AI versus Human Traders:

Comparing Performance and Identifying Strengths and Weaknesses

|

|

Stock trading has always been a battle of wits, with humans pitted against

each other in the never-ending pursuit of profits. But now, a new contender

has entered the arena: Artificial Intelligence (AI). With its lightning-fast

speed, data-crunching abilities, and 24/7 operation, AI trading robots are

challenging human traders in ways never seen before.

Before December 2022, no one believed that machines could have conversations with humans just like real people until chatGPT emerged, leaving everyone amazed: Artificial Intelligence has already become so powerful. In the financial field, not many people believe that machines can beat humans in securities trading, and with the rapid development of AI technology, who knows when a killer technology like chatGPT will appear in the stock market and shock humans again? If we don't prepare ahead of time, once another more powerful AI technology emerges in the market, it won't be as easygoing and lighthearted as just chatting; it is likely to make many people cry and faint.

But don’t worry, human

traders, you’re not going down without a fight! In this blog, we’ll compare

the pros and cons of AI and human traders, and determine once and for all,

who truly reigns supreme in the stock market.

Advantages of AI

Trading Robots

Speed: AI trading robots are able to process massive

amounts of data in real-time, allowing them to quickly analyze market trends

and make investment decisions. This speed advantage allows AI systems to

respond to market developments faster than human traders, increasing the

potential for profits.

Accuracy: AI systems use complex algorithms and

statistical models to analyze data, making their predictions much more

accurate and consistent than those made by human traders. This leads to more

rational and objective investment decisions, reducing the risk of impulsive

or emotional choices.

24/7 operation: AI trading robots can operate 24

hours a day, 7 days a week, without the need for rest. This allows them to

take advantage of market developments and investment opportunities at any

time, even outside of normal trading hours.

Consistency: AI systems are

not subject to emotional biases that often influence human decision-making.

This leads to a more consistent approach to investment decisions, reducing

the risk of irrational or impulsive choices.

Data analysis: AI trading

robots are able to analyze vast amounts of data, including financial and

market data, economic indicators, and global developments. This allows them

to make informed investment decisions based on a broad range of data,

increasing the potential for profits.

Backtesting: AI systems can use

historical data to test investment strategies and make predictions about

future market trends. This allows traders to evaluate the potential success

of a particular strategy before putting real money on the line.

Portfolio

management: AI trading robots can be used to manage portfolios,

automatically rebalancing portfolios based on market developments and

investment goals. This allows traders to optimize their portfolios and

maximize profits with minimal effort.

Drawbacks of AI Trading Robots

Lack of creativity: AI systems rely on algorithms and pre-programmed

rules to make investment decisions. While this leads to more rational and

objective decision-making, it also means that AI systems lack the creativity

and intuition that can sometimes lead human traders to make successful

investments.

Dependence on data: AI systems are only as good as the data

they are trained on. If the data used to train the AI system is incorrect or

outdated, the investment decisions made by the AI system will be based on

inaccurate information.

Over-reliance on technology: Some traders may

become too dependent on AI systems, losing their own investment skills and

knowledge in the process. This could lead to a lack of understanding of the

markets and investment strategies, reducing the potential for profits.

Cost: AI systems can be expensive to develop and implement, and may require

ongoing maintenance and upgrades. This can be a significant barrier for

smaller traders and investors who may not have the resources to invest in

this technology.

Limited understanding: AI systems can be complex and

difficult to understand, even for experienced traders. This can make it

difficult for traders to assess the performance of the AI system and make

informed investment decisions.

Potential for errors: AI systems, like any

technology, are not immune to errors and malfunctions. This can lead to

incorrect investment decisions and potential losses, which could be costly

for traders and investors.

Black Box problem: AI systems can sometimes

make investment decisions that are difficult to explain, even to experienced

traders. This “black box” problem can lead to a lack of trust in the AI

system and may prevent traders from fully utilizing its potential.

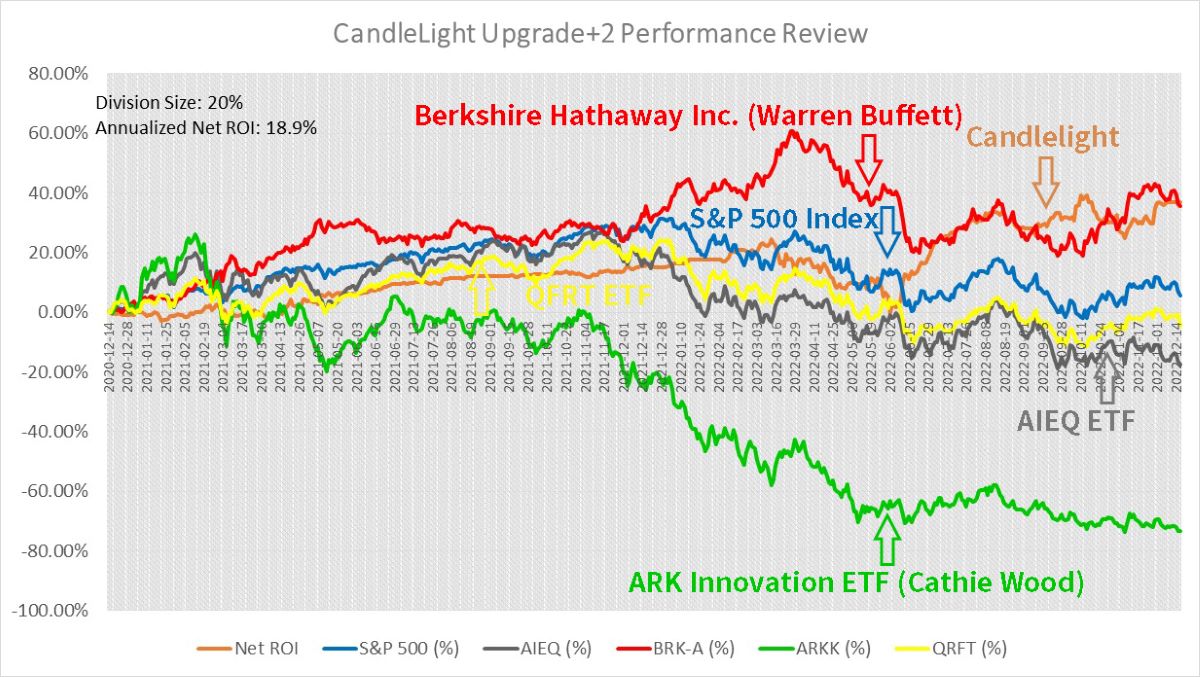

There

are some AI-Powered stock trading systems running ETFs are really working in

markets, such as AIEQ and QRFT. And more and more AI-Enhanced systems are

jointing the the party. For example, after 2 years forward testing,

Candlelight’s Growth Rate is neck and neck with Buffett’s performance, with

decisions made 100% by machines, more details:

Two Years, 100+ Sets of Testing

Results Confirm: Machines Can Beat Human Aces in Stock Market!

Advantages of Human Traders

Intuition: Human traders are capable of

using their intuition, experience, and judgement to make investment

decisions. This can be especially valuable in situations where data and

algorithms may not be enough to fully understand market developments and

trends.

Flexibility: Human traders are capable of adapting to changing

market conditions and investment strategies. They can quickly pivot their

investment strategies based on new information and developments, allowing

them to take advantage of new opportunities.

Emotional intelligence:

Human traders are able to understand and analyze the emotions and

motivations of other market participants. This can be especially valuable in

predicting market developments and making investment decisions.

Creativity: Human traders are capable of using their creativity and

outside-the-box thinking to develop new investment strategies and approach

markets in unique ways. This can lead to more innovative and profitable

investment decisions.

Understanding of market context: Human traders have

a broader understanding of market context, including economic indicators,

geopolitical developments, and industry trends. This allows them to make

informed investment decisions that take into account a wide range of

factors.

Human judgement: Human traders are capable of using their

judgement and critical thinking skills to assess market trends and make

investment decisions. This can be especially valuable in situations where

the data is conflicting or incomplete.

Independent decision-making: Human

traders are able to make investment decisions independently, without relying

on pre-programmed algorithms or rules. This allows them to respond to market

developments and investment opportunities in real-time, increasing the

potential for profits.

Drawbacks of Human Traders

Emotional

biases: Human traders are prone to emotional biases, such as fear and greed,

that can cloud their judgement and lead to poor investment decisions. This

can result in missed opportunities or significant losses.

Limited data

processing capacity: Human traders have a limited ability to process large

amounts of data and information. This can make it difficult for them to keep

up with the rapidly changing market developments and make informed

investment decisions.

Overconfidence: Human traders can sometimes become

overconfident in their investment decisions, leading them to take excessive

risks and make poorly thought out investment decisions.

Fatigue: Human

traders can become fatigued and less effective over long periods of time,

leading to mistakes and poor investment decisions.

Lack of objectivity:

Human traders may be influenced by their personal opinions, beliefs, and

biases, leading to subjective and potentially incorrect investment

decisions.

Short-term focus: Human traders can sometimes become focused

on short-term gains, rather than considering the long-term potential of

investments. This can lead to missed opportunities for long-term growth and

stability.

Inability to execute complex strategies: Human traders may not

have the expertise or technical skills to execute complex investment

strategies, such as algorithmic trading, which can limit their ability to

maximize profits.

In conclusion, both AI and human traders have their own

strengths and weaknesses in the stock market. While AI systems offer speed,

accuracy, and 24/7 operation, they lack creativity and can be limited by

their dependence on data. On the other hand, human traders offer intuition,

flexibility, and emotional intelligence, but are prone to emotional biases

and can sometimes make impulsive decisions. In the end, it seems that the

best approach to stock trading is a combination of both AI and human

traders, utilizing the strengths of each approach to achieve maximum

profits. So, let’s raise a glass to the future of stock trading, where

robots and humans work together in perfect harmony… until the robots take

over, of course.

PS. We are trying AI Trading based on Machine

Learning technologies, please take a look at our experiment records:

Two Years, 100+ Sets of Testing

Results Confirm: Machines Can Beat Human Aces in Stock Market! |

|

Free Tutorial

Share

|

|

|

|