Unleashing the Power of Algorithmic Trading: The Future of Stock Market

|

|

Have you ever heard of a robot who is better at stock trading than a human?

No, it’s not a scene from a sci-fi movie, it’s a reality known as

algorithmic trading.

Imagine having a trading buddy who never takes a

coffee break, never complains about working overtime, and never gets a

headache from staring at a screen for hours. That’s the beauty of

algorithmic trading!

Algorithmic trading, also known as automated

trading or algo trading, is a method of executing trades using computer

algorithms. These algorithms use mathematical models and statistical

analysis to make decisions on buying and selling financial instruments such

as stocks, bonds, and commodities. The rise of algorithmic trading has

dramatically changed the financial landscape, offering many benefits over

traditional manual trading methods. Here, we’ll explore the basics of

algorithmic trading and some of the key benefits it offers, along with

examples to illustrate each benefit.

What is Algorithmic Trading?

Algorithmic trading involves using complex mathematical models and

statistical analysis to make informed decisions about buying and selling

financial instruments. These algorithms take into account a wide range of

market data, including current market trends, price movements, and news

events. The algorithms are designed to automatically execute trades based on

pre-defined criteria, such as price movements, market volatility, and other

key indicators. This allows for quick and efficient execution of trades, as

well as the ability to make decisions based on real-time data.

For

example, a trader can use an algorithmic trading strategy that buys stocks

when their price drops below a certain level and sells when the price rises

above a certain level. The algorithm will continuously monitor the stock

prices and execute trades automatically, without the need for manual

intervention.

“If you don’t find a way to make money while you sleep,

you will work until you die.” — Warren Buffett

Benefits of

Algorithmic Trading

Increased Efficiency: Algorithmic trading allows

for the quick and efficient execution of trades, reducing the amount of time

and effort required to make decisions. This can be especially beneficial in

fast-moving markets where time is of the essence.

For example,

algorithmic trading algorithms can execute trades in milliseconds, much

faster than a human trader could do manually. This speed and efficiency can

be especially beneficial in markets where prices can fluctuate rapidly, such

as the cryptocurrency market.

2. Reduced Emotions: Algorithmic

trading eliminates the need for human intervention, reducing the influence

of emotions on trading decisions. This can lead to more consistent and

rational decision-making, reducing the risk of emotional-based mistakes.

For instance, a trader who is feeling anxious about a particular stock

might make an impulsive decision to sell, even if it is not the right move.

With algorithmic trading, the algorithm will make decisions based on

pre-defined criteria, eliminating the risk of emotional-based mistakes.

3. Improved Accuracy: Algorithmic trading algorithms use complex

mathematical models and statistical analysis to make decisions, reducing the

risk of human error. This leads to improved accuracy and consistency, which

can lead to better returns in the long-term.

For example, algorithmic

trading algorithms can continuously analyze market data and execute trades

based on real-time market trends, reducing the risk of human error and

leading to improved accuracy.

4. Increased Speed: Algorithmic trading

algorithms can process large amounts of data in real-time, making decisions

and executing trades much faster than manual methods. This can provide a

significant advantage in fast-moving markets.

For instance,

algorithmic trading algorithms can process news and market data as it

becomes available, making decisions and executing trades in real-time. This

speed and efficiency can provide a significant advantage in fast-moving

markets where prices can fluctuate rapidly.

5. Backtesting:

Algorithmic trading allows traders to test their strategies using historical

market data, allowing them to identify and optimize the best algorithms.

This leads to more informed and confident trading decisions.

For

example, a trader can use historical market data to test different

algorithmic trading strategies and see which ones have performed the best.

This can help the trader identify the best algorithms to use for future

trades and make more informed and confident trading decisions.

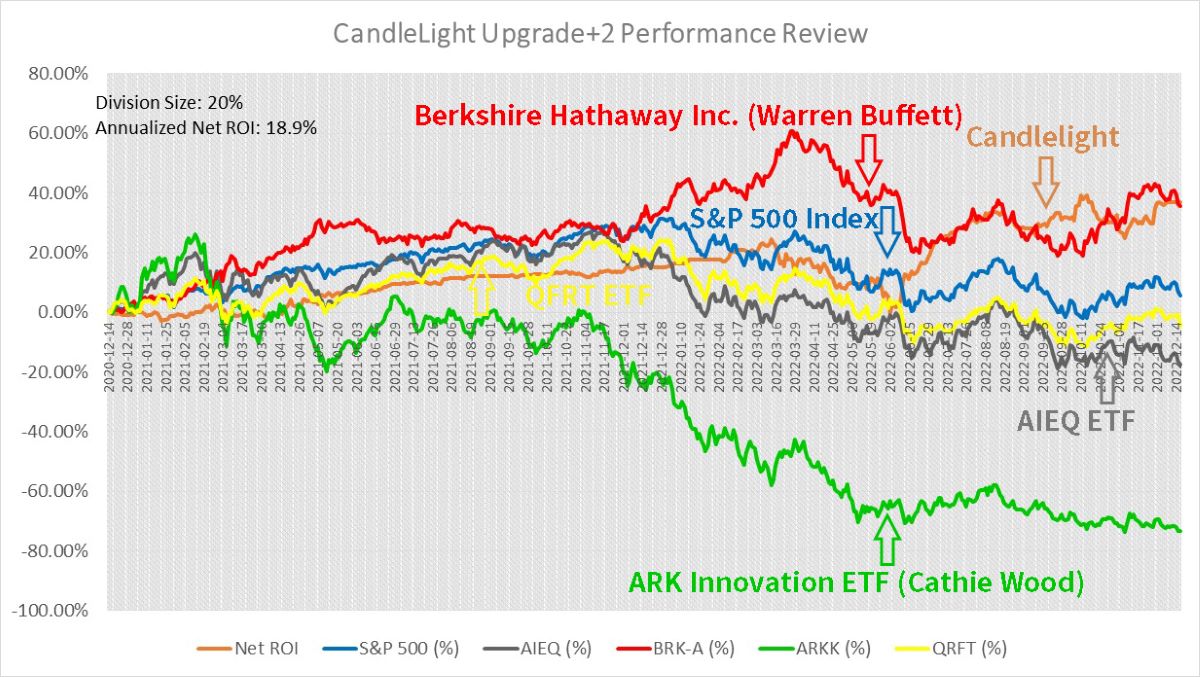

Another one, after months and months forward testing, Candlelight’s Growth

Rate is neck and neck with Buffett’s performance, decisions 100% made by

machines, details: Two Years, 100+

Sets of Testing Results Confirm: Machines Can Beat Human Aces in Stock

Market!

6. Cost-Effective: Algorithmic trading can be cost-effective compared to

traditional manual methods, as it eliminates the need for human traders and

reduces the cost of executing trades. This can be especially beneficial for

small traders and investors who may not have the resources to employ a large

trading team.

For instance, an individual investor can use

algorithmic trading algorithms to execute trades at a fraction of the cost

of hiring a professional trader. This can provide a cost-effective solution

for small traders and investors who want to take advantage of the benefits

of algorithmic trading.

7. Scalability: Algorithmic trading allows

traders to execute trades on a large scale, making it possible to execute a

large number of trades simultaneously. This can be especially beneficial in

fast-moving markets where the ability to execute trades quickly is critical.

For example, a hedge fund can use algorithmic trading algorithms to

execute a large number of trades simultaneously, taking advantage of market

fluctuations and maximizing returns.

8. Better Risk Management:

Algorithmic trading algorithms can help traders manage risk more

effectively, by automatically executing trades based on pre-defined criteria

and market conditions. This can help traders reduce their exposure to market

volatility and minimize losses.

For instance, an algorithmic trading

algorithm can automatically sell a stock if the price falls below a certain

level, reducing the trader’s exposure to market volatility and minimizing

losses.

“Change will not come if we wait for some other person or

some other time. We are the ones we’ve been waiting for. We are the change

that we seek.” — Barack Obama

Algorithmic trading offers many

benefits over traditional manual methods, including increased efficiency,

reduced emotions, improved accuracy, increased speed, backtesting,

cost-effectiveness, scalability, and better risk management. These benefits

have led to the widespread adoption of algorithmic trading in the financial

industry and made it a popular choice for traders and investors of all

sizes.

Gone are the days when traders had to rely on intuition, gut

feeling, and good luck to make a profit. With algorithmic trading, the

computer does the heavy lifting, leaving the trader to sip cocktails on a

beach.

So, whether you’re a seasoned trader looking to improve your

game or a novice looking to break into the world of trading, algorithmic

trading may just be the solution you’ve been searching for. It’s time to say

goodbye to the stress and hello to the profits with the power of algorithmic

trading!

“I choose a lazy person to do a hard job. Because a lazy

person will find an easy way to do it.” — Bill Gates

PS.

Two Years, 100+ Sets of Testing

Results Confirm: Machines Can Beat Human Aces in Stock Market! |

|

Free Tutorial

Share

|

|

|

|