|

To create a trading

strategy, you need to identify a set of rules that will determine when to

enter and exit trades. In this chapter, we will cover some basic trading

strategies and show you how to implement them in Excel using formulas and

VBA.

For example, have you ever

heard of the “Three White Soldiers” and “Three Black Crows” stock

candlestick patterns? Let’s take a look at this chart:

This is the so-call "Three

White Soldiers". It is a bullish candlestick pattern that typically

indicates a strong uptrend in the stock price. It consists of three long

white (or green) candles, each with small or no shadows, that open higher

and close higher than the previous day's candle.

The pattern is called "Three

White Soldiers" because the three candles resemble three soldiers marching

in a row. It is a sign of strong buying pressure and suggests that the bulls

are in control of the market. Traders often look for this pattern to

identify potential entry points for long positions, but it should be

confirmed with other technical indicators before making any trading

decisions.

Now, here we have another

pattern:

Let’s say hello to the

"Three Black Crows". It is a bearish candlestick pattern that is typically

seen at the end of an uptrend in the stock price. It consists of three long

black (or red) candles, each with small or no shadows, that open lower and

close lower than the previous day's candle.

The pattern is called "Three

Black Crows" because the three candles resemble three crows sitting in a

row. It is a sign of strong selling pressure and suggests that the bears are

in control of the market. Traders often look for this pattern to identify

potential entry points for short positions, but it should be confirmed with

other technical indicators before making any trading decisions.

According to these ideas, we

can develop a trading strategy to buy stocks while we see the Three White

Soldiers appearing, and short sell the stocks when we find the Three Black

Crows sitting there.

Now we start to write a VBA

Macro, a simple program to execute this strategy. To write a VBA macro,

follow these steps:

1.

Open Microsoft Excel.

2.

Press Alt+F11 to open the

Visual Basic Editor.

3.

In the Visual Basic Editor,

select the workbook in which you want to create the Macro.

4.

Click on the Insert menu and

select Module. This will create a new module for the Macro.

5.

In the module, type the code

for the Macro. The code should be written in the VBA programming language.

6.

Save the Macro by clicking

on the Save button or by pressing Ctrl+S.

7.

Close the Visual Basic

Editor.

8.

To run the Macro, open the

workbook in which it was created and press Alt+F8 to open the Macros dialog

box.

9.

Select the Macro you want to

run and click the Run button.

Note: It is important to

test the Macro thoroughly before using it on important data. Also, make sure

to enable Macros in Excel before running the Macro.

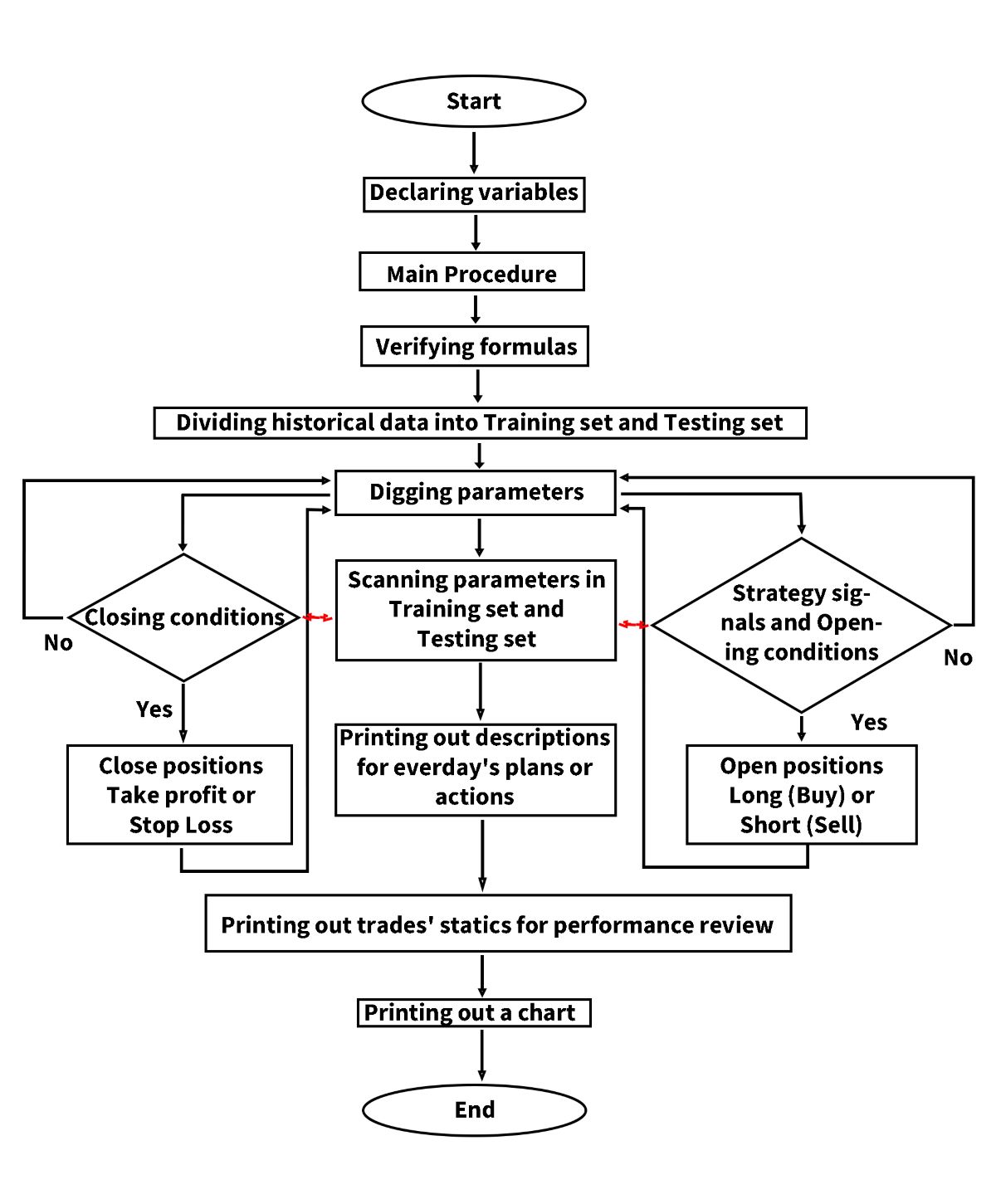

Before starting to do this

VBA coding, we need a plan. It looks like the programming flowchart below:

First of all, we need to

declare variables. Declaring variables in VBA is important because it helps

to allocate memory to store the data that the variable will hold. This

allows the program to use the variable efficiently and effectively.

By declaring variables, you

can also specify the data type of the variable (such as integer, string, or

boolean), which ensures that the variable is used correctly throughout the

program. If you don't declare a variable, VBA will assume a data type based

on the value assigned to the variable, which can cause errors or unexpected

results.

Declaring variables also

makes the code more readable and easier to understand, as it makes it clear

what each variable represents and how it will be used.

In the Main Procedure, we will turn

off Automatic Calculation to speed up VBA. Use

Application.Calculation = xlCalculationManual at the beginning of the

code, and turn it on again at the end with Application.Calculation =

xlCalculationAutomatic.

Then we do some

initialization, and call four subroutines, each implementing a different

function.

Call Self_Verifying

'Verifying formulas

Call Digging ‘Digging parameters

Call Scanning 'Scanning parameters in Training set and Testing set

Call EquityChart

'Printing out a chart to evaluate the result

In the Self-Verifying

procedure, we will verify all formulas used in every Excel worksheet, such

as calculating moving average value, indicator value, stock position, cash,

equity, etc. These formulas have been set into the demo Excel files. To

prevent them from being ruined or damaged accidentally, every time the VBA

Macro is run, the program will verify all formulas automatically to ensure

that the results and output are correct and fit the same standards.

In the Digging procedure, we

will dig through every parameter combination to simulate opening and closing

positions, calculate the profit or loss, compare ROI, eliminate

low-performance parameters, and select profitable combinations.

For digging out good

parameter combinations, we want to borrow some ideas from Machine Learning

technology (very fashionable, eh?), to divide historical data into two

parts, test our Trading Strategy (or we can use another word, “Model”, in

Machine Learning) under different conditions.

In machine learning, the

data is often divided into two subsets: the training set and the testing

set. The training set is used to train the machine learning model, while the

testing set is used to evaluate the performance of the trained model.

The purpose of dividing the

data into training and testing sets is to avoid overfitting, which is a

situation where the model performs very well on the training data but poorly

on new, unseen data. By evaluating the model's performance on the testing

set, we can get an estimate of how well the model will perform on new,

unseen data. For stock trading, it means: based on the training set’s

performance, we can select some strong parameters to test in the testing

set, screen out and throw out the weak ones which will lead us to failure

and loss, those survivors will give us a likelihood to estimate how

profitable the strategy will perform in the future.

The historical data can be

divided into training and testing sets, with a typical split of 70% for

training and 30% for testing. In our Demo Excel files, the default split is

70% for Training set and 30% for Testing set. Users can adjust them to 60%

or 80% for training and 40% or 20% for testing. Be careful, the split ratio

could affect the final results significantly.

The most important part in Digging procedure is the trading strategy conditions. We have a subroutine named as Signals to take charge of comparing the opening conditions. For example, we can Call Signals() to generate the simplest "Three White Soldiers and Three Black Crows" signals (three white candles or three black candles in a row) like this:

If LongOK = False And _

(Cells(Candle,

"L").Value - Cells(Candle, "I").Value) / Cells(Candle, "I").Value >

Trigger And _

(Cells(Candle +

1, "L").Value - Cells(Candle + 1, "I").Value) / Cells(Candle + 1,

"I").Value > Trigger And _

(Cells(Candle + 2,

"L").Value - Cells(Candle + 2, "I").Value) / Cells(Candle + 2,

"I").Value > Trigger Then

'The "Candle + 1" means one

day before today's candlestick, The "Candle + 2" means two days before

today's candlestick. Within these three days, Close prices (stored in

column L) are higher than Open prices (stored in column I) in a row, and

exceed at a certain point, the difference is bigger than the Trigger,

then the Long signal goes to OK.

LongOK = True

BCBM = Candle

BBP =

Round(Cells(Candle, "L").Value, 2)

Cells(Candle,

"N").Value = "Long OK " & Int([B20].Value * CP / 100 / BBP) & " @ " &

BBP

Exit Sub

End If

And generate the "Three

Black Crows" signal as below:

If ShortOK = False And _

(Cells(Candle,

"L").Value - Cells(Candle, "I").Value) / Cells(Candle, "I").Value < -1 *

Trigger And _

(Cells(Candle +

1, "L").Value - Cells(Candle + 1, "I").Value) / Cells(Candle + 1,

"I").Value < -1 * Trigger And _

(Cells(Candle + 2,

"L").Value - Cells(Candle + 2, "I").Value) / Cells(Candle + 2,

"I").Value < -1 * Trigger Then

'The "Candle + 1" means one

day before today's candlestick, The "Candle + 2" means two days before

today's candlestick. Within these three days, Close prices (stored in

column L) are lower than Open prices (stored in column I) in a row, and

exceed at a certain point, the difference is bigger than the Trigger,

then the Short signal goes to OK.

ShortOK = True

SCBM = Candle

SBP =

Round(Cells(Candle, "L").Value, 2)

Cells(Candle,

"N").Value = "Short OK " & Int(([B20].Value + 1.5 * [B19].Value *

SlPebP) / 1.5 * CP / 100 / SBP) & " @ " & SBP

Exit Sub

End If

On the next few days, if the

LongOK signal is On and the ShortOK signal is Off, then the VBA Macro will

open a Long position. Conversely, if the ShortOK signal is On and the LongOK

signal is Off, the program will open a Short position. Codes look like

these:

If BCBM - Candle >

[B7].Value Then LongOK = False

If SCBM - Candle >

[B7].Value Then ShortOK = False

'Open Long

If BCBM - Candle <=

[B7].Value Then

'

If LongOK = True And ShortOK = False And Cells(Candle, "I").Value

> BBP Then

If LongOK =

True And ShortOK = False Then

DlPe = Round((Cells(Candle, "J").Value + Cells(Candle,

"K").Value) / 2, 2)

If [B19].Value = 0 Then

TdSum = Int([B20].Value * CP / 100 / DlPe)

Cells(Candle, "O").Value = -1 * TdSum * DlPe

[B19].Value = [B19].Value + TdSum

PBM = DlPe

BM = [B20].Value + Cells(Candle, "O").Value + [B19].Value * PBM

[B20].Value = [B20].Value + Cells(Candle, "O").Value

Cells(Candle, "AE").Value = [B20].Value + [B19].Value *

Cells(Candle, "L").Value

Cells(Candle, "N").Value = "Buy/Open " & TdSum & " @ " & DlPe

End If

End If

End If

'Open Short

If SCBM - Candle <=

[B7].Value Then

'

If ShortOK = True And LongOK = False And Cells(Candle, "I").Value

< SBP Then

If ShortOK =

True And LongOK = False Then

DlPe = Round((Cells(Candle, "J").Value + Cells(Candle,

"K").Value) / 2, 2)

If [B19].Value = 0 Then

TdSum = Int([B20].Value / 1.5 * CP / 100 / DlPe)

Cells(Candle, "O").Value = TdSum * DlPe

[B19].Value = [B19].Value - TdSum

PBM = DlPe

BM = [B20].Value + Cells(Candle, "O").Value + [B19].Value * PBM

[B20].Value = [B20].Value + Cells(Candle, "O").Value

Cells(Candle, "AE").Value = [B20].Value + [B19].Value *

Cells(Candle, "L").Value

Cells(Candle, "N").Value = "Sell/Open " & TdSum & " @ " & DlPe

End If

End If

End If

VBA Macro will execute these

codes again and again, until finish all loops which are appointed by us.

According to all results, the program will delete bad parameters and retain

the good ones to pass to the next procedure.

The Scanning procedure looks

the same as the Digging procedure. All good parameters screened out from the

Digging procedure will be tortured (if you feel this word is too cruel,

replace it by “tested”) again in this part. We will use historical data from

the Testing set to test the parameters and simulate opening and closing

positions during the Testing set's time period. Most parameter combinations

will be eliminated because they fail to generate a profit, or the profit is

too low. Only the top-performing parameters have value and can be considered

as real fighters. In the end, we will let the winners scanned in the Testing

set run a full test, from day one to the most recent data, and screen out

the final competitors for future's real battles.

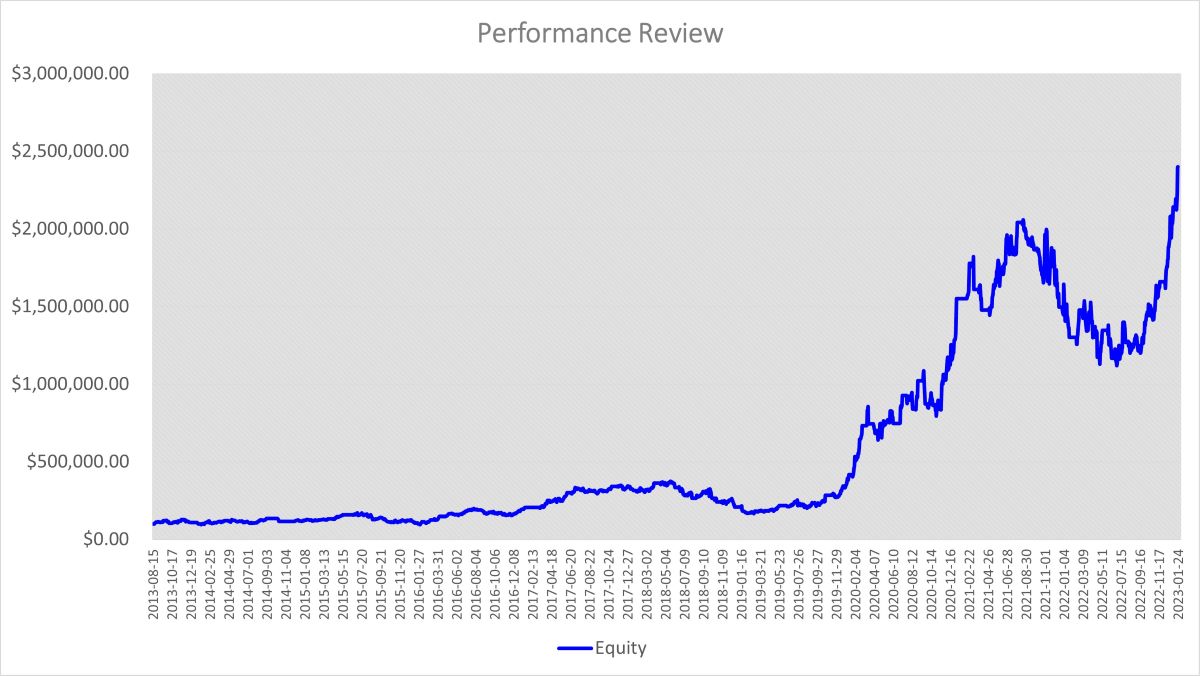

In the final stage, the VBA

Macro generates a chart which allows users to easily evaluate the results.

With just a glance at the curve, the pattern speaks for itself, better than

thousands of words. The curve may resemble something like this:

Can you guess which stock

this is? If I told you it was Tesla, you might say "No wonder", eh? The

curve appears like a roller coaster ride, eh? The ROI is so high (Annul ROI

goes to almost 40%), but it will also cause our blood pressure to rise high,

eh? The “Three White Soldiers” and “Three Black Crows” trading strategy

looks “WOW!”, but still require a lot of modifications and optimizations,

which we will cover in a future chapter.

As we come to the end of

this chapter, let me remind you of a crucial fact: trading is not for

everyone. If you find yourself getting anxious or losing sleep over your

trades, it's time to take a break and re-evaluate your life choices. Maybe

knitting or stamp collecting is more your speed. As we come to the end of

this chapter, let me remind you of a crucial fact: trading is not for

everyone. If you find yourself getting anxious or losing sleep over your

trades, it's time to take a break and re-evaluate your life choices. Maybe

knitting or stamp collecting is more your speed.

But if you're still

determined to become a successful trader, remember to keep your sense of

humor intact. As Groucho Marx once said, "If you're not having fun, you're

doing something wrong." So laugh off your losses, celebrate your wins, and

don't forget to take a break from staring at those candlestick charts every

once in a while.

With that said, happy

trading and may the Three White Soldiers always march in your favor! (Just

don't get too close to the Three Black Crows.)

If you would like to try out

the “Three White Soldiers & Three Black Crows” strategy backtesting tool,

click on Free Trial to get a 30-day free trial

demo.

LIGHTING THE PATH TO PROFITABLE TRADING

(the whole tutorial handbook pdf Free Download)

A Step-by-Step Guide to Building a Trading

Strategy Verification Tool with VBA Macros

|