Big Innovation: Overview of different algorithmic trading strategies

|

|

Once upon a time, in the land of Wall Street, there was a group of traders

who relied on intuition and gut feelings to make their trades. They would

spend hours analyzing charts and financial reports, trying to predict the

future movement of stock prices. But little did they know, their kingdom was

about to be taken over by a group of nerdy algorithms. Yes, you heard it

right, algorithms that traded with mathematical models and statistical

analysis. The traders who once ruled the market were now forced to adapt or

become obsolete. But, like any good story, not all algorithmic strategies

were created equal. Some were mean and made you regret your investments,

while others followed trends like a loyal dog, and some even acted like a

superhero, exploiting price differences and saving the day. This is the tale

of algorithmic trading, where every strategy has its own unique set of

advantages and disadvantages. So sit back, grab a cup of coffee, and let’s

dive into the world of algo trading.

“Innovation distinguishes

between a leader and a follower.” — Steve Jobs

Algorithmic trading,

also known as automated trading or algo trading, is a method of executing

trades using computer algorithms. These algorithms use mathematical models

and statistical analysis to make decisions on buying and selling financial

instruments such as stocks, bonds, and commodities. The rise of algorithmic

trading has dramatically changed the financial landscape, offering many

benefits over traditional manual trading methods.

There are several

different algorithmic trading strategies that traders and investors can use,

each with its own set of advantages and disadvantages. In this article,

we’ll provide an overview of some of the most popular algorithmic trading

strategies, including their key characteristics and when they are best used.

Mean Reversion

Mean reversion is a statistical strategy that assumes

that the price of an asset will eventually return to its average price over

a given period of time. This strategy uses mathematical models to identify

when an asset is overpriced or underpriced and then executes trades based on

that information. Mean reversion strategies are often used in conjunction

with other strategies, such as trend following, to improve overall

performance.

For example, a trader uses a mean reversion algorithm to

track the average price of Apple (AAPL) stock over the past 100 days. If the

stock price rises significantly above its average, the algorithm may sell a

portion of the trader’s AAPL position. Conversely, if the stock price falls

significantly below its average, the algorithm may buy more AAPL shares.

Trend Following

Trend following is a strategy that assumes that an

asset’s price will continue to move in the same direction it has been

moving. This strategy uses mathematical models to identify the current trend

of an asset and then executes trades based on that information. Trend

following strategies are often used by long-term investors and traders who

are looking to profit from long-term price movements.

For instance,

an investor can use a trend following algorithm to track the direction of

the S&P 500 index. If the S&P 500 has been trending upwards for several

months, the algorithm may buy more index funds. If the S&P 500 starts

trending downwards, the algorithm may sell some of the index funds.

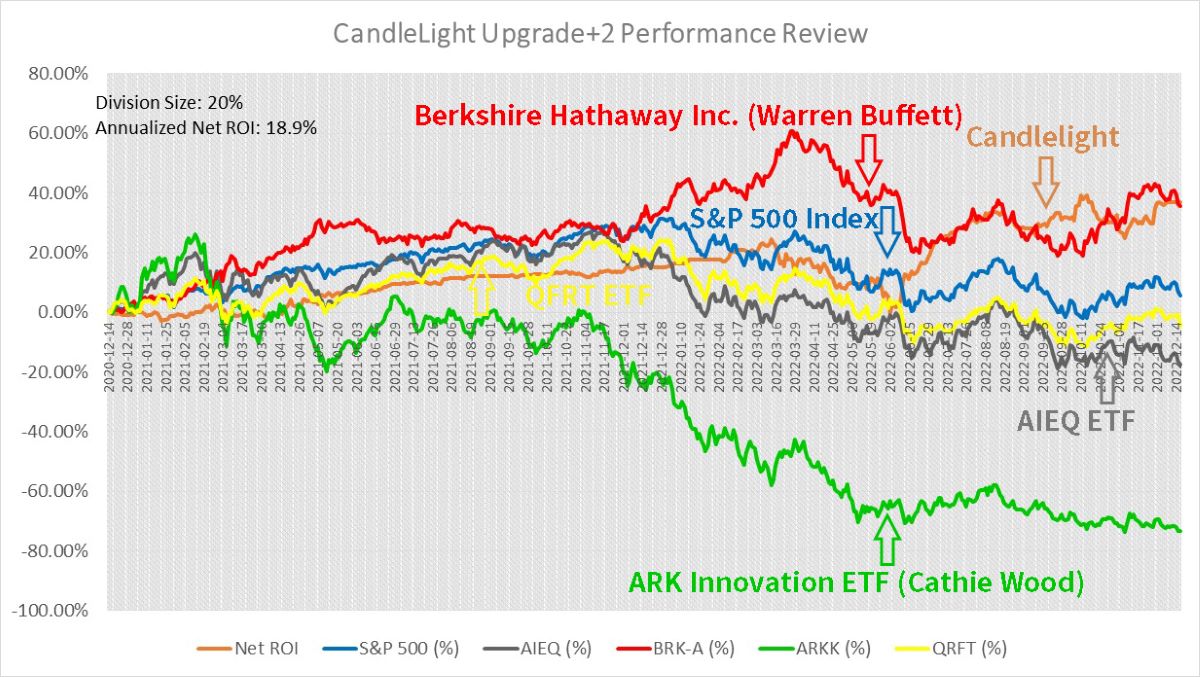

Another example, after months and months forward testing, Candlelight’s

Growth Rate is neck and neck with Buffett’s performance, decisions 100% made

by machines, details: Two Years,

100+ Sets of Testing Results Confirm: Machines Can Beat Human Aces in Stock

Market!

Statistical Arbitrage

Statistical arbitrage is a strategy that assumes

that there is a relationship between two or more assets, and that this

relationship can be used to make profitable trades. This strategy uses

mathematical models to identify and exploit price differences between

related assets. Statistical arbitrage strategies are often used by traders

and investors who are looking to profit from short-term price movements.

For example, a trader uses a statistical arbitrage algorithm to track

the price difference between two stocks, such as Google (GOOG) and Amazon

(AMZN). If the price difference between the two stocks deviates

significantly from its historical average, the algorithm may buy GOOG and

sell AMZN, or vice versa.

Momentum Trading

Momentum trading is a

strategy that assumes that an asset’s price will continue to move in the

same direction it has been moving, due to the momentum of the market. This

strategy uses mathematical models to identify the current momentum of an

asset and then executes trades based on that information. Momentum trading

strategies are often used by short-term traders and investors who are

looking to profit from short-term price movements.

For instance, a

trader may use a momentum trading algorithm to track the momentum of the

NASDAQ Composite Index. If the index has been rising steadily for several

days, the algorithm may buy technology stocks that are part of the index. If

the index starts to decline, the algorithm may sell some of the technology

stocks.

High-Frequency Trading

High-frequency trading is a

strategy that uses high-speed computers to execute trades at extremely fast

speeds, taking advantage of small price movements. This strategy uses

mathematical models to identify profitable trades and then executes trades

based on that information. High-frequency trading strategies are often used

by traders and investors who are looking to profit from short-term price

movements.

For example, a trader can use a high-frequency trading

algorithm to execute trades in milliseconds. The algorithm may track the

price of a stock, such as Tesla (TSLA), and place a buy order if the price

drops below a certain level or place a sell order if the price rises above a

certain level. This process may be repeated several times a day, taking

advantage of small price movements.

Algorithmic trading has come a

long way since its inception, and today it’s an integral part of modern

finance. As with any new technology, there are both advantages and

disadvantages to be considered. It’s important to note that algorithmic

trading strategies are not a one-size-fits-all solution, and what works well

for one trader may not work as well for another. As such, traders need to

carefully consider their own investment goals, risk tolerance, and market

knowledge before selecting an algorithmic trading strategy.

In order

to verify whether a trading strategy is effective, it’s essential to

backtest it under real market conditions. Without proper backtesting, using

any trading strategy can be risky. However, backtesting can be made easy

with a little knowledge of computer programming, such as Excel VBA.

Alternatively, you can seek help and tutorials online to learn the basics of

backtesting a trading strategy. For example, you can visit the Data

Gladiator Blog (tyzu.com) to access a comprehensive tutorial handbook for

free! Additionally, you can click Free Trial to download some backtesting

tools and enjoy a 30-day free trial.

And with that, folks, we have a

wrap on our overview of the popular algorithmic trading strategies. But

remember, always do your research and never let a robot make all your

financial decisions for you! After all, computers can crash, algorithms can

go haywire, and you don’t want to be the one left holding the bag… of stock,

that is. Happy trading!

“Innovation is not just creating something

new, it’s creating something better.” — Tim Cook

PS.

Two Years, 100+ Sets of Testing

Results Confirm: Machines Can Beat Human Aces in Stock Market! |

|

Free Tutorial

Share

|

|

|

|