|

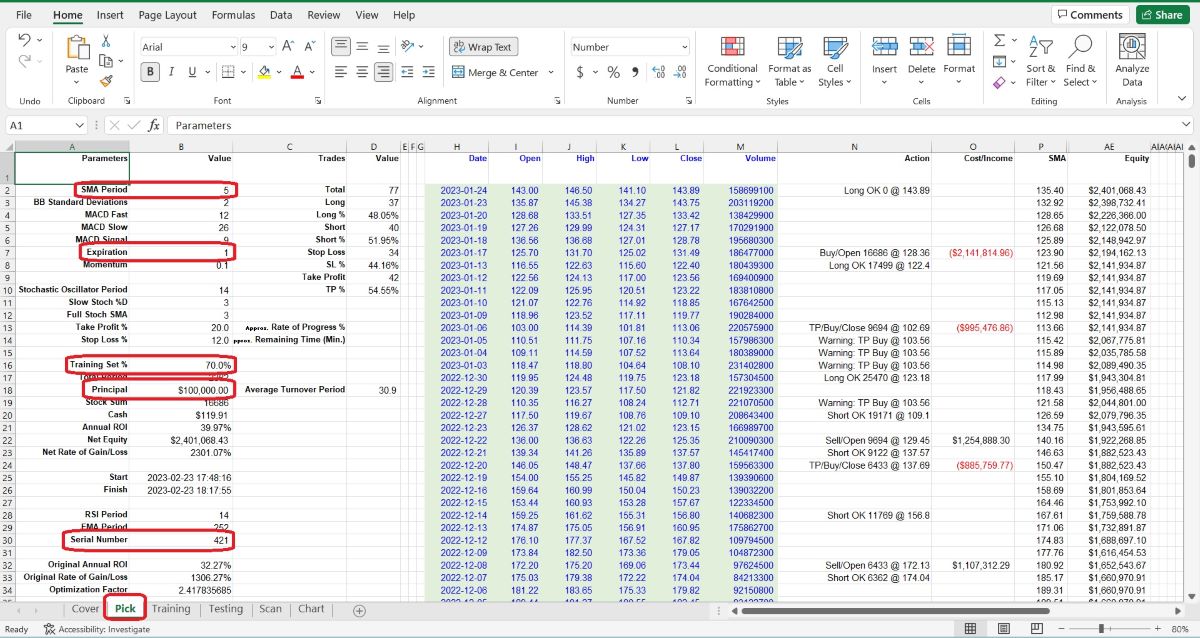

Once you have a trading

strategy, the next step is to do backtesting for it. In this chapter, we

will show you how to create a backtesting spreadsheet that will allow you to

test your strategies on historical data.

Before doing backtesting, we

need to set some conditions first. For example, we use the “Three White

Soldiers” and “Three Black Crows” strategy to simulate trading TSLA (Tesla,

Inc.), click the “Pick” worksheet, we can see:

In the "Pick" worksheet, set

the Principal at cell B18 (typically set at 100,000), and the Training % at

cell B16 (normally set at 70).

Set the SMA at cell B2

(normally set at 5), and the Expiration at cell B7 (normally set at 3).

Fill the Optimization Factor

value in cell B34. This value is specific to each stock and is calculated

based on its unique features. It influences the Trigger and Momentum used

during the backtesting VBA Macro. Users can follow us for getting the newest

unique Optimization Factor for particular stock.

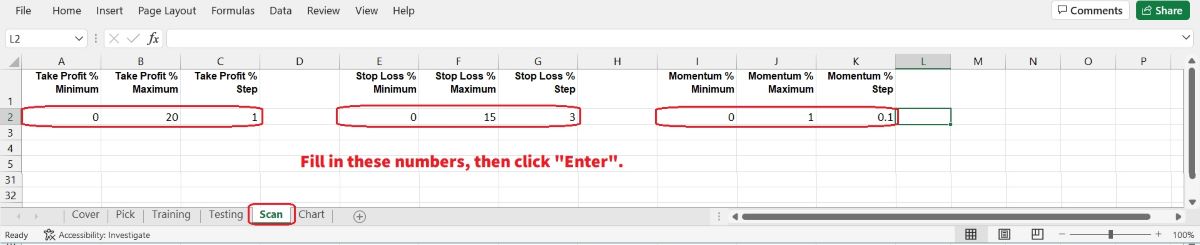

Now, let’s go to the “Scan”

worksheet, set the scan ranges for Take Profit, Stop Loss, and Momentum. The

“Scan” worksheet looks like below:

The backtesting VBA Macro

will try every combination, such as Take Profit at 3%, Stop Loss at 10%, and

Momentum (a standard to trigger the Buy or Sell actions) at 0.5%, etc. This

tool will execute these conditions to simulate a series of trading actions

using historical data from the beginning, opening and closing long or short

positions based on the signals generated by your trading strategies.

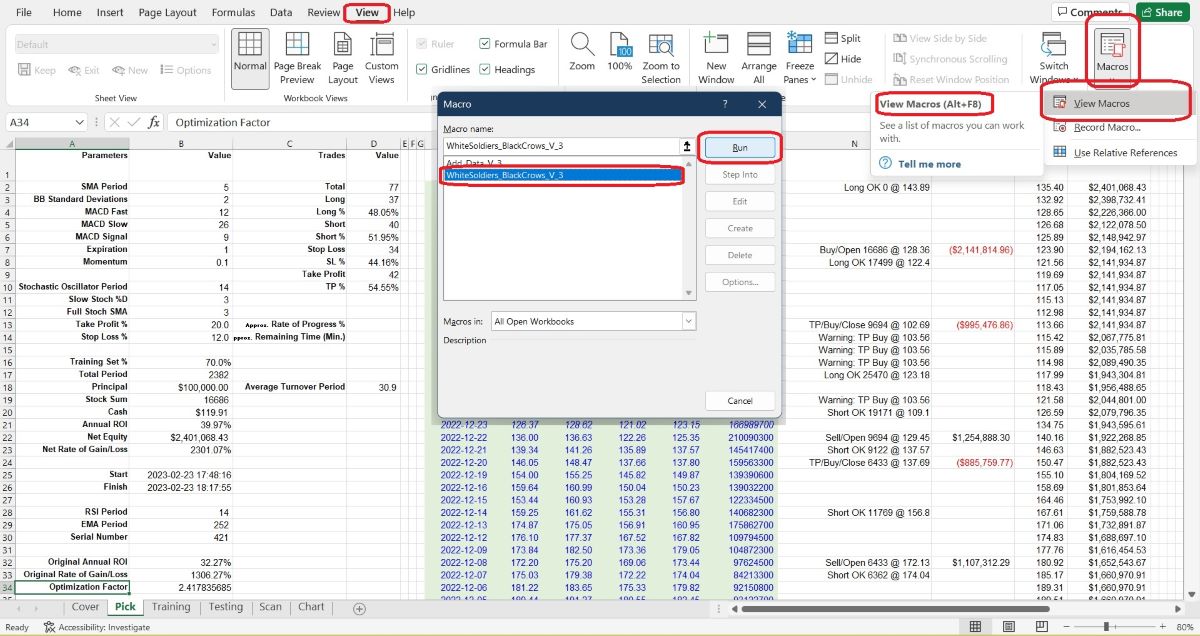

To run the VBA Macro

program, there are several methods, for example, we can:

1.

Click on the "View" tab on

the Excel ribbon.

2.

Click on the "Macros" button

in the "Macros" group. This will open the "Macro" dialog box.

3.

In the "Macro" dialog box,

select the Macro that you want to run.

4.

Click on the "Run" button.

5.

We can also press Alt + F8,

the "Macro" dialog box will jump out, select the Macro (the name in this

demo is “WhiteSoldiers_BlackCrows” and its version number), then click the

“Run” button.

6.

The fastest method is using

shortcut hot keys: Press Ctrl + Y, the Macro will run immediately.

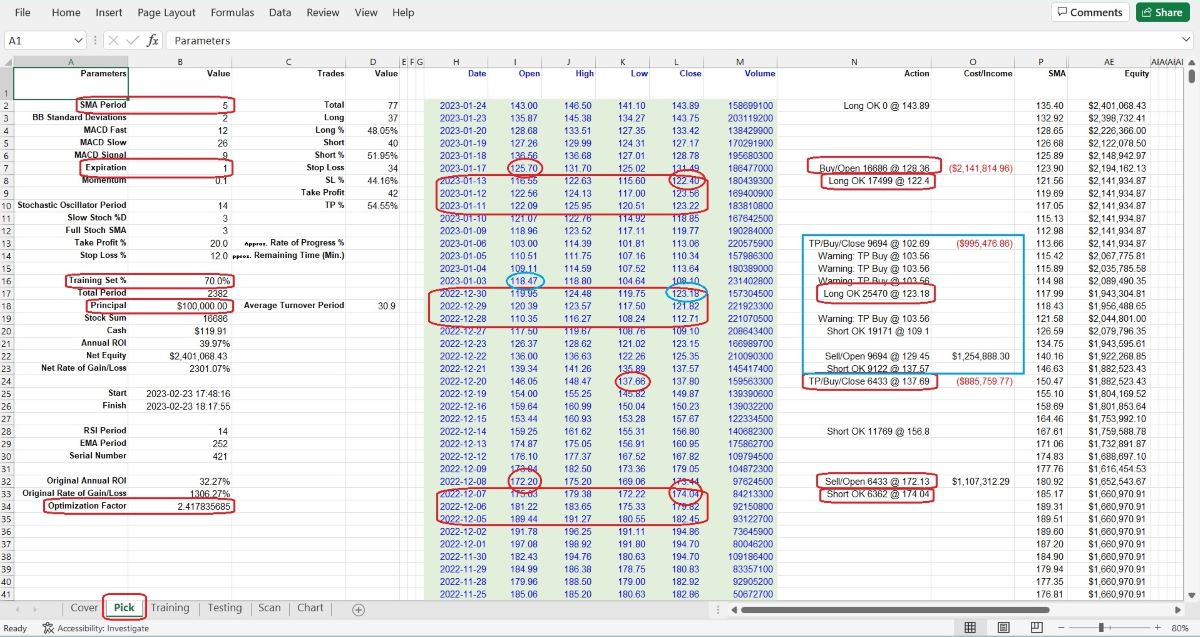

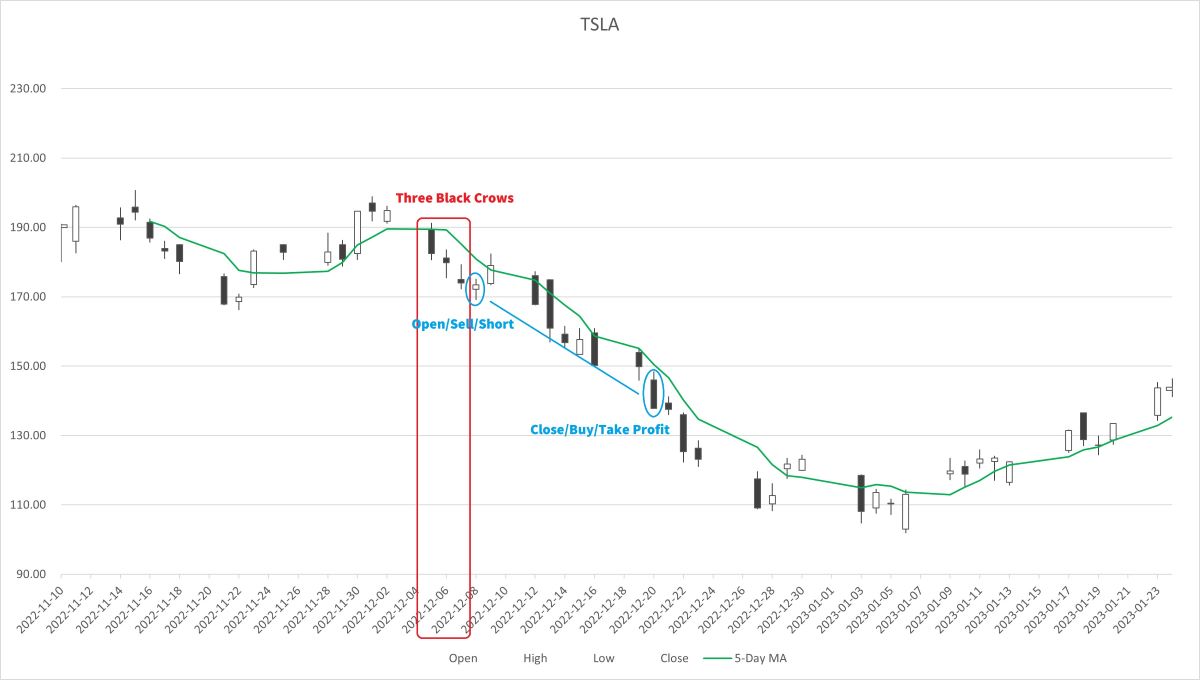

Let's take a closer look at

the backtesting trading simulation record generated by the VBA Macro. In

column N, the program lists every plan and action, which allows users to

easily understand the trading strategy's actions. For example:

We can see:

On December 5, 2022, TSLA's

Open price was 189.44 and closed at 182.45, with the Close price being lower

than the Open price, the first Black Crow appeared.

On December 6, 2022, TSLA's

Open price was 181.22 and closed at 179.82, with the Close price being lower

than the Open price too, the second Black Crow appeared.

On December 7, 2022, TSLA's

Open price was 175.03 and closed at 174.04, with the Close price being lower

than the Open price again, the third Black Crow appeared. The condition of

Short was triggered, and this VBA backtesting tool generated a Short OK

signal after this trading day, planning to open short positions on the next

trading day if the Open price of the next trading day is lower than the

current day's Close price.

On December 8, 2022, TSLA's

Open price was 172.20, which was lower than the previous day's Close price,

the final condition of our strategy was triggered, then the VBA backtesting

tool executed the Short (Sell) Open action finally.

(If you would like to try

out the “Three White Soldiers & Three Black Crows” strategy backtesting

tool, click on

Free Trial

to get a 30-day free trial demo.)

On December 20, 2022, TSLA's

price went down to 137.66, hitting the 20% Take Profit target, so the VBA

backtesting tool executed the Close action according to the program, as seen

in the chart below.

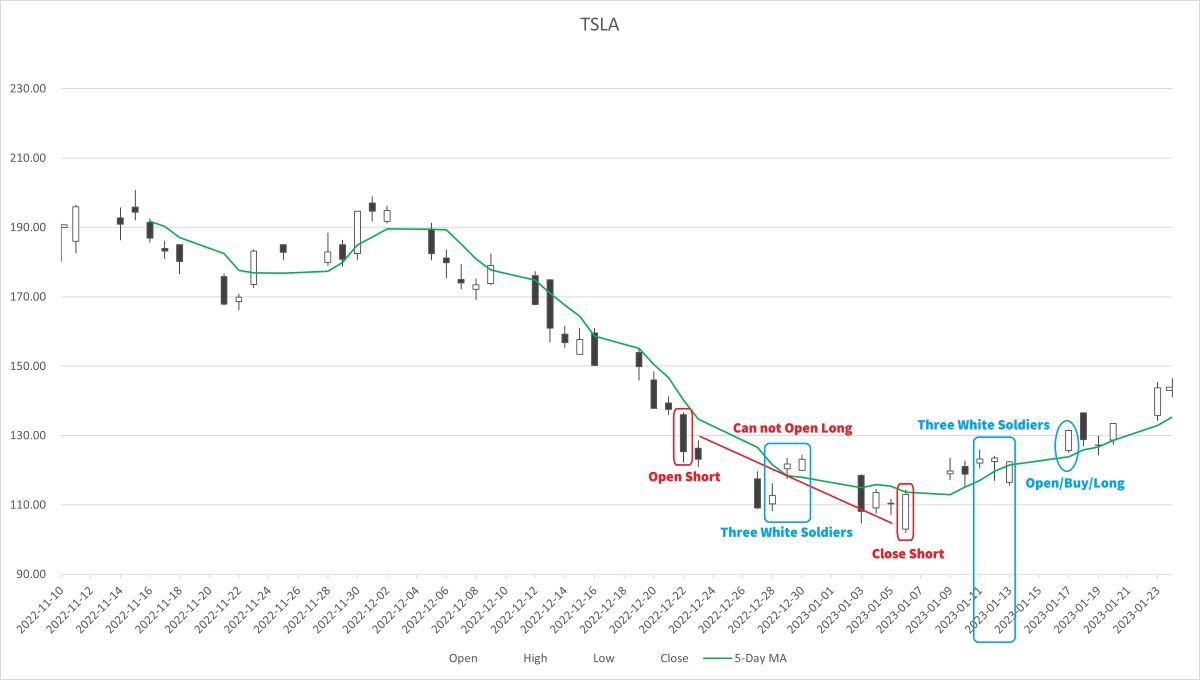

2022-12-30, the “Three White

Soldiers” signal appeared, the VBA Macro generated a Long signal, but did

not execute Opening action on the next day, why? Because on 2022-12-22, the

program had opened a Short position, and this Short position was not closed

until 2023-01-06, therefor we could not open a Long position during the

Short action.

2023-01-11 to 2023-01-13,

the “Three White Soldiers” signal appeared again, the next trading day,

2023-01-17, the backtesting tool executed Open Long positions finally, just

like the chart above.

As you can see, everything

can be explained based on data, without any guesswork. This type of tool can

help us calculate, evaluate, and make decisions based on concrete facts and

details. While historical performance cannot guarantee future results,

backtesting can help us avoid hopeless and blind guessing and imagination.

Although it may not guarantee making money in the present, it can certainly

help us make more informed decisions for the future.

After every loop is done,

the VBA program will calculate the ROI, and store into a cell, then move to

next loop. When it has finished calculating and comparing all ROI from the

beginning to the end of the training set, the tool will move to the testing

set and repeat the process. Finally, it will give you a chart, showing how

good or bad this strategy will work.

While a trading strategy may

perform well in backtesting, there is no guarantee that it will be

profitable in future real-money trading. Past performance is not necessarily

indicative of future results. Conversely, if a trading strategy consistently

loses money in backtesting, there is a high likelihood that it will also

lose money in future real-money trading.

In short, if an apple was

tasty and fresh in the past, there is no guarantee it will remain as good in

the future, and it may even spoil quickly. On the other hand, if an apple

was sour or tasted bad in the past, it is unlikely to become fresh and sweet

in the future.

Just like an apple's taste

and quality can change over time, a trading strategy's performance can also

change in the future, even if it has performed well in the past. And just

like a bad-tasting apple is unlikely to become fresh and sweet, a trading

strategy that consistently loses money in backtesting is unlikely to become

profitable in the future. That is why we say that backtesting may not

necessarily help us create a money-making machine, but it can greatly assist

us in identifying and eliminating poor trading strategies, as well as

optimizing a good strategy by adjusting its parameter settings. Just like an apple's taste

and quality can change over time, a trading strategy's performance can also

change in the future, even if it has performed well in the past. And just

like a bad-tasting apple is unlikely to become fresh and sweet, a trading

strategy that consistently loses money in backtesting is unlikely to become

profitable in the future. That is why we say that backtesting may not

necessarily help us create a money-making machine, but it can greatly assist

us in identifying and eliminating poor trading strategies, as well as

optimizing a good strategy by adjusting its parameter settings.

After all that hard work

backtesting your trading strategy, you finally sit back and admire your

spreadsheet. You're feeling pretty confident in your strategy until you

notice that your cat has been walking across the keyboard and undoing all

your hard work. Looks like it's time to start over, but hey, at least you

have a trading strategy that even your cat can appreciate.

Remember, always make sure

to save a backup copy of your work, especially when working with important

data and trading strategies. It's better to be safe than sorry, and having a

backup can save you a lot of time and stress in case something goes wrong

with your original file. So, be sure to save and backup your work regularly

to avoid losing any progress or important information.

LIGHTING THE PATH TO PROFITABLE TRADING

(the whole tutorial handbook pdf Free Download)

A Step-by-Step Guide to Building a Trading

Strategy Verification Tool with VBA Macros

|