Unlock the Secrets of Quantitative Trading: From Math to Market Mastery

|

|

Math and market mastery, who knew it was a winning combination? Well, Jim

Simons did and he became a billionaire by using quantitative trading! Get

ready to crack the code on the secrets of quant trading, from understanding

the mathematical models to becoming the next ‘Quant King’ (or Queen) of Wall

Street.

Quantitative trading, also known as quant trading, is a

systematic approach to investing that uses statistical and mathematical

models to analyze market data and execute trades. Unlike qualitative

analysis that assesses opportunities based on subjective criteria, quant

trading relies solely on data and models. It has become popular among

financial institutions and hedge funds due to the high computing demands of

the method, but recent advancements in technology have made it possible for

individual traders to also engage in quant trading.

Quant trading

works by evaluating the probability of a specific outcome using data-based

strategies. Historical data, mathematical models, and programming are key

components of the process. Traders may incorporate variables such as price

and volume into their mathematical models and may also explore alternative

datasets to discover present and potential trends.

Quant traders

create automated software that is designed with mathematical models to

identify patterns in historical data and make informed trading decisions.

They may modify existing strategies or create their own. A background in

mathematics, engineering, or financial modeling, as well as experience in

computer programming and working with data feeds and APIs, is preferred for

those seeking to work as quant traders.

Quantitative trading offers

several advantages, including the ability to evaluate a wide range of

markets using infinite data points, reduced bias in decision-making due to

the absence of emotions, and increased efficiency with automated or

semi-automated systems. However, quant trading also has its disadvantages,

including the complexity of the method and the potential for models to be

incorrect.

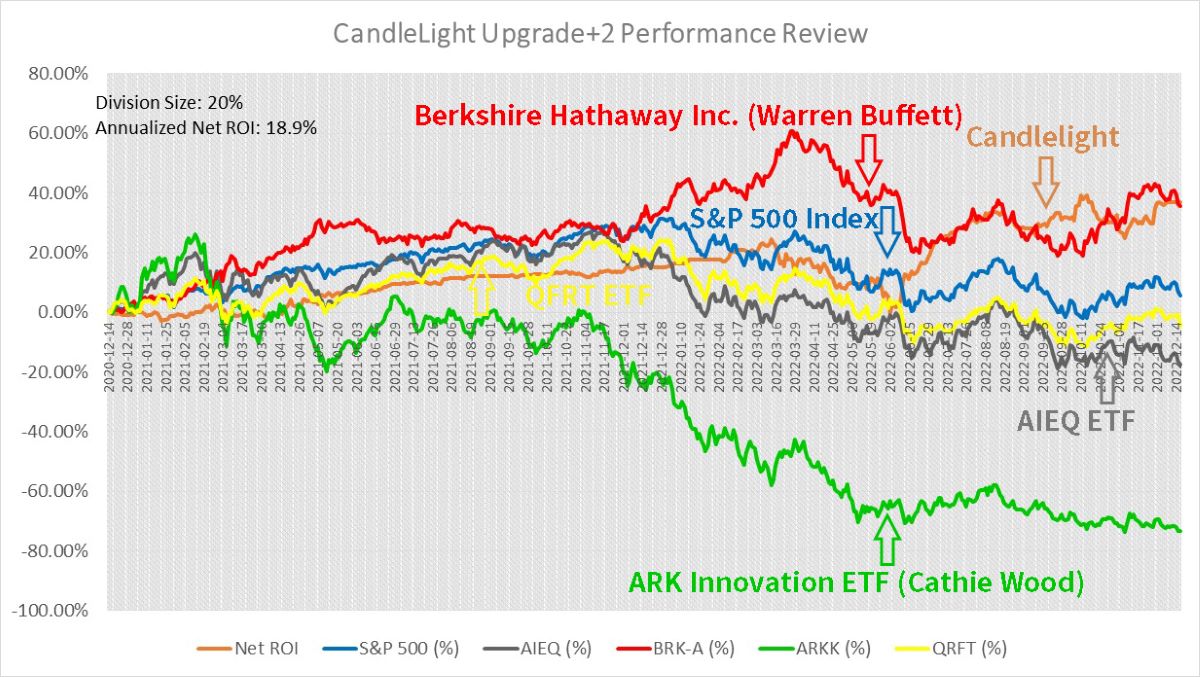

For example, after months and months forward testing,

Candlelight’s Growth Rate is neck and neck with Buffett’s performance,

decisions 100% made by machines, details:

Two Years, 100+ Sets of Testing

Results Confirm: Machines Can Beat Human Aces in Stock Market!

Quantitative stock trading is widely regarded as the next big thing in the

trading world. This method of analysis has several advantages that make it a

top choice for traders.

One of the biggest advantages of quantitative

trading is scalability. Unlike traditional trading that uses only several

analytical tools, quantitative trading can use an unlimited number of

strategies and inputs, thanks to its use of high-performance computing. This

means that even retail investors can use quantitative analysis to make

informed investment decisions.

Quantitative trading also offers

unlimited opportunities for diversification. This is because quantitative

analysis can be used on any market, making it a suitable choice for traders

who want to reduce risk by diversifying their portfolios. Additionally, the

automated execution mechanism of quantitative trading allows traders to

simultaneously operate multiple strategies.

Another benefit of

quantitative trading is its accuracy. With statistical arbitrage, traders

can rely on highly accurate data to make informed decisions. The use of

algorithms and computers enables traders to make fast, precise decisions,

which is especially important for high-frequency trading.

Quantitative trading is particularly useful for traders who want to

diversify their portfolios, test various trading strategies, or operate in

high-risk markets like cryptocurrencies. To make the most of quantitative

trading, it is essential to have a deep understanding of market conditions,

historical data, and available analysis methods.

Quantitative trading

works by using mathematical analysis to create projection models that can be

used to make informed trading decisions. To develop and configure the

software, traders need to have programming skills, using languages such as

C++, C#, MATLAB, R, Python, and VBA, etc.

In quantitative trading, a

particular time interval is selected, and data is gathered and analyzed

using algorithmic methods. This analysis is then used to make trading

decisions based on the results. For example, if a share price rose from $12

at the opening of trading to $10.45 at noon, $14.78 at 12 PM, and fell to

$9.35 after the close of intraday positions, a quantitative trader could

analyze various parameters such as current time, current bid-ask prices,

opening price, high/low price, current price direction, and MACD readings to

make informed trading decisions.

There are many aces in quantitative

trading area, one of the most famous masters is Jim Simons. He is a legend,

known as the “Quant King”, and “The Man Who Solved the Market”, he is the

founder of Renaissance Technologies and the Medallion Fund.

James

Harris Simons is an American mathematician, hedge fund manager, and

philanthropist who is best known as the founder of Renaissance Technologies,

a quantitative hedge fund. With his remarkable success as an investor and

hedge fund manager, Simons is widely considered as the “greatest investor on

Wall Street” and “the most successful hedge fund manager of all time.”

Simons was born on April 25, 1938, in Brookline, Massachusetts. He

received a Bachelor’s degree in Mathematics from MIT in 1958 and a PhD in

Mathematics from UC Berkeley in 1961 at the age of 23. Throughout his

academic and scientific career, Simons focused on the geometry and topology

of manifolds, leading to numerous breakthroughs and advancements in the

field. He was awarded the AMS Oswald Veblen Prize in Geometry in 1976 and

was elected to the National Academy of Sciences of the USA in 2014.

Simons’ investment career began with the creation of Renaissance

Technologies, a quantitative hedge fund that employs mathematical models and

algorithms to analyze and execute trades. The main fund, Medallion, has been

closed to outside investors since its inception in 1988 and has earned over

$100 billion in trading profits, translating to an average gross annual

return of 66.1% or a net annual return of 39.1%. In addition to Renaissance,

Simons founded Math for America, a non-profit organization aimed at

improving mathematics education in U.S. public schools.

Simons is

also known for his philanthropy, particularly in supporting research in

mathematics and fundamental sciences. He established the Simons Foundation

with his wife and has been a trustee of the Simons Laufer Mathematical

Sciences Institute at UC Berkeley since 1999. In 2016, the International

Astronomical Union named asteroid 6618 Jimsimons after him in honor of his

contributions to mathematics and philanthropy.

Quantitative trading is

a cutting-edge method of investing that uses mathematical models and data

analysis to make informed trades. Although it can be complex and

challenging, it offers many advantages, including scalability,

diversification, and accuracy. And if you happen to become a legendary quant

trader like Jim Simons, you may even have an asteroid named after you! But

remember, before embarking on your quant trading journey, it’s crucial to

have a deep understanding of market conditions and a solid background in

mathematics and computer programming. Happy trading!

PS. We are doing

Quantitative Trading based on Machine Learning AI technologies, please take

a look at our experiment records:

Two Years, 100+ Sets of Testing Results Confirm: Machines Can Beat Human

Aces in Stock Market! |

|

Free Tutorial

Share

|

|

|

|