After backtesting your

strategies, you need to analyze the results to see if they are profitable.

In this chapter, we will cover some basic metrics that you can use to

evaluate your strategy's performance.

After backtesting your

strategies, you need to analyze the results to see if they are profitable.

In this chapter, we will cover some basic metrics that you can use to

evaluate your strategy's performance.

Analyzing the results of

your backtesting is a critical step in evaluating the effectiveness of your

trading strategies. It helps you to identify strengths and weaknesses in

your approach and to make any necessary adjustments to improve your

strategy's performance.

There are several metrics

that you can use to evaluate your strategy's performance, including the

following:

1.

Profit and Loss (P&L): This

is the most basic metric for evaluating a trading strategy. It measures the

total profit or loss generated by the strategy over a specific period.

2.

Win Rate: Win rate is the

percentage of trades that are profitable. A high win rate does not

necessarily mean a profitable strategy.

3.

Turnover Period: It is

typically calculated as the average number of days between two actions. A

shorter turnover period is generally seen as more efficient, as it indicates

that the trading strategy is more robust.

4.

Maximum Drawdown: Maximum

drawdown is the largest decline in value experienced by a portfolio or

investment strategy from its peak value to its lowest value.

5.

Sharpe Ratio: The Sharpe

ratio is a measure of risk-adjusted return. It takes into account the return

of the investment relative to the risk involved.

6.

Average Profit and Loss per

Trade: This metric helps you to determine whether your strategy is making

enough money per trade to justify the risk.

7.

Average Holding Time:

Average holding time is the average length of time a trade is held. This

metric can help you to optimize your strategy's holding period.

By analyzing these metrics,

you can gain insights into the performance of your strategy and make

adjustments as needed to improve its profitability. It is important to

remember that no strategy is perfect, and there is always a risk of loss in

trading. However, by backtesting and analyzing your results, you can reduce

the risk and increase the chances of success.

In this demo version, we

provide several simple metrics to help users understand some basic ideas

about how to evaluate a trading strategy. For more complicated metrics, we

will add them in future releases. In this chapter, we will use another

trading strategy – “Golden Cross and Death Cross” – as an example to explain

how to analyze backtesting results.

Golden Cross is a bullish

technical analysis pattern that occurs when a short-term moving average

crosses above a long-term moving average. For example, a stock's 50-day

moving average crosses above its 200-day moving average. This pattern is

widely used by traders and investors to identify potential buying

opportunities.

The Golden Cross suggests

that the momentum of the stock is turning bullish, as the short-term moving

average is starting to rise above the long-term moving average. This can be

seen as a bullish signal, as it indicates that the stock's recent price

trends are starting to shift to the upside.

The "death cross" is a

technical chart pattern that occurs when a stock's short-term moving average

crosses below its long-term moving average, indicating a bearish trend. For

example, the stock's 50-day moving average crosses below its 200-day moving

average. This can be seen as a signal of increased selling pressure in the

market and a potential downturn in the stock's price. Some traders use the

death cross as a signal to sell their positions or to take a short position

in the stock.

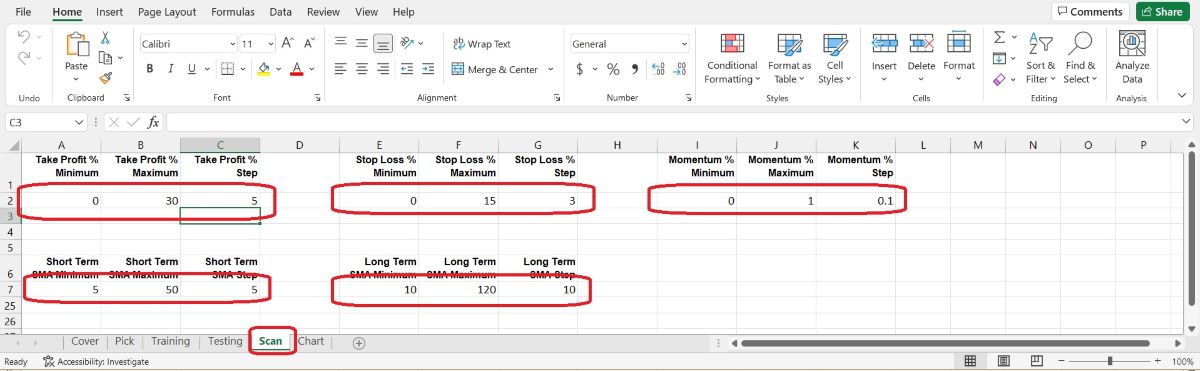

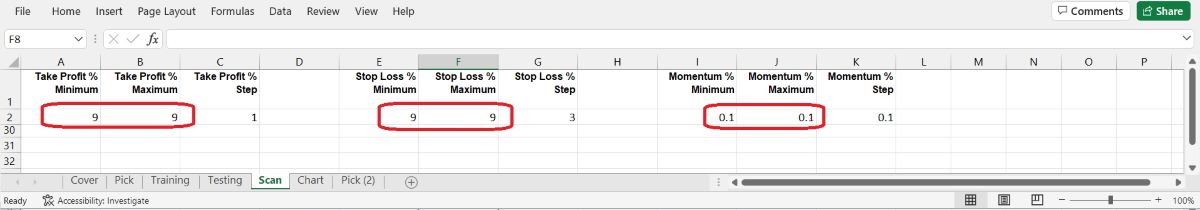

Let’s set parameter scanning

range in “Scan” worksheet like this:

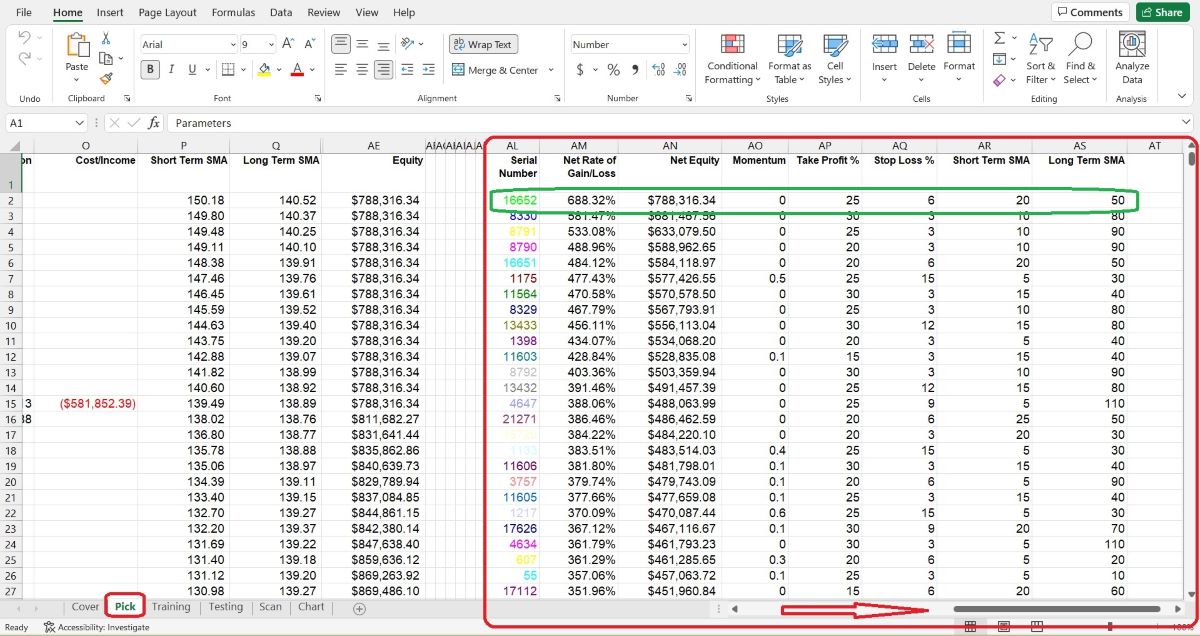

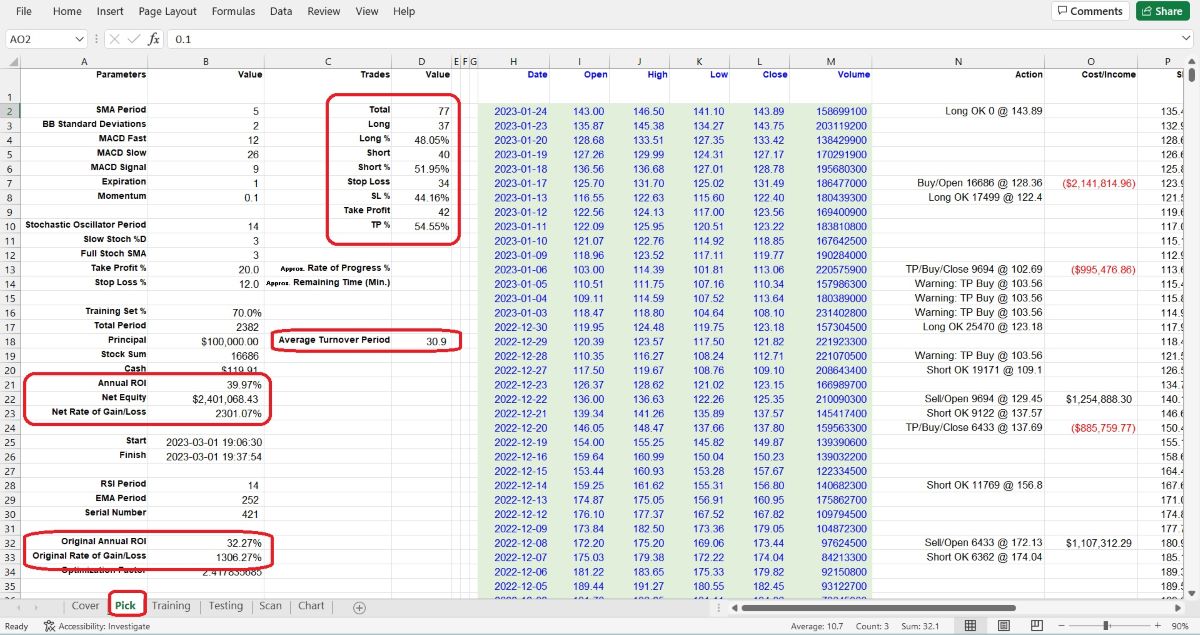

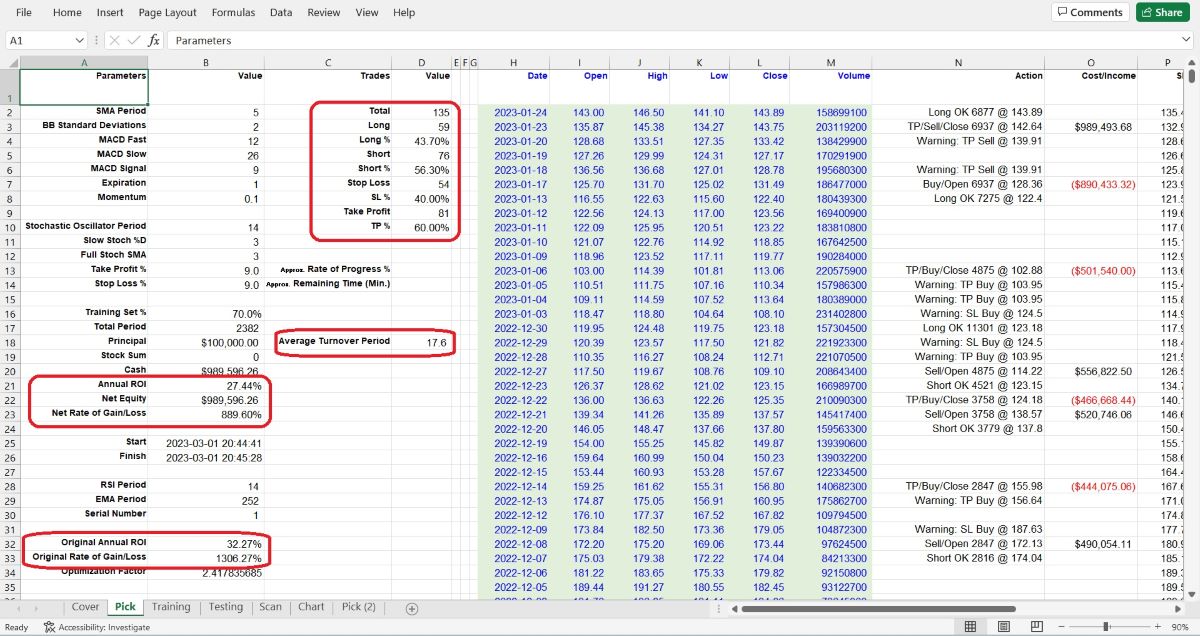

After running the VBA tool,

we will get a series of parameter combinations in “Pick” worksheet like

this:

The VBA Macro will pick the

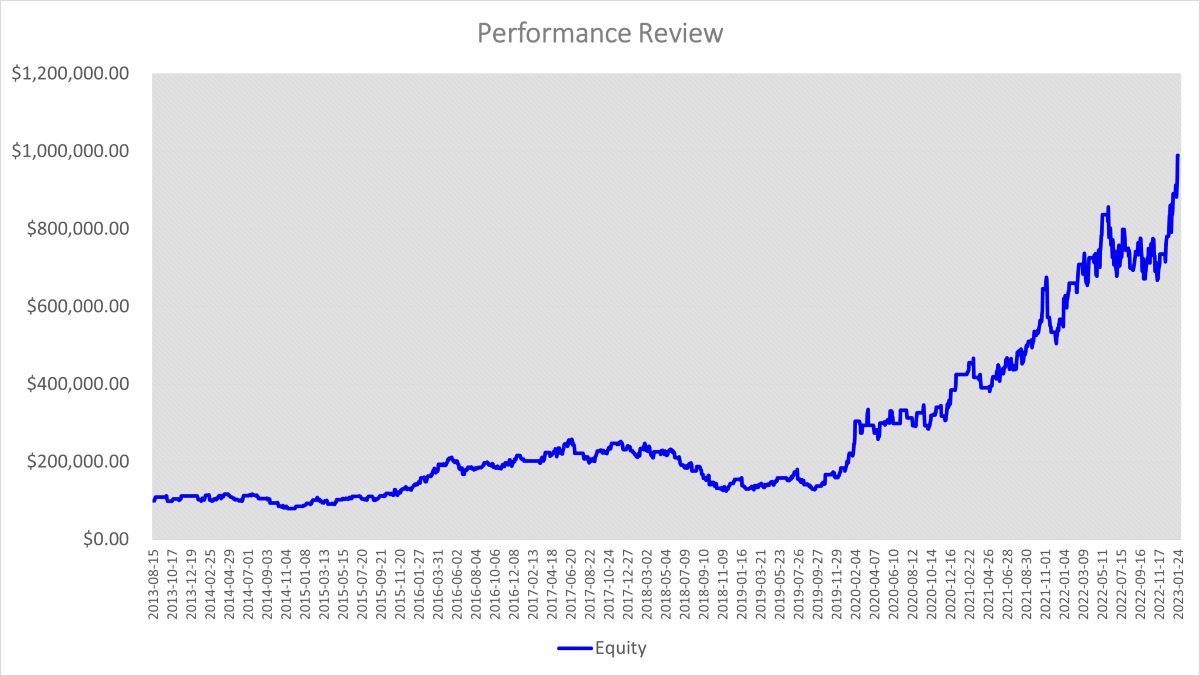

top one parameter combination (stored in cells AO2 to AS2) to print out a

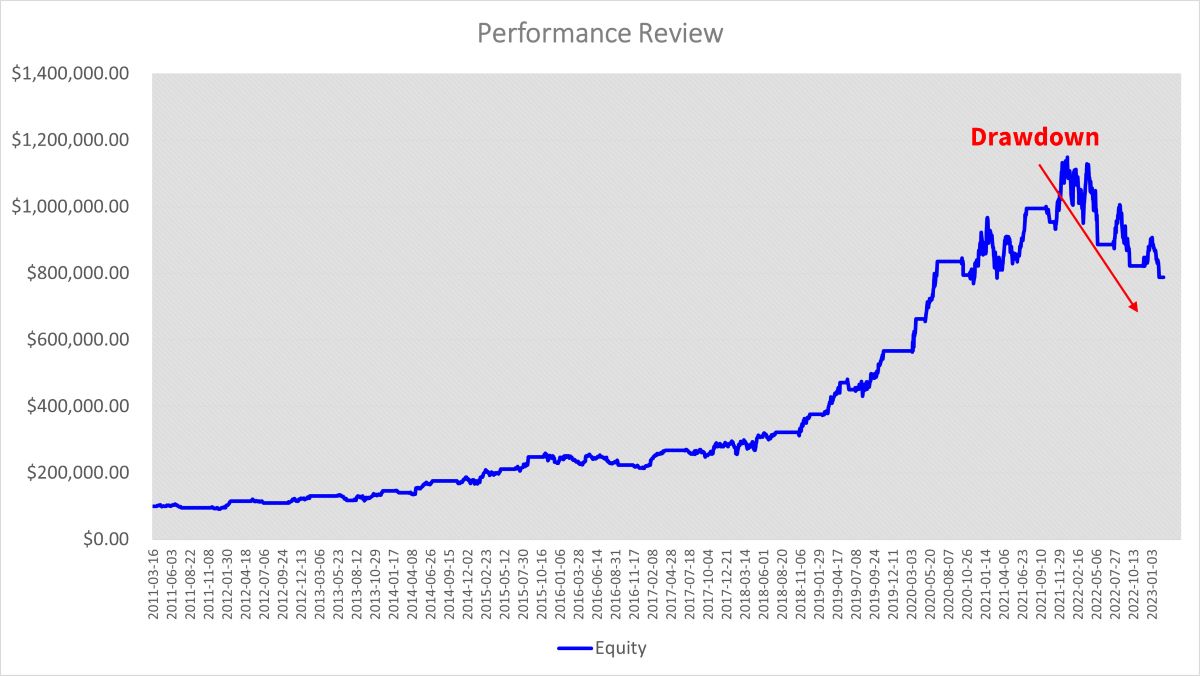

chart:

The Maximum Drawdown looks a

little bit ugly. And we can review this parameter combination‘s performance

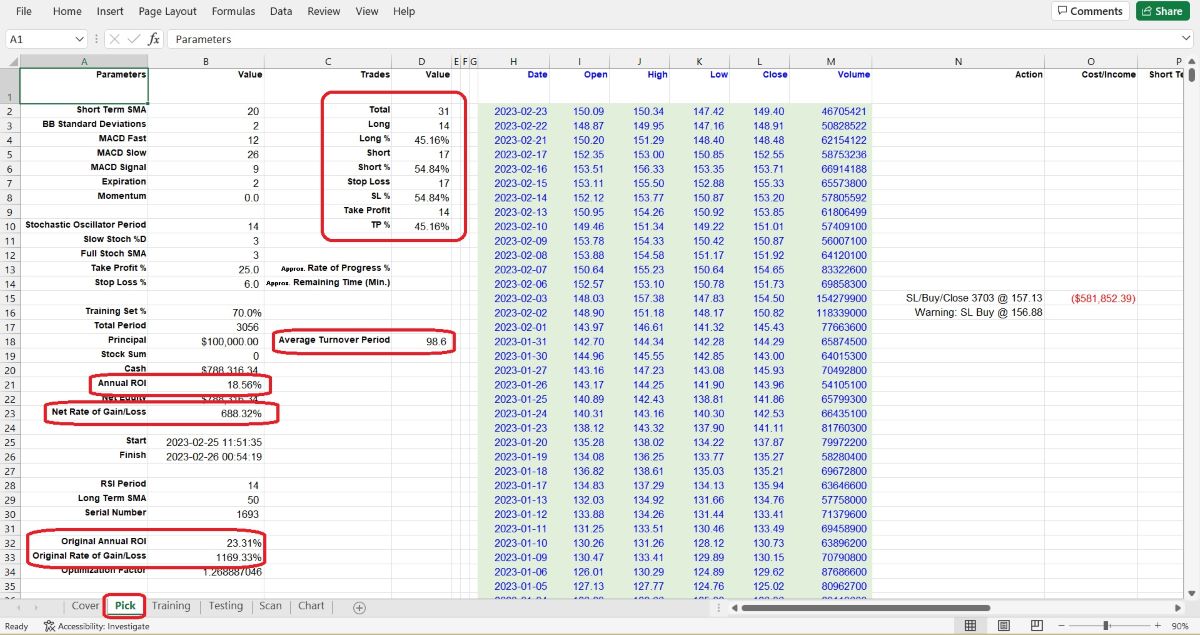

metrics in worksheet “Pick”:

After a long run, since

2011-01-03 to 2023-02-23, which is a total of 3056 trading days, and with

the following parameters set: Momentum at 0, Take Profit at 25%, Stop Loss

at 6%, Short Term SMA at 20 days, and Long Term SMA at 50 days, we will get

an Annual ROI at 18.56%, not bad, eh? During this period, there were 31

trade deals completed, with 14 of them being long positions and 17 of them

being short positions. Stop loss was triggered 17 times, while take profit

was achieved 14 times. The ratio of stop loss vs. take profit was 54.84% vs.

45.16%. On average, it took 98.6 days to complete one full round of buying

and selling.

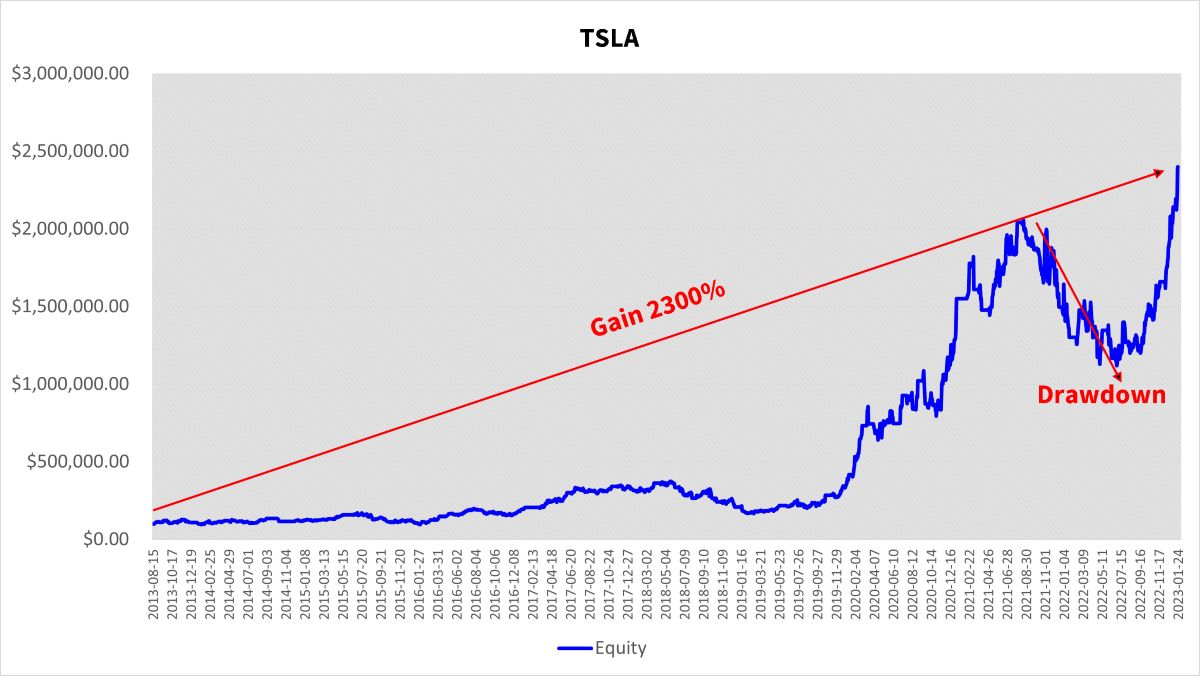

Now the ugly Drawdown and

the Annual ROI at 18.56% (on par with Warren Buffett's performance) come

together, can you accept that? Some people may enjoy high returns and can

bear temporary big losses, while others may prefer stability and may not

care if the profits are low. It depends on individual's investment

philosophy; we cannot say whether it is right or wrong.

Profit and risk are

inseparable in the market, and high profit comes with high risk, which is a

normal situation in the real trading world. For example, investing in a

startup company or a volatile cryptocurrency may offer the potential for

high returns, but also comes with a high level of risk. Conversely,

investing in a stable, blue-chip stock or a government bond may offer more

moderate returns, but also carries a lower level of risk.

While this VBA backtesting

tool can save time on calculations and charting, it cannot replace your own

decision-making process and critical thinking.

Still remember the TSLA’s

curve in chapter 4? Let’s review it here:

Since 2013-08-08 to

2023-01-24, the backtesting Annual ROI of TSLA using the

“WhiteSoldiers_BlackCrows” VBA Macro has been as high as 39.97%, and it has

gained a total of 2301.07%. This performance is not only better than Warren

Buffett’s average of 17%, but also higher than the original Tesla stock’s

ROI of 32.27% during the same period.

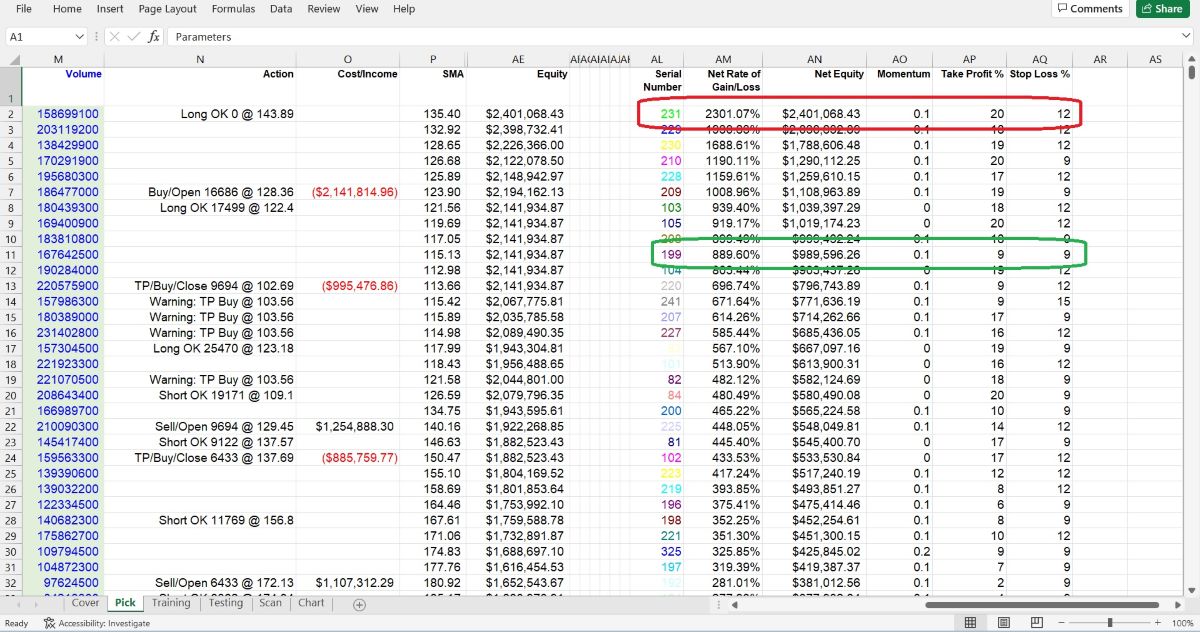

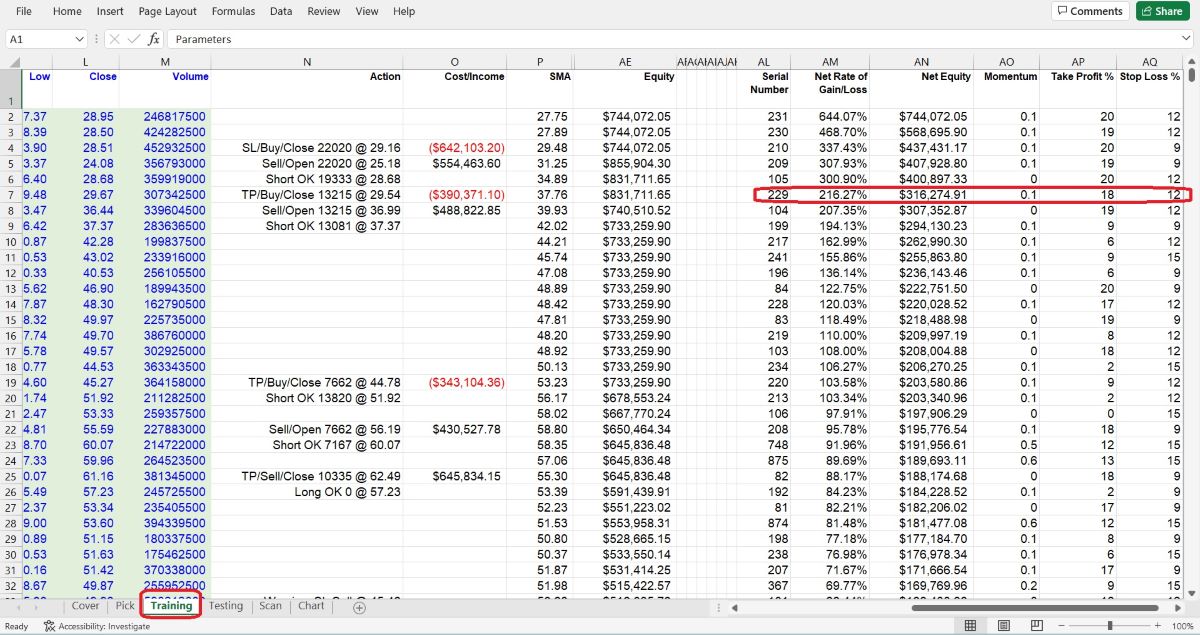

This return is based on the

parameter combination stored in cells AO2 to AQ2 of the "Pick" worksheet:

Momentum at 0.1, Take Profit at 20%, and Stop Loss at 12%, which is

indicated by a red frame as shown below:

If you want to avoid a large

drawdown, try using a different set of parameters indicated by the green

frame in cells AO11 to AQ11. Write down these values, go to the 'Scan'

worksheet, and enter them into the Take Profit, Stop Loss, and Momentum

cells. In this case, set both the 'Take Profit % Minimum' and 'Take Profit %

Maximum' to 9, and ignore the 'Take Profit % Step'. This setting tells the

VBA Macro to run this specific parameter combination only once, without

running all other loops. Similarly, set both the 'Stop Loss % Minimum' and

'Stop Loss % Maximum' to 9 (occasionally, here it is the same as the TP

group, but in other cases, it may be other values), and ignore the 'Stop

Loss % Step'. Then set both the 'Momentum % Minimum' and 'Momentum %

Maximum' to 0.1, and ignore the 'Momentum % Step'. Now run the VBA Macro,

the program will scan these settings particularly, and ignore other groups.

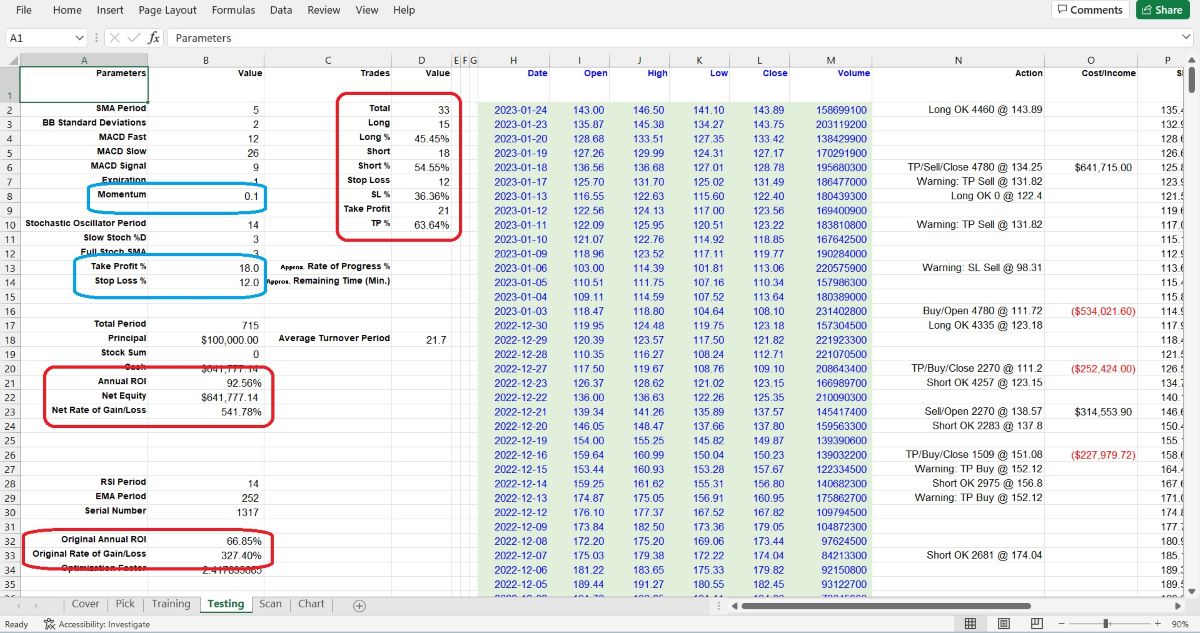

After pressing Control + Y,

you will quickly receive a new result:

the Annual ROI drops to

27.44%, with 135 trade deals (almost double the number of trades than the

top-gun setting). The Take Profit to Stop Loss ratio is now 60% to 40%. The

drawdown…

also looks more comfortable

and less severe, eh?

In conclusion, backtesting

cannot accurately predict how much profit we will make in the future, but it

can certainly calculate how much we have lost in the past if we have used a

wrong trading strategy, or how much we have missed out on if we own a strong

trading strategy but picked some weak parameters, heartbroken, eh?

As an example, let's

consider TSLA's historical data, which we split into a Training set (from

2013-08-08 to 2020-03-23) and a Testing set. If we pick the parameter

combination with serial number 229 and strictly follow the rules of the

"Three White Soldiers and Three Black Crows" strategy, obeying every signal

and plan to act from the Testing set's day one (2020-03-24) until

2023-01-24, which amounts to a total of 715 trading days…

we could have gained…

an explosive annual ROI of

92.56%!

Backtesting is a

cold-blooded truth teller, use it wisely. The trickiest challenge is how to

pick the right parameter combination, such as whether to pick serial number

229's parameters instead of the top one in Training set, which is serial

number 231. We never know what will happen tomorrow, even if we have a

powerful tool like backtesting. Ultimately, success depends on our own

experience, mindset and perhaps even… fate, eh?

As you analyze the results

of your backtesting, you might start to feel like a stock market Sherlock

Holmes, but don't forget to keep it fun! Just like in life, sometimes you

win, sometimes you lose, and sometimes you're just stuck in a holding

pattern. But with enough persistence and analysis, you'll eventually uncover

the clues to a profitable trading strategy. So grab your magnifying glass,

put on your deerstalker hat, and let's solve the mystery of the stock

market! (Disclaimer: No actual detective skills required.)

If you would like to try out

the “Golden Cross & Death Cross” strategy backtesting tool, click on

Free Trial to get a 30-day free trial

demo.

LIGHTING THE PATH TO PROFITABLE TRADING

(the whole tutorial handbook pdf Free Download)

A Step-by-Step Guide to Building a Trading

Strategy Verification Tool with VBA Macros