AI Takes the Investment World by Storm:

Introducing AIEQ, the First AI-Powered Equity ETF

|

|

The Stock Market just got a makeover, and AI is the stylist! With the launch

of AIEQ, the world’s first AI-powered equity ETF, the stock market just got

a futuristic haircut and a high-tech spa day. No more bad hair days for

investors as AIEQ is here to bring some much-needed zing to the investment

world.

EquBot, a fintech company, has launched the AIEQ, the world’s

first AI-powered equity ETF. This platform is designed to provide investors

with faster access to broader and deeper data sets through the use of

machine learning, knowledge graphs, and natural language processing (NLP).

The AIEQ is powered by IBM Watson technologies, such as natural language

understanding in Watson Discovery and Watson Studio for bias detection and

reduction. The ETF collects data on over 6,000 US companies each day,

including structured data from third-party data providers, and unstructured

data stored in formats that are difficult for analysts to inspect quickly.

By combining structured and unstructured data, AIEQ allows EquBot to

select portfolios that are more likely to have the highest opportunity for

market appreciation. The knowledge graphs that IBM Watson allows EquBot to

build are growing over time, leading to more predictive accuracy. In AIEQ’s

first year, it underperformed the broad US market, but in the subsequent

year, it significantly outperformed the US market.

One of EquBot’s

goals is to dispel the industry myth of AI being a “black box” technology.

EquBot uses four models to assess a given stock in AIEQ: a financial score,

natural language understanding, a management score, and external factors.

Watson’s NLU capabilities enable AIEQ to perform sentiment analysis,

providing additional context around treatments and the trustworthiness of

the data source.

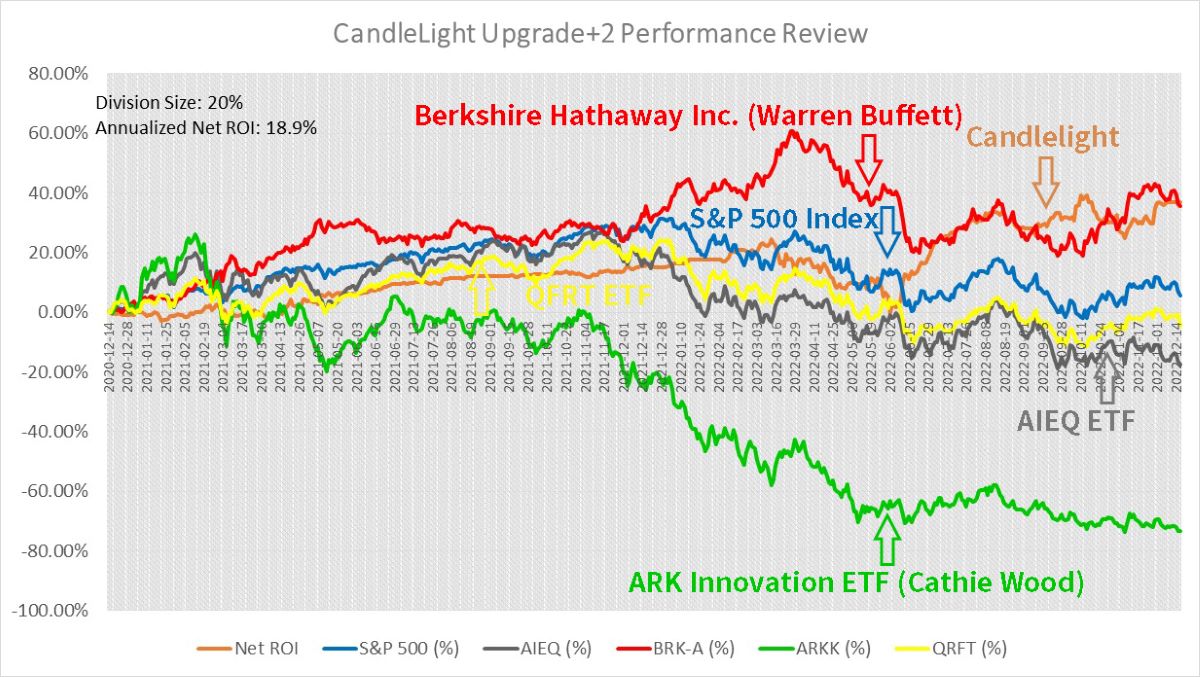

AIEQ initially underperformed against the US market

but eventually surpassed it in 2020, when it beat the S&P 500 by at least

seven percentage points. But after 2021, AIEQ faced challenges from other

AI-powered competitors, such as QRFT ETF, etc. (And in forward testing, the

growth rate of CandleLight quant trading system, which is designed by us has

surpassed it since 2022. More

details: Two Years, 100+ Sets of Testing Results Confirm: Machines Can Beat

Human Aces in Stock Market!)

EquBot uses internal tools and IBM Watson’s OpenScale tool to monitor 10

metrics on each model, flag bias or model drift, and track each model’s

judgment calls. The company also has two people on its team who are

responsible for watching bias-related metrics full-time, while the

individual owners of each model check for red flags once a day.

Artificial Intelligence (AI) and Machine Learning (ML) have been talked

about as potential game-changers in the field of investment fund management

since the 1950s. The idea was that AI, being tireless and immune to human

biases, could outperform human fund managers who only have limited access to

information and are prone to behavioral biases. However, the reality so far

has not lived up to the expectation.

One of the main applications of

AI in investment management has been in processing unstructured data such as

news stories and text reporting. AI can process vast amounts of such data,

distill the useful information, and process it faster and more accurately

than humans. Another area in which AI and ML have been widely used is

trading algorithms, which execute trades at a speed faster than humans.

However, AI has yet to make a significant impact on the actual

investment decision-making process. AI is slowly being integrated into

quantitative investing, but mainly for signal extraction and trading, rather

than replacing human decision-making. We can see AI as one further step in

the evolution of quant investment methods, allowing managers to process

information faster and in more expressive ways, but not replacing human

decision-making.

Just like we mentioned before, The world’s first ETF

managed entirely by AI, AIEQ, was launched in 2017 by three co-founders who

had an idea to bring sector knowledge together using AI and turn it into

investment insights. The ETF is run by EquBot, an AI investment platform,

and uses its tens of thousands of proprietary models to analyze

approximately 6,000 US companies. AIEQ gets insights from both structured

data (revenue, growth, R&D expenditure, market movements) and unstructured

data (news articles, blogs, corporate innovation announcements, and social

media). The models are trained on historical data ranging from five to 30

years and are fed into knowledge graphs, which can then be used by AIEQ as

training tools.

There are two areas of hope for a larger role of ML

in investment management. Firstly, underperformance is an opportunity for

improvement and ML can get better over time. Secondly, institutional

investors are getting interested in using ML for asset allocation, which is

a more complex task than security selection. AI is the only known approach

to constructing a true global portfolio.

While AI and ML may not have

taken over the world of investment management just yet, it’s clear that

they’re making their mark. And who knows, in a few years, we may all be

sitting back and watching our portfolios grow, sipping margaritas made by

AI-powered robotic bartenders. But for now, we’ll have to settle for AI just

helping us beat the market.

PS.

Two Years, 100+ Sets of Testing

Results Confirm: Machines Can Beat Human Aces in Stock Market! |

|

Free Tutorial

Share

|

|

|

|