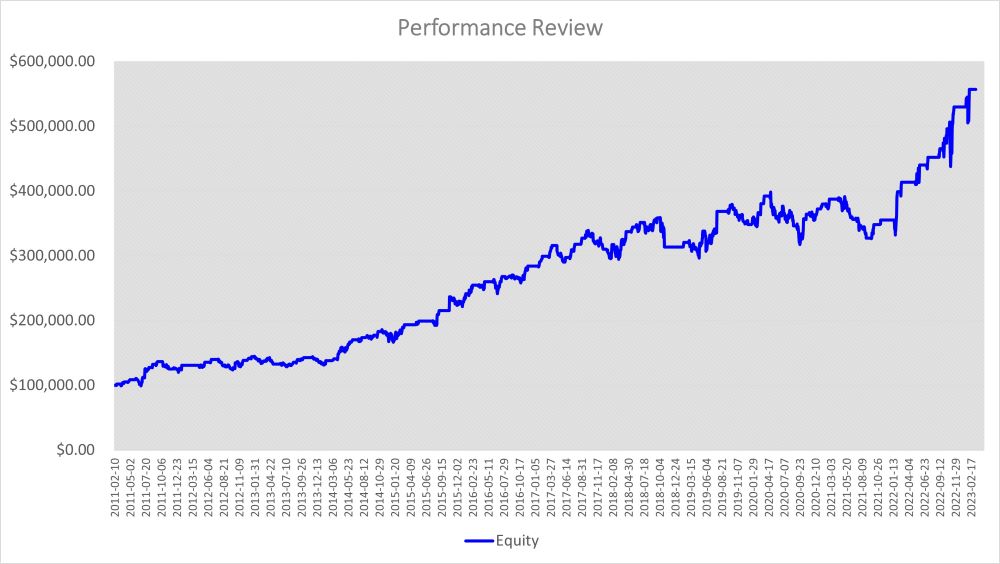

tool finishes scanning, we will get a curve in “Chart” worksheet like this:

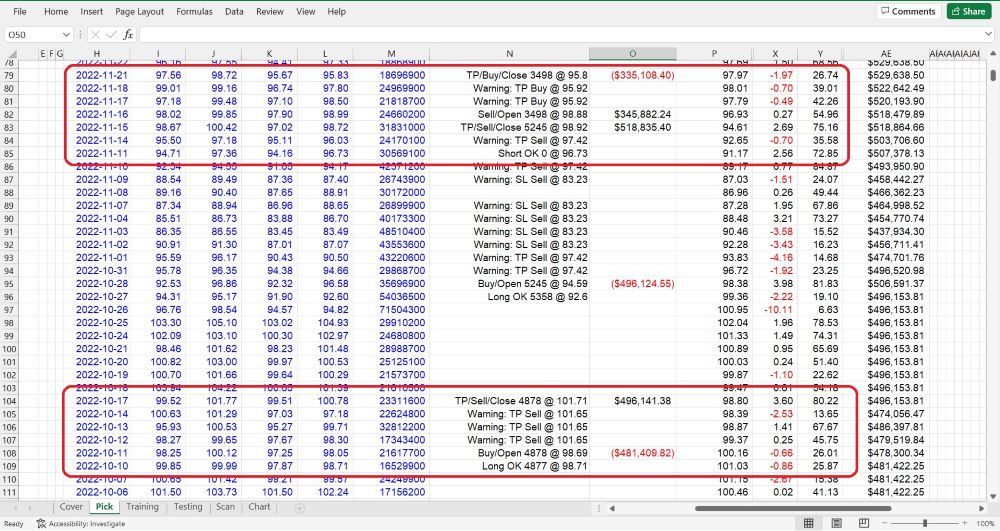

And we can see, when the RSI is below 30, the VBA Macro generates a Long OK

signal, and Buy to open Long within three days; when the RSI is above 70,

the VBA program gives a Short OK signal, then Sell to open short within

three days. If we set the Expiration (“Pick” worksheet cell B7) as 1, the

signals will expire after 1 day.

After

a long run, since 2011–01–03 to 2023–03–15, which is a total of 3070 trading

days, and with the following parameters set: Momentum at 2, Take Profit at

3%, Stop Loss at 12%, RSI at 27, we will get an Annual ROI at 15.14%,

compared to S&P 500 Index’s average of 6%~7%, not bad, eh? During this

period, there were 103 trade deals completed, with 43 of them being long

positions and 60 of them being short positions. Stop loss was triggered 12

times, while take profit was achieved 91 times. The ratio of stop loss vs.

take profit was 88.35% vs. 11.65%. On average, it took 29.8 days to complete

one full round of buying, selling, holding, and empty position waiting.

In conclusion, the “RSI” Trading Strategy works okay for GOOG. The

transactions (which occurred 103 times over a 12-year period) are good

enough to provide strong evidence of the strategy’s repeatability. If this

indicator shows such quality while working solely, it is qualified to be one

part of materials in a trading strategy that integrates other indicators or

patterns of the same quality, and has the potential to be combined with

other good indicators or patterns to create a stronger trading strategy.

And there you have it, folks — the RSI, the Really Simple Indicator. Who

knew something so simple could be so effective? Just remember, while the RSI

may be easy to use, trading is still a risky business. So don’t go all-in on

a trade just because the RSI says so, unless you’re looking for a one-way

ticket to the poorhouse. Keep calm, trade on, and may the RSI be with you.

And if all else fails, you can always blame your losses on the indicator

being too darn simple. Happy trading! And there you have it, folks — the RSI, the Really Simple Indicator. Who

knew something so simple could be so effective? Just remember, while the RSI

may be easy to use, trading is still a risky business. So don’t go all-in on

a trade just because the RSI says so, unless you’re looking for a one-way

ticket to the poorhouse. Keep calm, trade on, and may the RSI be with you.

And if all else fails, you can always blame your losses on the indicator

being too darn simple. Happy trading!

Click

LIGHTING THE PATH TO PROFITABLE TRADING: A Step-by-Step Guide to Building a Trading Strategy Verification Tool with VBA Macros to get the whole tutorial handbook for free!

And click Free Trial to download other strategies testing tools, all for a 30-day Free Trial.

Click on Subscription to order more strategies testing tools to help your stock trading.

|

|

Free Tutorial

Share

|

|

|

|