CHAPTER 3: DATA ANALYSIS WITH EXCEL

|

|

To build a backtesting spreadsheet, you will need

to import historical data into Excel. In this chapter, we will cover the

process of importing data from external sources and how to clean and

transform the data for analysis.

There are several sources where you

can download stock historical data. Here are a few popular options:

1, Yahoo Finance: Yahoo Finance provides free historical price data for most

stocks, which can be downloaded in a CSV format. Simply go to the Yahoo

Finance website, enter the ticker symbol of the stock you are interested in,

and select the "Historical Data" tab. From there, you can download the data

for a specified time period.

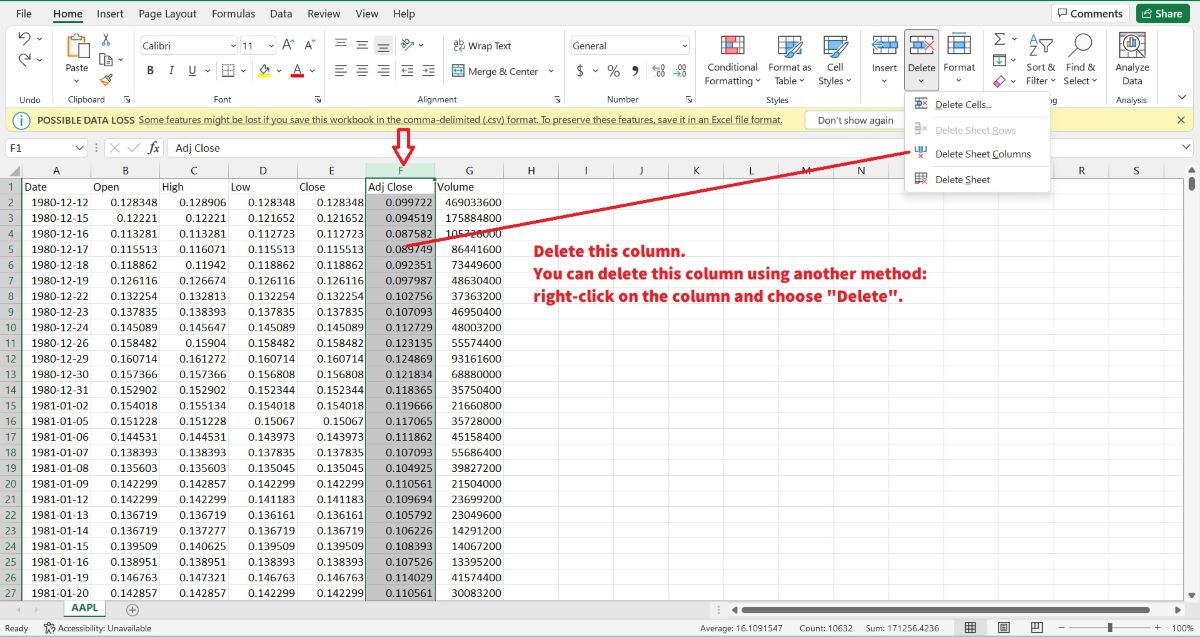

Open the .csv file, delete the “Adj.

Close” column. “Adjusted close” is the closing price after adjustments for

all applicable splits and dividend distributions. We don’t need it in our

method.

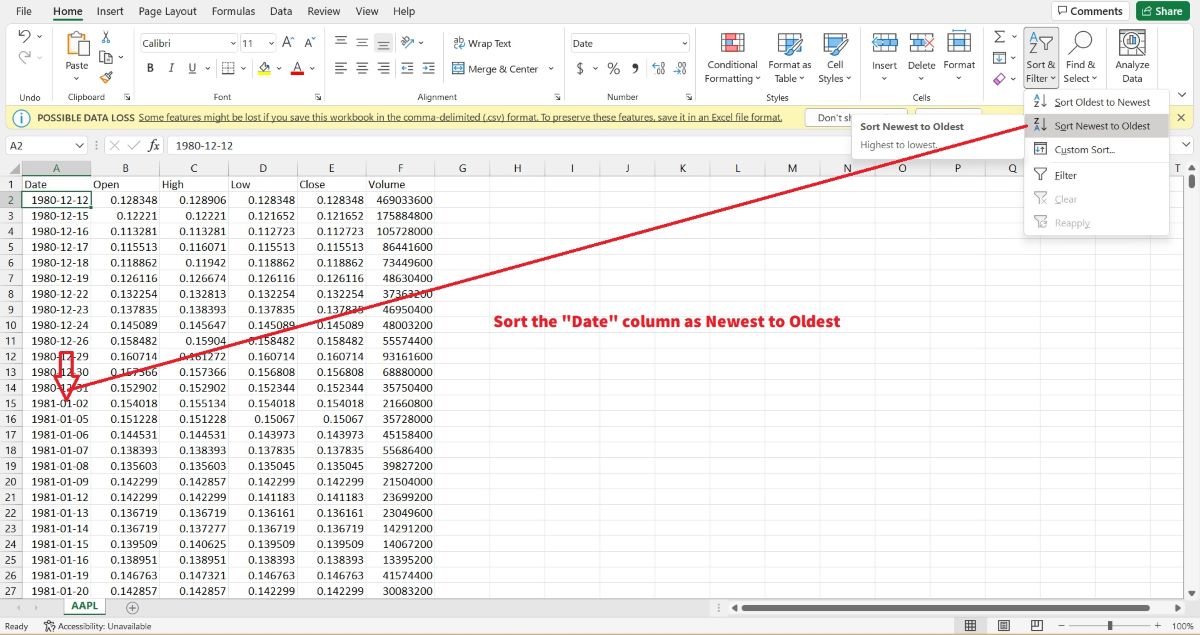

Click any cell in the “Date” Column. Sort the "Date" as Newest to

Oldest.

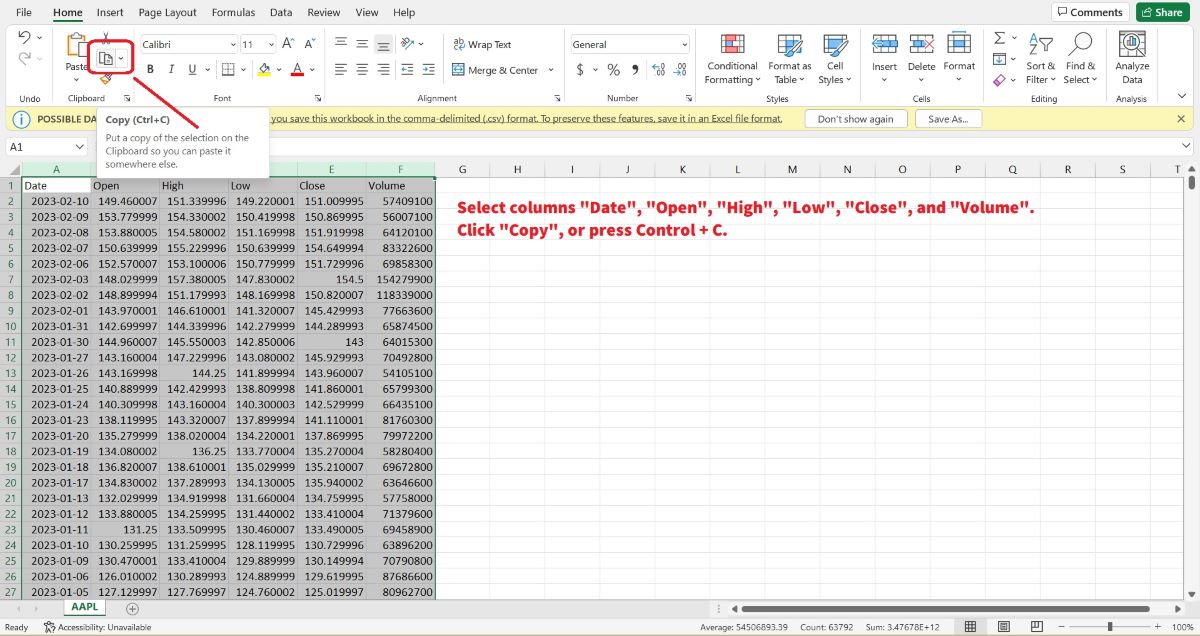

Select and Copy 6 columns including Date, Open, High, Low, Close and

Volume historical data.

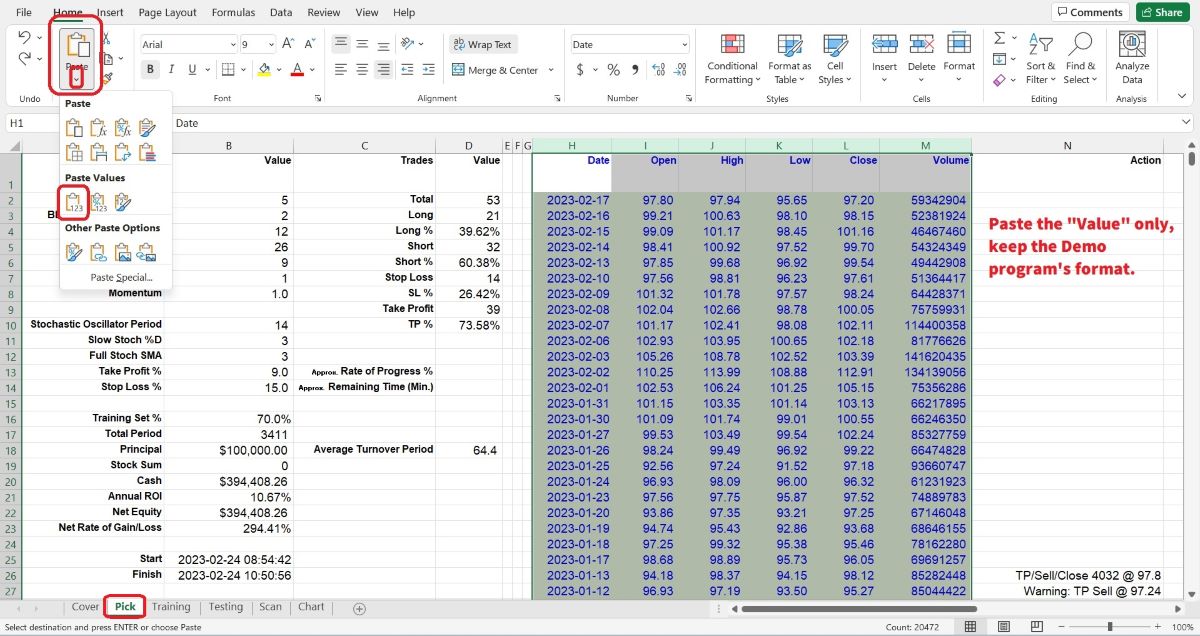

Open the Demo Excel file that contains the VBA Macro for backtesting,

click the "Pick" worksheet tab, select columns H to M that correspond to the

6 columns storing the Date, Open, High, Low, Close, and Volume historical

data. Then, paste the “Value” only (don’t bring the .csv files’ format into

the Demo Excel file) into these selected columns.

Save the Demo Excel file. We don’t need the Yahoo .csv file anymore, so

close it. Now the targeted stock’s historical data has been filled in the

Demo Excel file, and it is ready to run the VBA Macro program for

backtesting.

2, MSN.com: You can download historical stock prices

from MSN Money by following these steps:

Go to the MSN Money website

(https://www.msn.com/money).

Enter the ticker symbol of the stock you

want to download data for in the search bar and click "Search".

On

the stock's page, click on the "History" button, sometimes it is hidden

inside the three dots button in the top right corner.

In the

"History" section, select the time range you want to download data for.

The historical data will be displayed on the page. Select and copy the

data, paste into Excel sheets.

Note that not all stocks may be

available on MSN Money, and the historical data may be subject to delays or

inaccuracies. It's always a good idea to double-check the data before using

it in your analysis or trading strategy.

3, Google Finance: Google

Finance also provides free historical price data for most stocks. Simply go

to the Google Finance website, enter the ticker symbol of the stock you are

interested in, and select the "Historical Prices" option. You can then

download the data for a specified time period.

You can download

historical stock prices from Google using Google Sheets by following these

steps:

Open a new or existing Google Sheet.

In a cell, enter

the following formula:

=GOOGLEFINANCE("ticker", "attribute",

"start_date", "end_date", "interval")

where "ticker" is the stock

symbol you want to download data for, "attribute" is the price or volume

attribute you want to download (such as "open", "high", "low", "close",

"volume", or “all”), "start_date" is the date you want to start downloading

data from (in the format "YYYY-MM-DD"), "end_date" is the date you want to

stop downloading data at (in the format "YYYY-MM-DD"), and "interval" is the

frequency of the data you want to download (such as "DAILY" for daily data,

"WEEKLY" for weekly data, or "MONTHLY" for monthly data).

For

example, if you want to download the daily closing price data for Apple

stock (symbol "AAPL") from January 1, 2012, to December 31, 2022, you would

enter the following formula in a cell:

=GOOGLEFINANCE("AAPL", "all",

"2012-01-01", "2022-12-31", "daily")

Press Enter. The formula will

automatically download the historical data for the stock and display it in

the cell. Press Enter. The formula will

automatically download the historical data for the stock and display it in

the cell.

If you want to download data for multiple stocks or

attributes, you can copy the formula to other cells and edit the parameters

as needed.

Note that the GOOGLEFINANCE function may not be available

in all regions or may be subject to certain limitations. Additionally, the

historical data downloaded using this method may be subject to delays or

inaccuracies, so it's always a good idea to double-check the data before

using it in your analysis or trading strategy.

These are other

options for downloading stock data, but need to pay some fees. It's

important to note that the availability and quality of data may vary

depending on the source, so it's always a good idea to do your research and

make sure the data is suitable for your needs before using it.

After

importing all your historical stock data into Excel, you may start to feel

like a data analysis wizard. But be careful, with great power comes great

responsibility... to not accidentally delete all your hard work with one

misplaced click of the mouse! So, remember to save your Excel file often and

always have a backup, because you never know when Excel will decide to crash

on you. And if all else fails, just blame it on the stock market. It's

always the stock market's fault.

LIGHTING THE PATH TO PROFITABLE TRADING

(the whole tutorial handbook pdf Free Download)

A Step-by-Step Guide to Building a Trading

Strategy Verification Tool with VBA Macros

|

|

Free Tutorial

Share

|

|

|

|