CHAPTER 2: WHAT IS BACKTESTING AND WHY IS IT SO IMPORTANT

|

|

Backtesting is essential in stock trading because

it allows you to evaluate the performance of a trading strategy based on

historical market data. By backtesting a trading strategy, you can determine

how well it would have performed in the past, which can give you an idea of

how well it is likely to perform in the future. Backtesting is essential in stock trading because

it allows you to evaluate the performance of a trading strategy based on

historical market data. By backtesting a trading strategy, you can determine

how well it would have performed in the past, which can give you an idea of

how well it is likely to perform in the future.

Backtesting can also

help you identify any flaws or weaknesses in your trading strategy. For

example, if your strategy performs poorly during certain market conditions,

you can modify it to improve its performance in those conditions.

In

addition, backtesting can help you set realistic expectations for your

trading strategy. By evaluating its performance over a long period, you can

get a good idea of the average returns and drawdowns you can expect from the

strategy. This can help you avoid overestimating the potential profits of

your strategy and taking on too much risk.

To perform a backtest, you

need to:

Define the rules of the trading strategy: This involves

specifying the entry and exit conditions of the strategy, such as when to

buy or sell a stock based on certain technical indicators.

Gather

historical market data: This involves collecting price data for the

securities you are interested in over the period you want to backtest.

Apply the trading strategy to the historical data: This involves

simulating the trades that would have been made by the strategy at each

point in time based on the historical market data.

Evaluate the

results: This involves analyzing the performance of the strategy in terms of

its profitability, risk, and other performance metrics.

Let's

consider an example of how backtesting works in practice. Suppose you want

to develop a simple trading strategy for a particular stock. Your strategy

involves buying the stock whenever its 50-day moving average crosses above

its 200-day moving average (a so-called 'Golden Cross'), and selling the

stock whenever the opposite occurs (known as a 'Death Cross'), as shown in

the chart below.

To backtest this strategy, you would need to gather historical price

data for the stock and calculate its 50-day and 200-day moving averages at

each point in time. You would then simulate trades using the trading

strategy and calculate the profit or loss that would have been made at each

point in time.

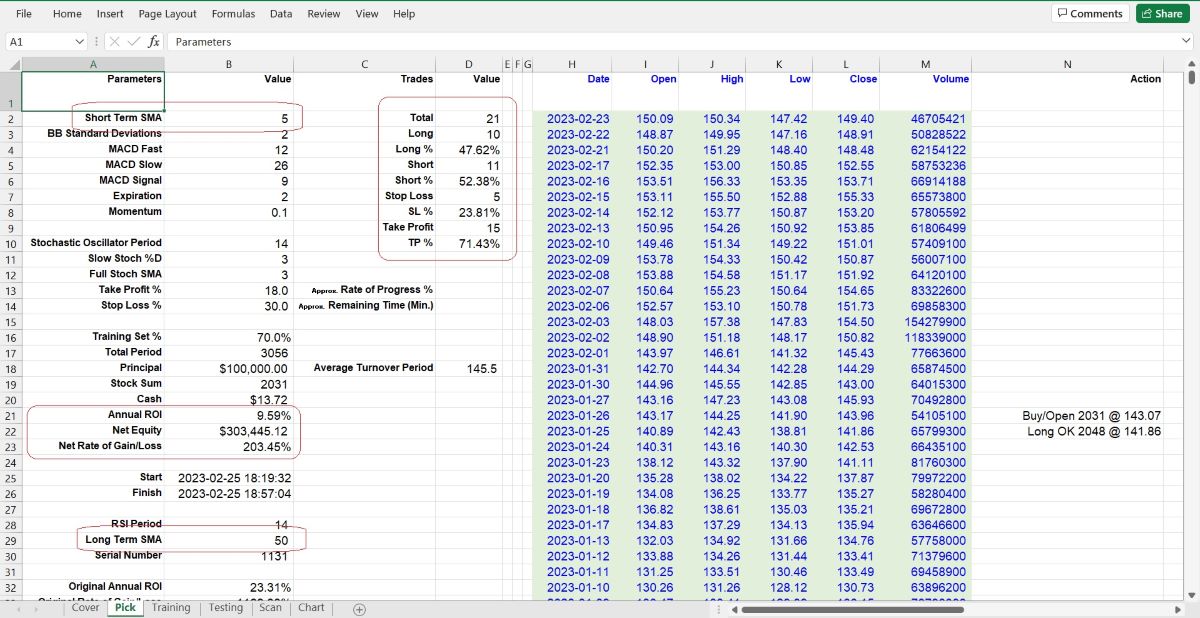

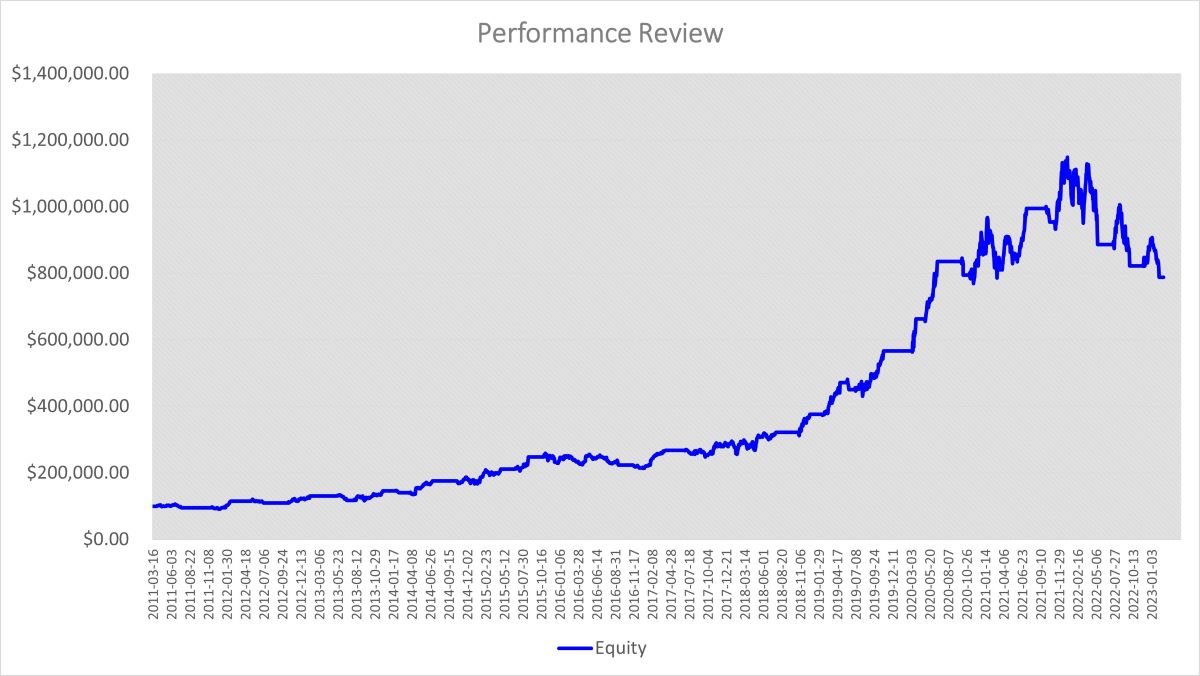

For example, we can create a VBA macro to

perform backtesting for the "Two Moving Average Lines Cross" trading

strategy. Do you remember the "10-day SMA and 100-day SMA" strategy code we

mentioned in Chapter 1? We can modify it, change the short term SMA to

50-day, and the long term SMA to 200-day. Let's take AAPL (Apple Inc.'s

stock symbol) as an example. After downloading AAPL's historical data

(2011-01-03 ~ 2023-02-23) and running the VBA program, we will get a result

like this:

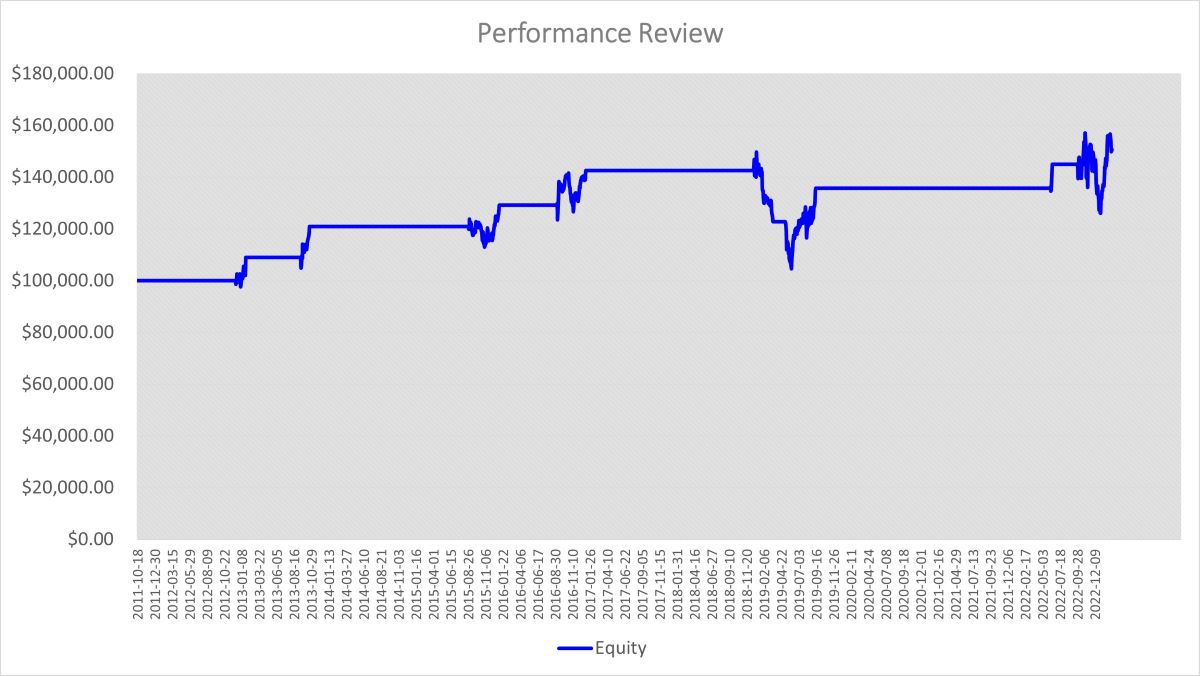

The result may not seem

impressive, eh? The trading strategy looks perfect, the company is famous

and strong. But when we deploy this trading strategy, the result is just

so-so. This case shows why a backtest can protect us from guesswork and

mystery, and a simple VBA program can save us a lot of time and money.

After performing the backtest, you would evaluate the results to

determine if the strategy is profitable and if it meets your risk and

performance criteria. For example, you might evaluate the strategy based on

metrics such as the average annual return, maximum drawdown, and Sharpe

ratio.

If the results are satisfactory, you perhaps can use the

strategy to make trades in real-time. If the results are not satisfactory,

you may need to refine the strategy or develop a new one altogether.

Let's go back to the 'Two Moving Average Lines Cross' trading strategy, and

adjust the parameters by setting the short-term SMA to 5 days and the

long-term SMA to 50 days. This will increase the chances of executing the

strategy. The chart will look like the one below:

Run the VBA Macro again.

Look at the

results above, much better, right? Let's dive into the details:

The Annual

ROI (Return on Investment) is 9.59%, which is higher than the average Annual

ROI of the S&P 500 index (6.9%). See the difference? With the same trading

strategy, same target, and same time period, just changing some parameters

can lead to significant differences in the result. If you do this manually,

it may take several days, if not weeks. However, by using VBA, it only takes

several minutes or hours. Conducting a backtest, it may seem like playing a

game of numbers. However, without it, we risk facing Life-or-Death

situations in real trading.

An Annual Return on Investment of around

10% is decent, OK but not a “WOW!” yet. Compared to Warren Buffett's average

ROI of 17% per year, there is much more room for improvement in the trading

strategy. The process of improving the strategy can be full of interesting

discoveries and surprises. We will continue to share more backtesting

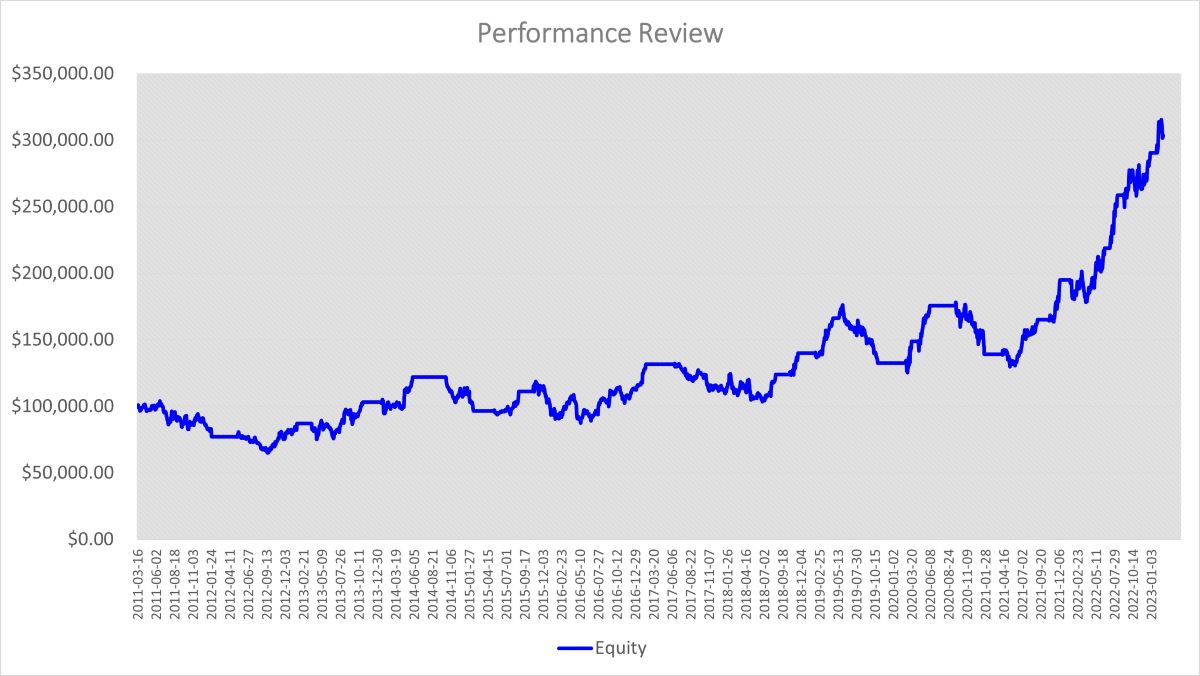

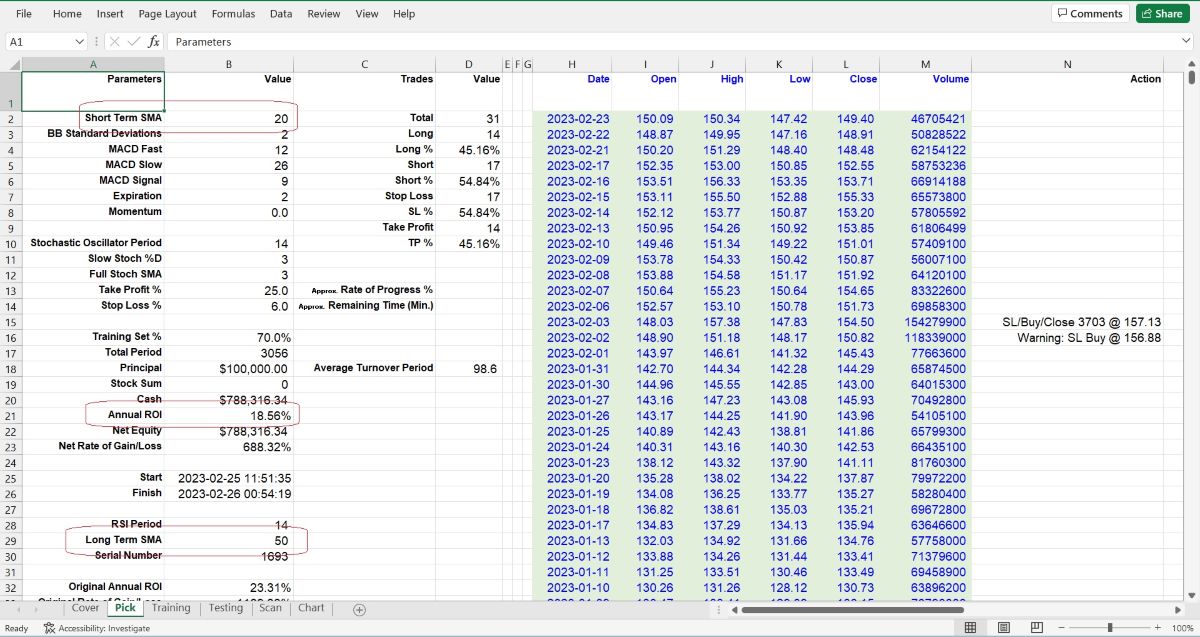

details in the following chapters. For example, if we change the short-term

SMA to 20 days and set the long-term SMA to 50 days, like this:

We

can double the ROI to 18%, which is neck-and-neck with Warren Buffett's

performance, as shown in the chart below:

Now, backtesting brings us

a small "WOW!", doesn't it? Eh? In the following chapters, we will explain

the details of every part of VBA Macros which deploy different trading

strategies for different targets. Stay tuned.

In summary, backtesting

is an essential step in developing and evaluating trading strategies. It

allows you to test a strategy on historical market data and determine its

performance and potential profitability. Backtesting helps traders make

informed decisions and avoid costly mistakes when investing in the stock

market. Without it, you would have no way of knowing whether your strategy

is likely to be profitable or not, and you would be trading based on

guesswork and intuition rather than solid evidence.

As you can see,

the difference between a profitable trading strategy and a losing one can be

as small as a few parameter tweaks. In fact, some might say that trading is

just like cooking: you need to adjust the recipe until it tastes just right.

And if you're really good, you can make something that's not only tasty but

also nutritious. So go ahead, put on your chef hat and start backtesting

your trading strategies. Who knows, you might just cook up the next big

thing in the stock market!

LIGHTING THE PATH TO PROFITABLE TRADING

(the whole tutorial handbook pdf Free Download)

A Step-by-Step Guide to Building a Trading

Strategy Verification Tool with VBA Macros

|

|

Free Tutorial

Share

|

|

|

|