7 secrets about Machine Learning AI technology in stock trading

|

|

Machine Learning AI technology has revolutionized the world of stock

trading, allowing traders to make more informed decisions, reduce risk, and

improve their overall trading strategies. Perhaps you like to know some of

the secrets about using machine learning AI technology in stock trading.

1, Data is key: One of the most important secrets about using Machine

Learning in stock trading is data. The more high-quality data you feed into

your algorithms, the better they will perform. It’s important to use a wide

range of data, including financial data, news articles, social media

sentiment, and more. Of course, never use garbage data, they will ruin the

output. In computer science, people always say: “garbage in, garbage out

(GIGO).”

Then what kind of data will be high-quality? Let’s Focus on

three things:

Relevance: The data should be relevant to the specific

stock market or industry being analyzed. For example, news articles about

the technology sector may not be relevant to the oil and gas sector.

Timeliness: The data should be up-to-date and reflect the current market

conditions. Historical data can be useful, but it should not be relied upon

solely.

Diversity: The data should be diverse and inclusive,

representing a variety of perspectives and experiences. This can help to

reduce bias in the algorithms and improve their overall accuracy.

2,

Machine learning algorithms are only as good as the data they are trained

on: Another important secret is algorithms. Good algorithms will do these

jobs:

Predictive modeling: Machine learning algorithms can be used to

predict future events or trends, such as stock prices or market movements.

Pattern recognition: Machine learning algorithms can be used to identify

patterns and relationships in large amounts of data.

Classification:

Machine learning algorithms can be used to categorize data into different

classes or categories, such as positive or negative trends.

Clustering: Machine learning algorithms can be used to group similar data

points into clusters, such as grouping stocks based on their characteristics

and performance.

Optimization: Machine learning algorithms can be

used to optimize processes, such as portfolio optimization or risk

management.

Anomaly detection: Machine learning algorithms can be

used to identify unusual or unexpected events, such as market crashes or

sudden stock price changes.

Recommender systems: Machine learning

algorithms can be used to recommend products or services, such as stock

recommendations.

Natural language processing: Machine learning

algorithms can be used to process and understand human language, such as

analyzing news articles to make investment decisions.

3, Don’t rely

solely on machine learning: Although machine learning AI technology can

provide valuable insights and make informed decisions, it’s important not to

rely solely on Using human judgment and experience to make final investment

decisions is still important.

4, Machine learning algorithms can be

biased: Machine learning algorithms can be biased if the data they are

trained on is biased. It’s important to take steps to ensure that your

algorithms are not biased and that you are using diverse and inclusive data.

5, Model accuracy is not the only factor: Model accuracy is not the only

factor to consider when using machine learning AI technology in stock

trading. It’s also important to consider factors such as interpretability,

speed, and scalability.

6, Keep up with the latest advancements: The

field of machine learning AI technology is constantly evolving, and it’s

important to keep up with the latest advancements. Stay informed about new

algorithms, methods, and techniques to ensure that you are getting the most

out of your machine learning AI technology.

7, Use machine learning

as a tool, not a replacement: Machine learning is a powerful tool, but it

should not be used as a replacement for human judgment and experience. Use

AI technology to complement your existing skills and knowledge, not to

replace them.

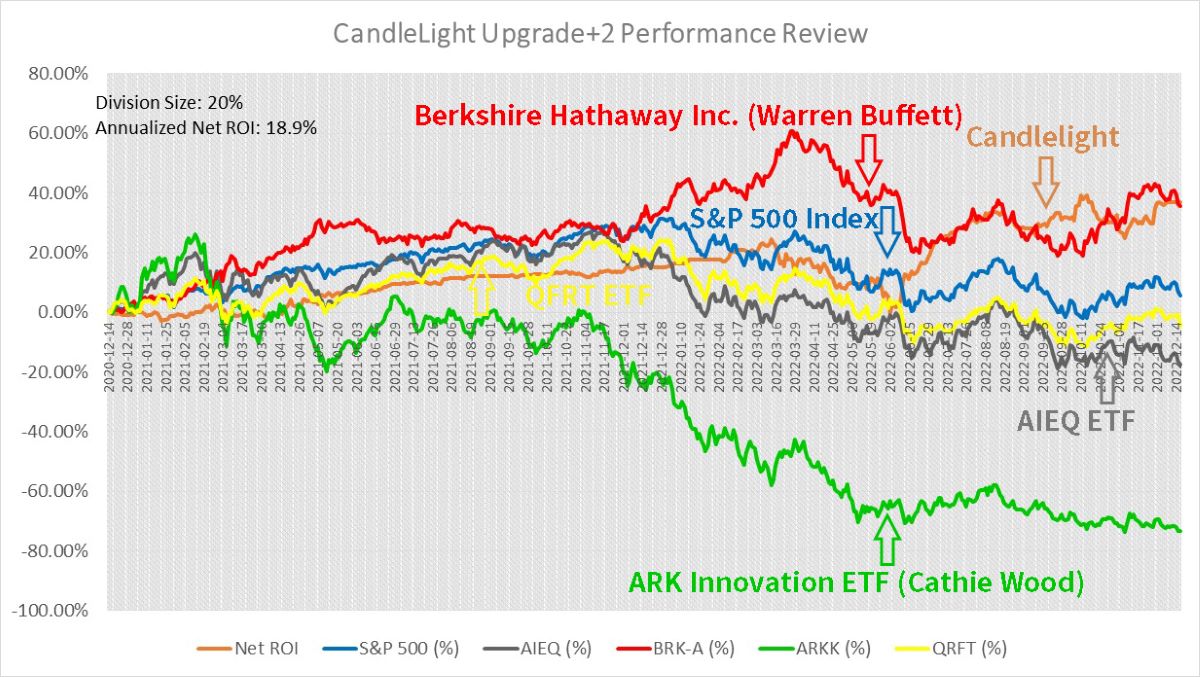

PS. Two Years,

100+ Sets of Testing Results Confirm: Machines Can Beat Human Aces in Stock

Market!

|

|

Free Tutorial

Share

|

|

|

|