|

Forward testing is a method

of evaluating a stock trading strategy by applying it to current or future

data, and then monitoring its performance in real-time. This is in contrast

to backtesting, which involves testing the strategy on historical data. Forward testing is a method

of evaluating a stock trading strategy by applying it to current or future

data, and then monitoring its performance in real-time. This is in contrast

to backtesting, which involves testing the strategy on historical data.

Forward testing is an

important step in the development of a stock trading strategy, as it can

provide insight into how the strategy will perform in real-world conditions.

By testing a strategy in real-time, traders can observe how it performs

under actual market conditions and make any necessary adjustments to improve

its performance.

Forward testing can be done

manually, by paper trading or demo trading, or it can be automated using

trading software. The goal is to evaluate the strategy's performance over a

period of time and make any necessary changes to improve its profitability.

Paper trading (or demo

trading) is a simulated trading process that allows traders to practice

trading strategies without risking real money. It involves using a simulated

account, which looks and operates like a real trading account but uses fake

money to execute trades.

With paper trading, traders

can test their strategies in real market conditions and gain experience

without the risk of losing actual money. It allows traders to evaluate the

effectiveness of their trading strategies and make necessary adjustments

before risking their capital in the actual market.

Paper trading can also be

used to test and compare multiple trading strategies to determine which one

is the most profitable. Additionally, it can be used to test the performance

of new trading instruments, such as options, futures, or forex, before

trading them with real money.

After finishing the

backtesting process for a trading strategy, it is not advisable to rush into

real trading immediately. In my opinion, it is better to spend several

months doing paper trading based on the strategy to verify its robustness

repeatedly. During this time, it is important to update the training set and

testing set with new data to ensure they remain relevant and reflective of

current market conditions.

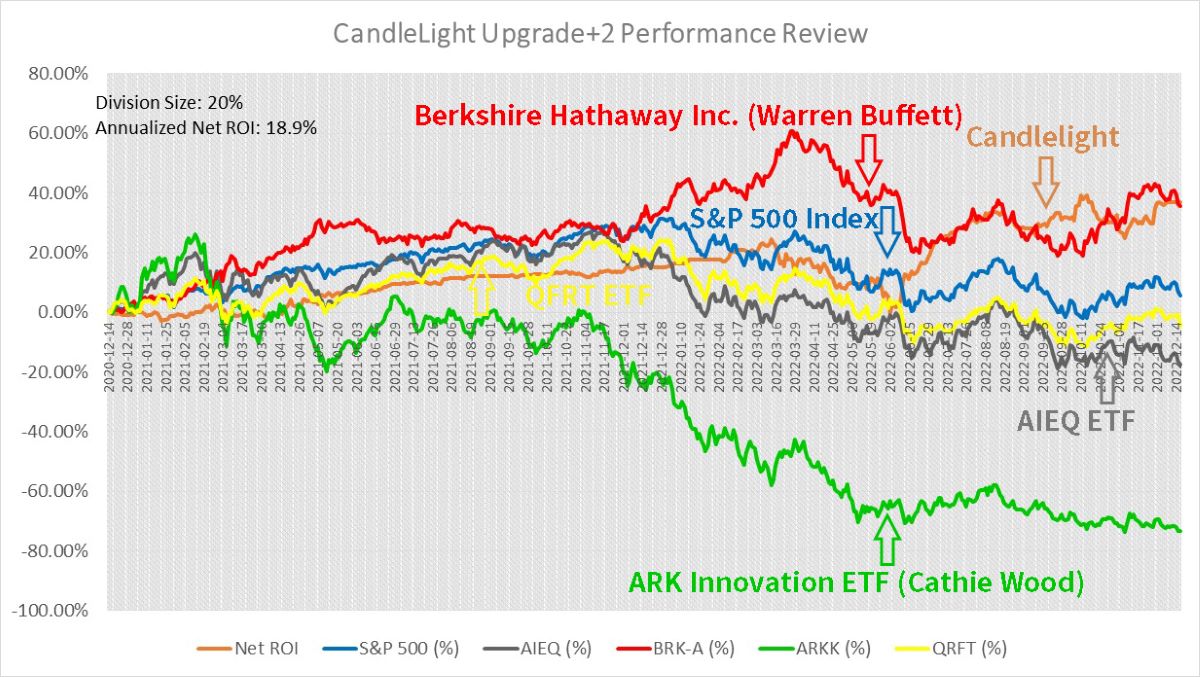

For example, besides these

Demo strategies which are based on Technical Analysis Methodology and have

been displayed in this handbook, I am developing another strategy based on

Artificial Intelligence Machine Learning, and have been doing Forward

Testing over 2 years. Do you still remember how many things happened during

2020 and 2022?

Let's take a look back at

some of the most dramatic events that have occurred during the past 24

months, as well as the 113 groups of forward testing done for this

AI-Powered trading strategy:

December 2020: One year had

passed since the outbreak of COVID-19;

January 2021: Capitol Hill

Riots, USA political turmoil;

August 2021: Afghanistan

changed, and the United States accepted defeat and withdrew hastily;

December 2021: Two years had

passed since the outbreak of COVID-19;

January 2022: The USA

reports that the inflation rate hit 7% the previous month;

February 2022: The

Russia-Ukraine war broke out;

March 2022: The Fed raised

interest rates by 25 points for the first time in nearly three years;

America's inflation rate jumped to 8.5% last month; Shanghai lockdown; The

Russia-Ukraine peace talk, which turned out to be a scam;

May 2022: The Fed raised

interest rates by 50 points due to severe inflation;

June 2022: The USA inflation

rate hit 8.6%, the highest since 1981; The Fed raised interest rates by a

whopping 75 points;

July 2022: US inflation hit

9.1%, the highest since 1981; The Fed raised another blockbuster 75 points

interest rates; The USA economy grew at a negative rate for the second

quarter in a row; Political turmoil in UK, prime minister resigned;

August 2022: China reported

unemployment at 5.4% last month and youth unemployment at 19.9%;

September 2022: Queen of UK

Elizabeth II died; Russia partially mobilized and the war escalated; The

explosion of the Nord Stream gas pipeline between Russia and Germany,

worsening the European energy crisis and high inflation; US inflation still

high, the Fed raised interest rates for the third time with 75 points;

October 2022: USA-Saudi

Arabia relations broke down as OPEC+ announced crude oil production cuts;

The Crimean bridge was bombed; UK's new prime minister resigns after just 45

days, the shortest serving in the history of UK;

November 2022: US inflation

remained high and the Federal Reserve raised interest rates by 75 heavy

points for the fourth time this year;

December 2022: G7 and the

European Union set a cap on the price of Russian oil, causing another wave

in the international energy supply; The Fed raises rates aggressively by 50

points to fight inflation.

…

See? Every day, we may

encounter so many unknown incidents that can affect stock markets, some

small like Hollywood stars' fashion dresses, some big like wars. Therefore,

it's important to be patient, and conducting more Forward Trading can give

you more confidence in your trading strategies.

In short, Forward Trading

(Paper Trading or Demo Trading) involves using virtual money to simulate

real trading, which helps traders understand how their strategies perform in

different market conditions without risking actual money. It allows traders

to fine-tune their strategies and make any necessary adjustments before

transitioning to real trading.

Additionally, it is crucial

to consider the impact of transaction costs, such as brokerage fees and

slippage, on the performance of the trading strategy. This is especially

important when deciding whether to continue using a particular strategy

after paper trading. Therefore, it is recommended to incorporate transaction

costs into the backtesting process to obtain a more accurate representation

of the strategy's performance.

Forward testing is like

trying out a new recipe before serving it to your guests. Just like how you

wouldn't want to serve a dish without tasting it first, you wouldn't want to

trade without forward testing your strategy. Imagine trying out a new recipe

without tasting it first, and your guests end up with a disastrous meal that

makes them want to run to the nearest fast-food restaurant. The same goes

for trading; you wouldn't want to risk your hard-earned money without

testing your strategy first. So, forward testing is like a taste test for

your trading strategy - you want to make sure it's deliciously profitable

before serving it up to the market!

LIGHTING THE PATH TO PROFITABLE TRADING

(the whole tutorial handbook pdf Free Download)

A Step-by-Step Guide to Building a Trading

Strategy Verification Tool with VBA Macros

|