Revolutionizing Investment Management:

Qraft Technologies and the Rise of AI ETFs

|

|

Investing has been a wild ride since the beginning of time. But hold on

tight, because things just got a whole lot wilder with the rise of

artificial intelligence in the stock market! Yes, you heard that right —

robots are now managing your money and they’re doing a pretty good job so

far. So sit back, grab some popcorn and let’s take a ride on the AI express

with Qraft Technologies and their AI ETFs. Get ready for a journey filled

with alpha, beta and a whole lot of zeros and ones. Because it’s time to say

goodbye to traditional investment management and hello to the future of

finance!

Qraft AI ETFs leverage AI technology to provide investors

with balanced exposure to factors that have historically been associated

with strong investment returns. The ETFs aim to find high alpha factors and

extract investment strategies to achieve potential outperformance.

QRFT seeks to provide investors with exposure to

quality, size, valuation, momentum, and low risk by using AI to identify its

historical relationship with macroeconomic and financial factors and

determine which factors are likely to perform well in the future. AMOM

leverages AI to deliver purer exposure to the momentum factor and has

recently outperformed the S&P 500, largely due to correctly anticipating the

price movements of Tesla.

Qraft Technologies is a fintech company

focused on driving innovation growth in the asset management industry

through AI. The company currently offers four AI ETFs and other products

such as a robo-advisory solution and an AI order execution system.

Investors should carefully consider the investment objectives, risks,

charges, and expenses before investing in Qraft AI ETFs. The funds provide

actively managed exposure to U.S. large cap stocks with AI managing the

security selection process. The ultimate goal of Qraft is to provide a high

level of alpha continuously with AI technologies.

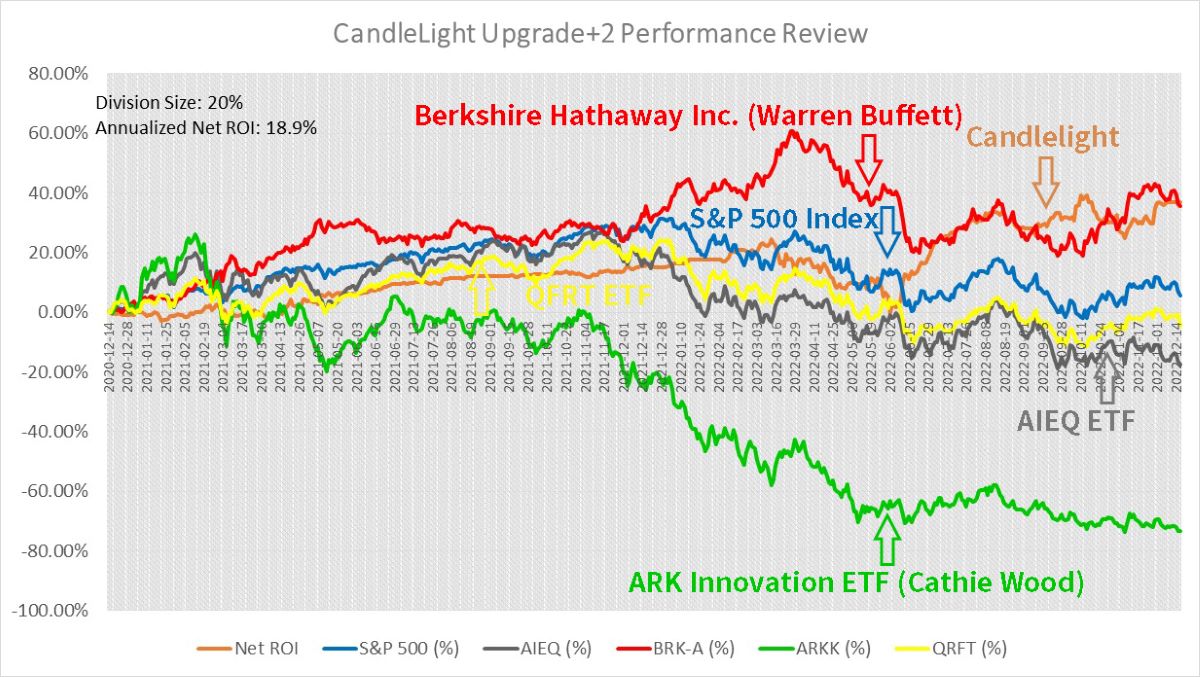

Qraft AI ETFs are

doing well, but still face challenges from other AI-powered competitors,

such as AIEQ ETF, etc. (And in forward testing, the growth rate of

CandleLight quant trading system, which is designed by us has surpassed

competitors since 2022. More

details: Two Years, 100+ Sets of Testing Results Confirm: Machines Can Beat

Human Aces in Stock Market!)

Investing has always been about finding the right balance between risk

and reward. And in recent years, the rise of artificial intelligence has

presented a new and exciting opportunity for investors looking to maximize

their returns and minimize their risk.

With ten patents awarded to date and more pending, Qraft’s intellectual

property includes innovations in technology and AI, including proprietary

trading and order execution tools, asset price prediction, and portfolio

generation.

The Qraft AI Risk Indicator is a prime example of how AI

is changing the way investors approach their portfolios. The tool predicts

market risk for the coming week using an easy-to-interpret scoring

methodology of 1 to 100.

In today’s challenging investment

environment, where volatile markets and macroeconomic factors are making it

harder for investors to navigate risk, Qraft’s AI Risk Indicator provides a

much-needed tool for managing near-term portfolio risk. The tool takes in

over 70 different macro inputs in nearly real time to assess current

momentum, volatility, and correlation metrics, and can be used as a general

indicator of market risk or as a tool to help in asset allocation decisions

between cash and equity positions.

Since its launch, the AI Risk

Indicator has demonstrated its value in a volatile market. With scores

ranging from 1 to 52, the model has shown that it can adapt rapidly to

changing market conditions and has had a positive impact on a hypothetical

portfolio comprised of U.S. Large Cap Equities. In the first six weeks after

its launch, this portfolio would have returned 4.99% compared to 3.90% for a

portfolio invested in U.S. Large Cap Equities alone.

The adoption of

artificial intelligence (AI) in the finance industry has increased

significantly in recent years, but there are still major challenges to

overcome for more widespread integration of AI. Two of the main challenges

are lack of usable financial data and difficulty in explaining AI decisions

(XAI).

One of the major problems of usable financial data is the

prevalence of poor data quality, which leads to data wrangling and the costs

associated with it. To tackle this issue, Qraft Technologies has developed

the Kirin API, which eliminates biases in financial data and allows for

easier filtering of specific investment universes.

Another issue

faced in the adoption of AI in finance is XAI. The OECD’s 2021 Business &

Finance Outlook highlights the difficulty in explaining AI decisions to

consumers, regulators, and lawmakers, and raises concerns about the ethical

use of AI. To address this, Qraft has developed the Alpha Factory, which

allows human input to influence portfolio construction and fill in gaps in

financial data, while also providing accountability and transparency.

While AI is a powerful tool, it is important to overcome these

challenges to ensure that AI is utilized in a responsible and effective

manner in the finance industry. With the right support, AI can help asset

managers to make informed decisions and optimize their strategies with

scalability.

Investing in the stock market is a challenging and risky

business, with many active-fund managers failing to pick outperforming

stocks or mistiming the market. As a result, many investors have opted for

passive strategies, leading to a significant migration away from high-fee

funds. To counter this trend, a new breed of funds has emerged, using

artificial intelligence (AI) to manage the portfolios. This new type of fund

aims to appeal to those who have moved away from active strategies but are

looking for something more than index-based or “smart beta” funds.

The AI-based funds, such as EquBot’s AI Powered US Equity ETF (AIEQ) and

Qraft AI-Enhanced US Large Cap ETF (QRFT), sound like “quant” funds but

aren’t entirely rule-based. Instead, they rely on the discretion of

portfolio managers, which can be a drawback for self-directed investment

platforms and advisers who have moved away from discretionary-managed funds.

For these funds to be successful, they will need to demonstrate notable

outperformance from broad equities.

In theory, AI-anchored

stockpicking should outperform traditional methods. With the power of

computing and cloud technology, machine learning engines can quickly analyze

a vast amount of data, such as regulatory filings, news articles, social

media posts, and quarterly results releases. This allows the AI system to

make investment decisions without human bias and adapt to changing market

conditions in real-time.

One of the key advantages of AI-based funds

is the ability to analyze unstructured data, such as text and tweets.

EquBot’s AIEQ, for example, uses deep learning algorithms and natural

language processing technologies from IBM Watson and Google Deepmind to rank

stocks by their likelihood of price appreciation. Portfolio managers still

oversee the AI model’s performance, but the speed and accuracy of the AI

system allow them to make better investment decisions.

However, there

are also some challenges associated with AI-based funds. Modeling errors can

occur when data is limited, leading to high turnover in the portfolio, which

can result in transaction costs and negatively impact returns.

Despite these challenges, AI-based funds show great promise as a new type of

investment vehicle. However, it is still early days, and many of the funds

that have been launched have already closed due to poor performance. As more

AI-based funds come to market, it will be possible to determine which

application of the technology is most effective and whether they can help to

slow the migration towards passive funds. Ultimately, while AI systems are

unlikely to replace human managers, they have the potential to enhance the

way active managers conduct research and provide a valuable tool for

investors seeking to generate higher returns from their investments.

And so, the revolution of AI ETFs continues to steamroll its way through the

investment world, with Qraft leading the charge. But remember, just because

you have AI on your side, doesn’t mean you can kick back and relax. Because

let’s face it, the stock market is still the Wild West of finance, and

there’s always room for a good old-fashioned tumble or two. So, saddle up,

put on your thinking cap, and remember to always keep an eye on your

portfolio, because as the wise John Wayne once said, “Life is hard, but it’s

harder if you’re stupid.”

PS.

Two Years, 100+ Sets of Testing Results Confirm: Machines Can Beat Human

Aces in Stock Market! |

|

Free Tutorial

Share

|

|

|

|